I. VIETNAM STOCK MARKET WEEK 21-25/04/2025

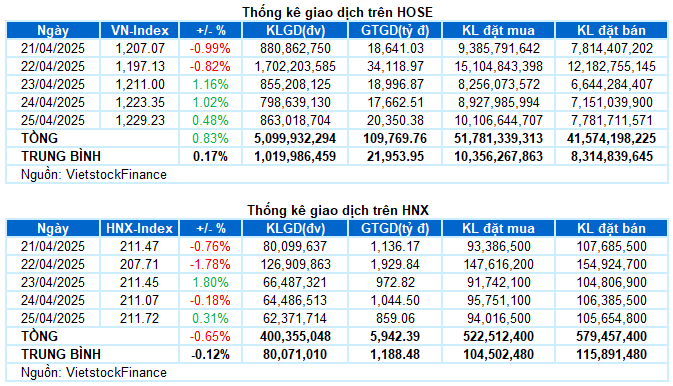

Trading: The main indices maintained their green status during the last trading session of the week. VN-Index increased by 0.48% from the previous session, ending the week at 1,229.23 points; HNX-Index reached 211.72 points, up by 0.31%. For the whole week, VN-Index gained a total of 10.11 points (+0.83%) while HNX-Index lost 1.38 points (-0.65%).

After two declining sessions at the beginning of the week, especially the shocking loss of over 70 points on Tuesday, VN-Index quickly rebounded with three consecutive recovering sessions. However, investor caution remained as the market still had many unpredictable factors, while the long holiday was also approaching. Money flow showed clearer differentiation as the index continued to fluctuate around the resistance threshold of 1,230 points. At the end of the week, VN-Index closed at 1,229.23 points, up 0.83% from the previous week.

In terms of impact, VIC was the main pillar supporting the index’s green status in the last session, contributing more than 4 points to the increase. In addition, the improvement of VHM and VNM also added over 2 points to the VN-Index. In contrast, the “king stocks” caused the most hindrance, occupying 9/10 positions in the top negative influences, taking away 4.5 points from the overall index.

The green status remained dominant in the sector groups. Essential consumer goods and real estate rose by more than 2% thanks to the strong breakthrough of large-cap stocks such as MCH (+4.61%), VNM (+3.55%), MSN (+3.51%), VHC (+3.22%); VHM (+1.8%), SSH (+1.88%) and especially VIC, which had its second consecutive ceiling session. However, differentiation was still evident as many codes in these groups sank into the red with significant liquidity, typically DBC (-2.68%), ANV (-2.52%), HNG (-4.55%); NVL (-3.98%), DIG (-1.34%), CEO (-1.6%), PDR (-1.26%), and HDC (-1.6%).

Meanwhile, the adjustment of the two “giants” VGI (-2.71%) and CTR (-1.76%) made the telecommunications group the worst performer in the market with a decrease of 1.87%, although a few codes still recorded outstanding gains such as ELC (+4.08%), FOC (+12.59%), SGT (+2.5%), and ICT (+1.15%). The financial group decreased by 0.64% with widespread adjustment pressure, except for a few bright spots like MBB, VAB, BAB, ORS, APG, and VIG.

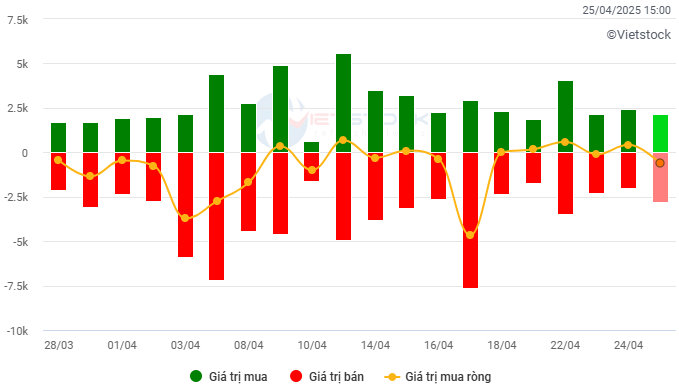

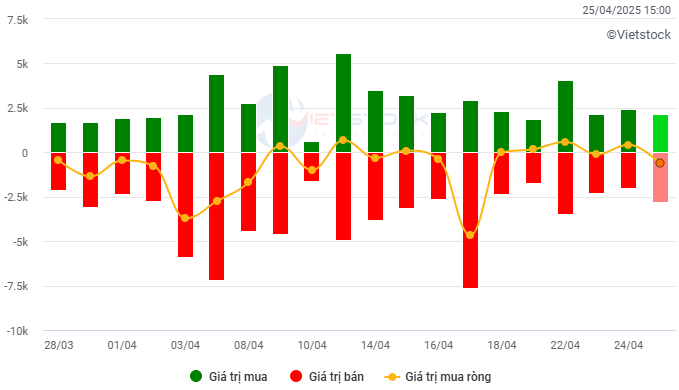

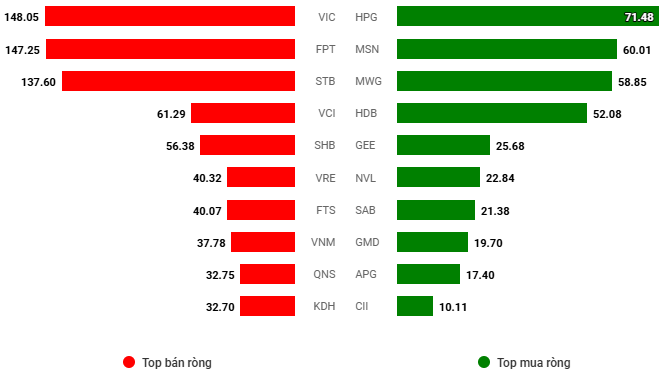

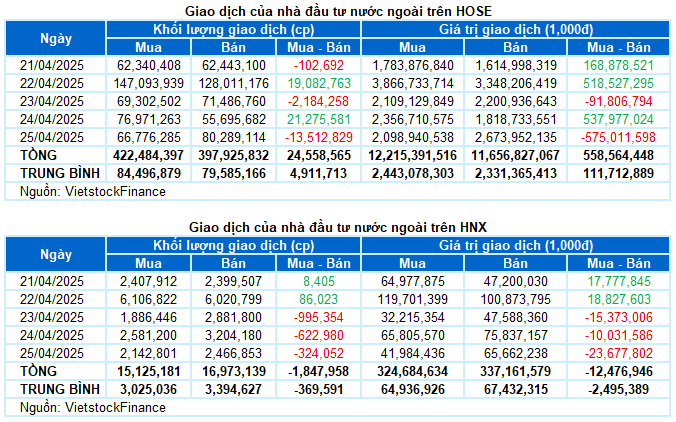

Foreign investors net bought with a value of more than VND 546 billion on both exchanges during the week. Of which, foreign investors net bought more than VND 558 billion on the HOSE but still net sold slightly more than VND 12 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

Net trading value by stock code. Unit: VND billion

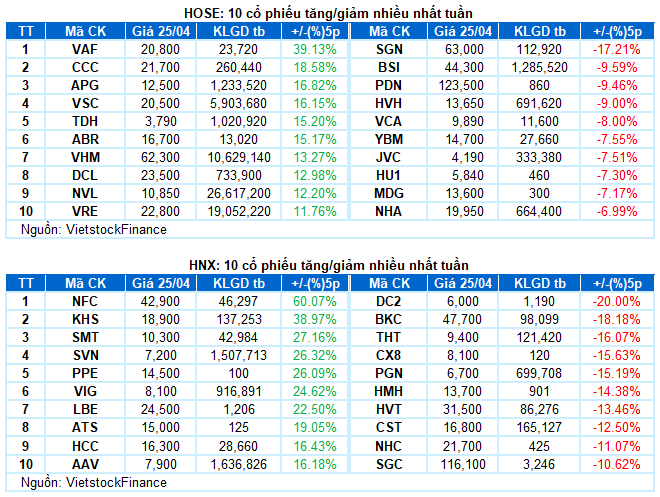

Stocks with outstanding performance last week: APG

APG increased by 16.82%: APG witnessed a bright trading week with a rise of 16.82%. The stock has mostly surged positively since breaking through the resistance formed in October 2024 (equivalent to the 10,400-10,900 region). At the same time, the trading volume exceeded the 20-day average, indicating strong participation of cash flow.

However, the Stochastic Oscillator indicator is now deep into the overbought zone. Investors should be cautious in the coming time if the indicator shows a sell signal again.

Stocks with the strongest decline last week: SGN

SGN decreased by 17.21%: SGN stock continued to face strong selling pressure last week with 3/5 sessions in the red. Although it recorded a significant recovery in the last two sessions of the week, the increase was not enough to prevent a negative trading week for SGN.

Currently, the MACD indicator continues to decline after giving a sell signal, indicating that the short-term adjustment risk remains.

II. STOCK MARKET STATISTICS FOR LAST WEEK

Economic and Market Strategy Division, Vietstock Consulting Department

Market Beat: Telecoms Shine as VN-Index Surges Over 13 Points

The trading session concluded with significant gains, as the VN-Index climbed by 13.87 points (+1.16%), reaching 1,211 points. Simultaneously, the HNX-Index experienced a notable surge, rising by 3.74 points (+1.8%) to close at 211.45. The market breadth tilted strongly in favor of advancers, with 636 tickers in the green versus 141 decliners. Dominating the VN30 basket, 23 constituents advanced, five declined, and two remained unchanged, painting a bullish picture across the board.

Market Beat: Afternoon Euphoria Sends VN-Index Soaring by 20 Points

The VN-Index defied the morning’s tug-of-war, surging in the afternoon session to close at 1,269.8 points on May 8, a substantial gain of 19.43 points. Mirroring this positive trend, the HNX-Index climbed 1.8 points to 215.21, while the UPCoM-Index inched up 0.06 points to 92.98. Trading value accelerated, surpassing 20,718 billion VND.

Market Beat: Energy & Real Estate Sectors Surge, VN-Index Rallies Further

The market closed with positive gains, seeing the VN-Index rise by 8.42 points (+0.68%), settling at 1,250.37. Likewise, the HNX-Index witnessed an increase of 0.52 points (+0.24%), ending the day at 213.41. The market breadth tilted in favor of the bulls, with 402 gainers versus 337 losers. The VN30 basket saw a similar trend, with 14 gainers outperforming 11 losers, while 5 stocks remained unchanged, adding a slight tilt to the bullish sentiment.

The Market Momentum: Can the Uptrend Persist?

The VN-Index witnessed a significant surge, forming a bullish White Marubozu candlestick pattern and breaching the 200-day SMA. This strong performance reflects a buoyant investor sentiment. Should the index sustain these levels and witness a substantial uptick in volume, the outlook would brighten considerably. Notably, the MACD indicator continues to flash a buy signal, and a potential crossover above zero in upcoming sessions remains on the cards. If this materializes, the optimistic short-term sentiment is here to stay.