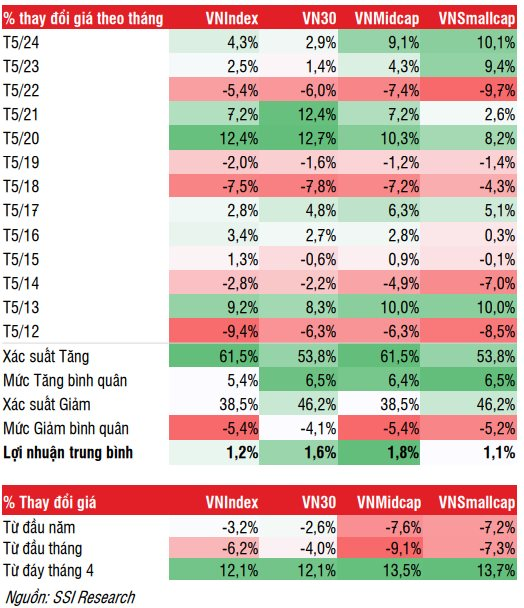

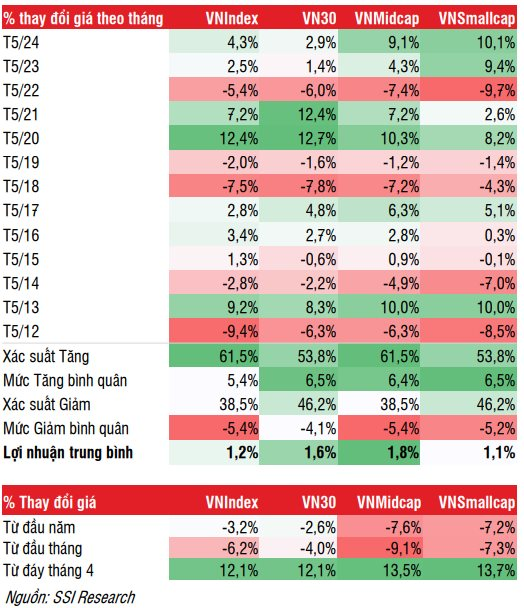

Equities Often Surge in May

The stock market has shown a decent recovery in the last 3 weeks of April, with a 12% gain on the VN-Index and VN30, 13.5% on VNMidcap, and 13.7% on VNSmallcap.

In its recently published May strategy report, SSI Securities (SSI Research) states that, based on data from the past 10 years, the market has a 70% chance of rising in May, reflecting a typically positive market sentiment. This occurs as May often experiences an information vacuum after most companies have held their shareholder meetings and released their Q1 financial statements in April.

As of May 5, the whole market’s Q1/2025 profit after tax (PAT) for parent companies continued to grow by 23% year-on-year, although slower than the previous quarter’s 29%, marking the sixth consecutive quarter of growth. “However, profit growth in the coming quarters remains uncertain as listed companies, despite their confidence in setting growth plans for 2025, have acknowledged that ‘instabilities’ surrounding tariffs could weaken growth,” the report stated.

According to SSI Research, to sustain the recovery momentum, the stock market needs to witness more positive developments in the trade negotiations between major economies, as well as in the Vietnam-US negotiations that commenced on May 7.

From a technical analysis perspective, the money flow ratio is tilting towards the VN30 group with a ratio of 53.4% – the highest since July 2024. Historical data suggests that this could indicate limited recovery potential for the VN30 group going forward.

Overall, the VN-Index remains in a volatile phase and is heading towards the 1,250 region. If it breaks through this level, the medium-term trend of the index will be more firmly established, with the next target around 1,280 – 1,300. Conversely, the 1,180 – 1,200 region currently acts as technical support during short-term corrections.

Stock Market Yields Outperform Savings Deposits

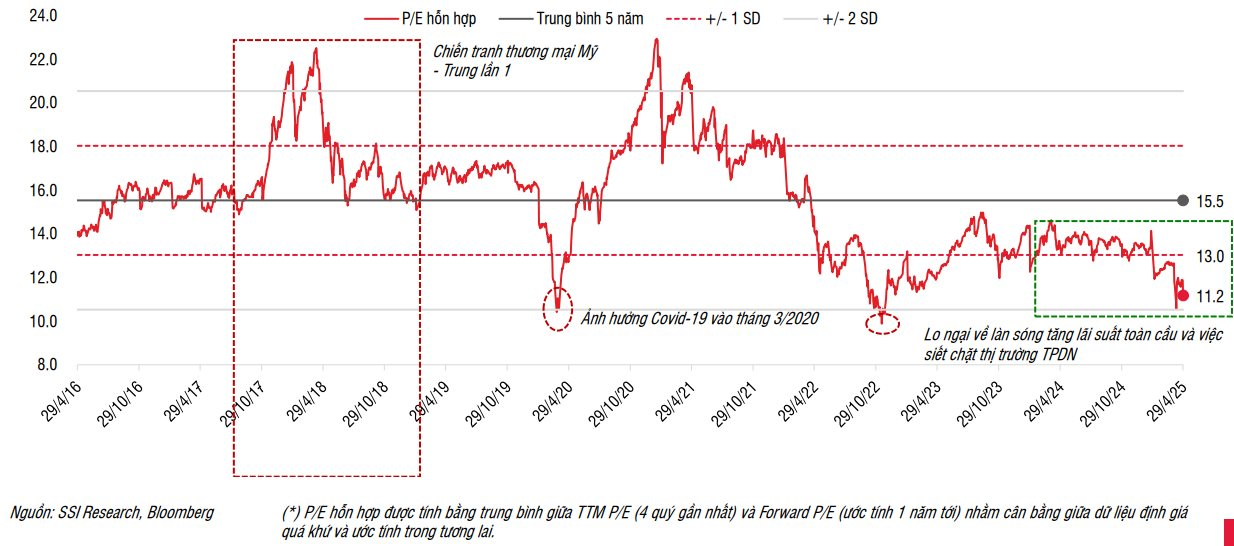

In the past, low valuations have been one of the fundamental factors supporting the market during periods of high volatility (such as the US-China trade war, Covid-19, Fed rate hikes, exchange rate fluctuations, and tight domestic bond market policies).

SSI Research points out that the blended P/E ratio has increased by 6.6% from 10.5 times on April 9 to 11.2 times on April 29, but it is still significantly lower than the 10-year average of 15.5 times. The estimated 1-year yield on the stock market, currently at 9.9% (based on VN-Index’s estimated 1-year P/E of 10.1 times), offers an attractive spread over deposit interest rates.

Blended P/E ratio is still significantly lower than the 10-year average

Sectors less directly impacted by tariffs, such as Media, Residential Real Estate, Retail, Tourism, and Entertainment, have outperformed during the recovery phase. This indicates that investment funds in the stock market are still willing to seek opportunities during deep downturns.

While uncertain risk factors persist for the stock market, it continues to be supported by long-term fundamental factors such as government support policies and a strong commitment to economic growth, as well as the smooth operation of the KRX system, which paves the way for an upgrade in Vietnam’s stock market status.

The Real Estate, Industrial Zone, Chemical, and Oil & Gas sectors, along with export-oriented industries, exhibited lower recovery rates than the market in the last 3 weeks of April. The SSI analysis team believes that the stocks in these sectors, particularly those in the mid-cap category (VNMidcap), will offer more short-term opportunities as positive signals emerge from the tariff negotiations. Conversely, any negative turns in the tariff negotiations will present good opportunities to gradually accumulate stocks in sectors that are less directly impacted.

The Stock Market Shakes Things Up: Domestic Investors Rush to Open Accounts

“There has been a significant surge in the number of domestic investors opening securities accounts, marking the highest increase in an eight-month period. This surge comes amidst a volatile market, heavily influenced by external factors.”

“SGI Capital: The “Haunting” 1200-Hour Mark Turns Supportive, Investors Should Stay Upbeat.”

“According to SGI Capital, the market valuation is significantly cheaper compared to past instances of 1200. Such low valuations are a prerequisite for ensuring low-risk, high-return potential.”