## Market Review for Week of May 5-9, 2025

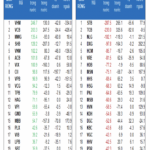

During the week of May 5-9, 2025, the VN-Index witnessed a strong surge, gaining 41 points and crossing above the SMA 200-week line since the index pierced this threshold in early April 2025. Additionally, trading volume surpassed the 20-day average, indicating positive participation from investors. However, the MACD indicator remains in sell signal territory and is below the zero level, suggesting that the market still carries inherent risks. Investors are advised to exercise caution in the coming period if this trend persists.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Stochastic Oscillator Deep in Overbought Territory

On May 9, 2025, the VN-Index witnessed a slight decline, with trading volume continuing to remain below the 20-day average in recent sessions, reflecting investors’ cautious sentiment.

Currently, the index is testing the group of SMA 50 and 100-day lines as the Stochastic Oscillator has ventured deep into the overbought region. If the indicator triggers a sell signal and exits this area in the coming sessions, the risk of a downward adjustment will heighten.

HNX-Index – Bollinger Bands Narrow

On May 9, 2025, the HNX-Index climbed, forming a Spinning Top candlestick pattern, while trading volume stayed below the 20-session average, indicating investors’ cautious attitude.

Moreover, the index is fluctuating amid alternating rising and falling sessions, appearing on the Middle line as the Bollinger Bands gradually narrow (Bollinger Squeeze). This suggests that the market’s sideways trend is likely to persist unless there’s an improvement in trading volume.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index indicator for the VN-Index is situated above the EMA 20-day line. If this status quo is maintained in the upcoming session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Capital Flow Variation: Foreign investors resumed net selling on May 9, 2025. If foreign investors maintain this stance in the forthcoming sessions, the situation will become even more pessimistic.

Technical Analysis Department, Vietstock Consulting

The Flow of Funds: Stocks Profit after 10 Sessions of Climbing, to Sell or to Hold?

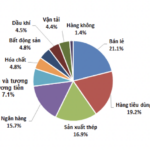

Although the VN-Index suffered a minor setback in the past week’s trading sessions, it has shown remarkable resilience with ten consecutive positive performances since the sharp decline on April 22nd. Numerous stocks have delivered impressive returns, with some even yielding profits of 15-20%.

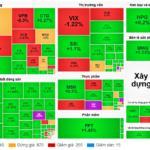

Market Beat: KRX Listing and AGM Season Spur VN-Index to Afternoon Rally

The afternoon session witnessed a remarkable rebound, with the market closing on April 24th at 1,223.35, a gain of 12.35 points. The UPCoM followed suit, ending the day up 0.17 points at 91.63. However, the HNX-Index remained in the red, dropping 0.38 points to 211.07. The momentum from the AGM season and the KRX’s launch date announcement contributed to the index’s positive performance.

“VN-Index Extends Gains, Yet Liquidity Remains Constrained”

The VN-Index witnessed a robust surge, despite trading volume remaining below the 20-day average. This indicates cautious participation amidst the index’s approach towards the nearest resistance zone formed in mid-April 2025 (1,230-1,245 points). Should the positive momentum persist, coupled with a significant improvement in liquidity in upcoming sessions, a breakthrough from this zone is plausible. Notably, the MACD indicator continues to signal a buy, reinforcing the strengthening market trend.