According to SSI Research, the stock market witnessed an encouraging recovery in the last three weeks of April, with a 12% increase in the VN-Index and VN30, 13.5% in VNMidcap, and 13.7% in VNSmallcap. After a week of intense selling, the market sentiment improved due to a 6.9% GDP growth in Q1, positive Q1 business results for listed companies, and easing trade tensions.

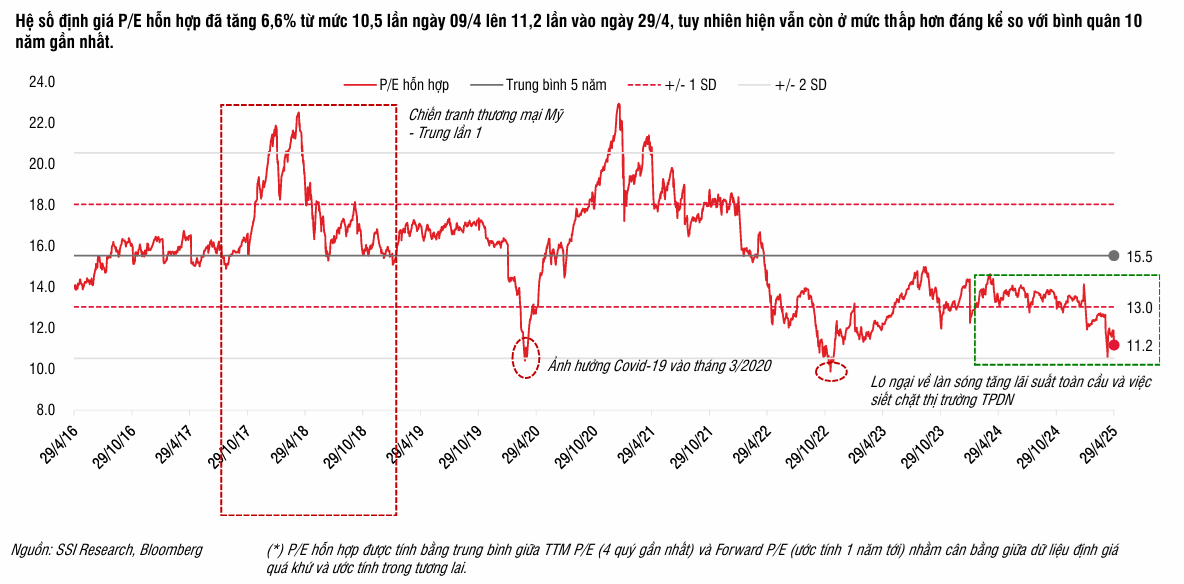

As of May 5, the market’s net profit growth maintained a 23% year-on-year increase, a slowdown from the previous quarter’s 29% but extending the growth streak to six consecutive quarters. However, profit growth in the coming quarters remains uncertain as businesses, despite their confident plans, have acknowledged that trade tensions could hinder their performance.

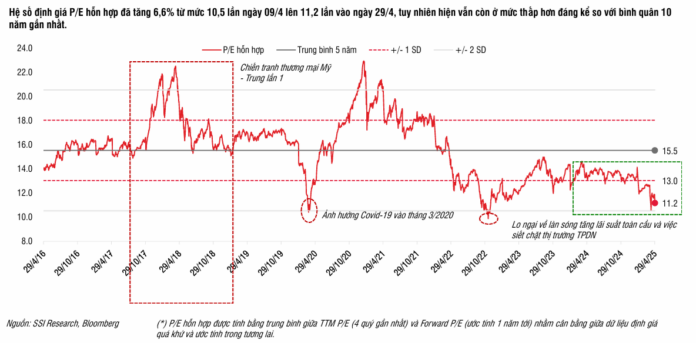

For the recovery to sustain, the market needs to witness positive developments, especially in the trade negotiations between major economies and between Vietnam and the US, which commenced on May 7. Historically, low valuations have been a supportive factor during periods of high volatility (e.g., the first US-China trade war, COVID-19, Fed rate hikes, exchange rate fluctuations, and the tightening of the domestic corporate bond market).

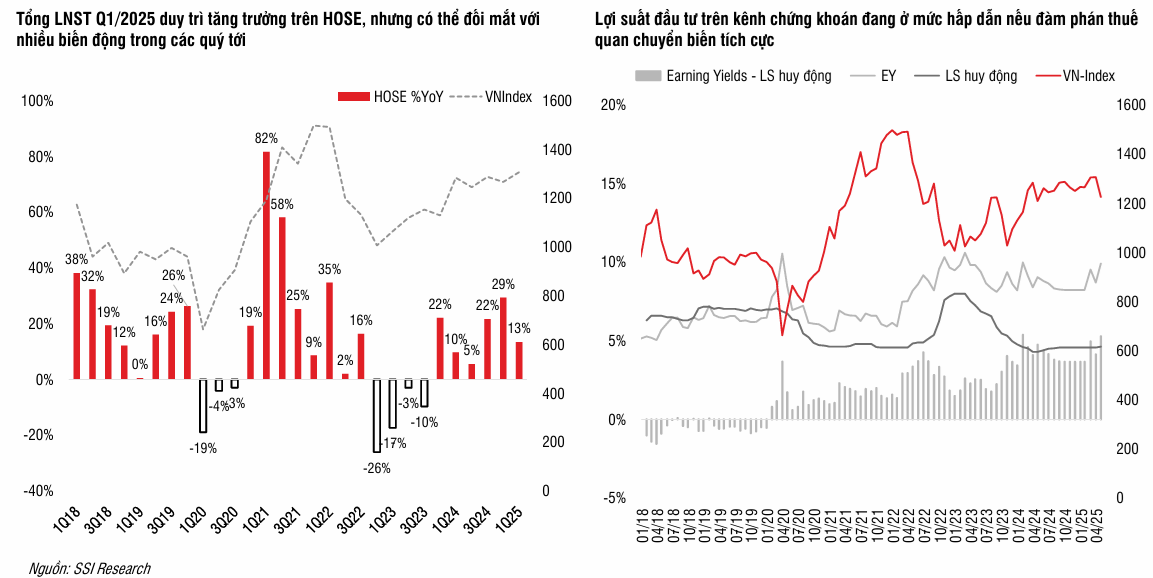

The mixed P/E ratio increased by 6.6%, from 10.5 on April 9 to 11.2 on April 29. However, it remains significantly lower than the 10-year average of 15.5. The estimated one-year market yield is currently at 9.9% (based on the estimated one-year P/E of VN-Index at 10.1), offering an attractive spread over deposit interest rates.

|

|

Sectors less directly impacted by tariffs, such as media, residential real estate, retail, tourism, and entertainment, outperformed during the recovery phase, indicating that investment funds in the stock market are still seeking opportunities during sharp downturns.

While uncertain risk factors persist, there are also long-term supportive factors, including the government’s supportive policies and commitment to economic growth, and the smooth operation of the KRX system, which paves the way for market upgrades. Real estate, industrial parks, chemicals, petroleum, and export sectors showed lower recovery rates than the market in the last three weeks of April.

SSI Research believes that the stocks in these sectors, particularly those in the mid-cap basket (VNMidcap), will offer short-term opportunities as positive signals emerge from trade negotiations. Conversely, any negative developments in trade talks will provide a good opportunity to gradually accumulate stocks in sectors less directly impacted by tariffs.

From a technical perspective, if the VN-Index breaks through the 1,250-point level, the medium-term trend will be more firmly established, with the next target range around 1,280 – 1,300 points. Conversely, the 1,180 – 1,200-point region currently acts as technical support during short-term corrective phases.

– 19:29 10/05/2025

Stock Market Week May 5-9, 2025: Powerful Breakthrough

The VN-Index concluded a highly positive week of trading, recording gains in 4 out of 5 consecutive sessions and surpassing the 200-day SMA. The resumption of net foreign buying was a key factor in supporting this upward momentum. If this trend persists into the next week, coupled with stronger market participation, the VN-Index is poised to further consolidate and extend its gains.

The Elusive Pivot: VN-Index Retreats Amid Cash Crunch

The VIC’s sharp decline has poured cold water on yesterday’s enthusiasm. Despite standouts like FPT and LPB, particularly the latter’s strong performance, its limited market cap prevents it from being considered a pillar, weakening the overall market support. Additionally, the money flow has turned notably cautious, with the breadth tilting towards the red and liquidity declining by 13%.

The Market Tug-of-War: Heavyweight Stocks Hold the Line, Foreign Investors Surprise with Strong Buying

The VN-Index struggled to maintain its highs this morning as blue-chip stocks continued to diverge and weaken. Only 5 out of the top 10 largest capitalization codes increased, fortunately including VIC and GAS. Trading volume decreased by 10% compared to yesterday morning, with a balanced breadth confirming a tug-of-war state. A bright spot was that foreign investors unexpectedly net bought 367 billion VND after 16 consecutive net selling sessions.

The Market Wary of Tariff Talks: Foreign Investors Turn Net Sellers

This morning, the market witnessed a significant cautious sentiment as preliminary and unofficial news regarding the first meeting on tariff issues was circulated. Despite an impressive surge in VIC, the second-largest market cap stock, the VN-Index fluctuated and posted a modest gain amid declining liquidity and a strong net sell-off by foreign investors.