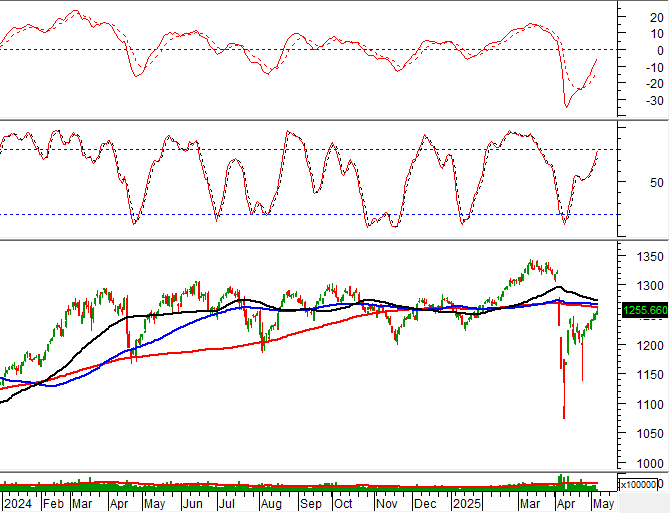

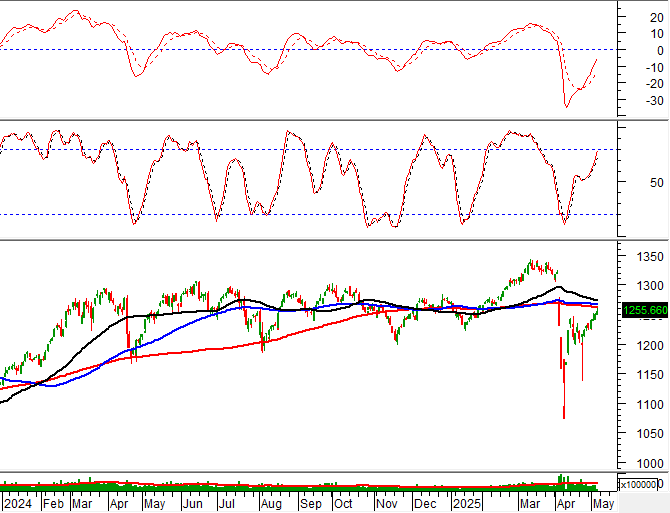

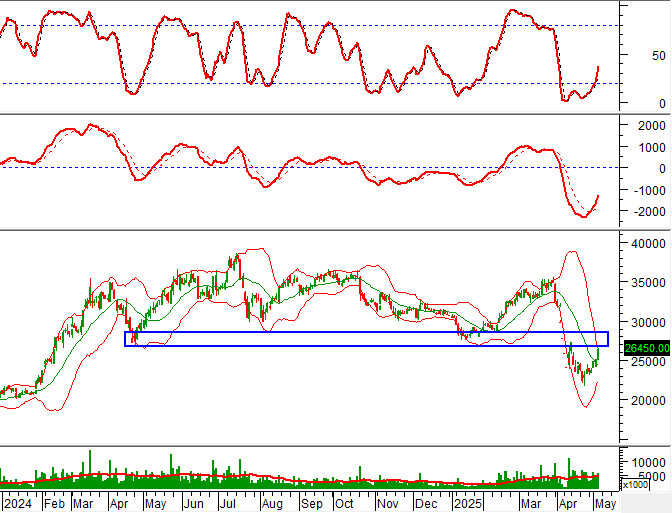

Technical Signals for the VN-Index

In the morning trading session of May 8, 2025, the VN-Index witnessed a rise in points, while liquidity slightly dipped, indicating investors’ cautious sentiment.

Additionally, the VN-Index is heading towards retesting the group of SMA 100-day and SMA 200-day lines, as the Stochastic Oscillator indicator maintains its previous buy signal. Should the index successfully surpass this resistance level, the mid-to-long-term optimistic outlook may return in upcoming sessions.

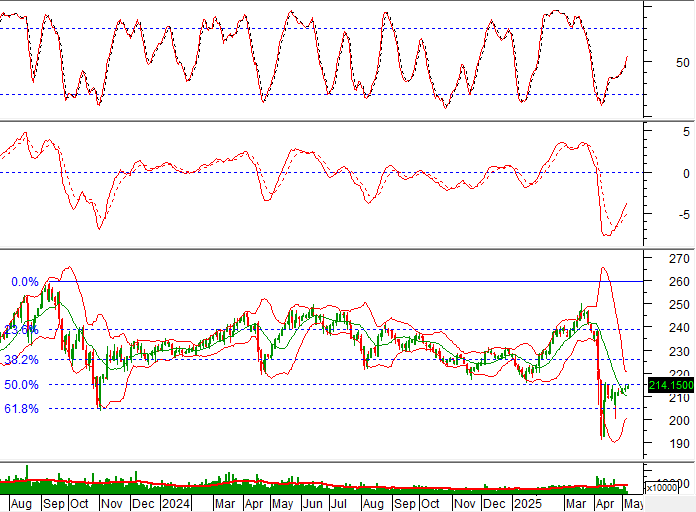

Technical Signals for the HNX-Index

On May 8, 2025, the HNX-Index climbed alongside trading volume, which did not witness a notable improvement, reflecting investors’ uncertainty.

At present, the HNX-Index continues to test the 50% Fibonacci Retracement threshold (equivalent to the 210-215 point region) as the MACD indicator flashes a buy signal again. Should the index surpass this resistance level, the recovery scenario could extend into forthcoming sessions.

EVF – Electric Finance Joint Stock Company

During the morning session of May 8, 2025, EVF’s price rose, and liquidity surpassed the 20-session average, indicating active trading among investors.

Currently, the stock price is retesting the group of SMA 50-day and SMA 100-day lines, while the Stochastic Oscillator indicator continues upward after providing an earlier buy signal. Should the stock price successfully breach this resistance, mid-term optimism will likely return in the upcoming sessions.

GVR – Vietnam Rubber Group Joint Stock Company

In the morning session of May 8, 2025, GVR’s price climbed, accompanied by a substantial surge in trading volume that exceeded the 20-session average, reflecting investors’ optimism.

Additionally, the stock price cut upwards and is presently above the Middle Bollinger Band, while the MACD indicator relentlessly expands its gap with the Signal line after offering a prior buy signal, suggesting that the recovery scenario is gradually materializing.

Technical Analysis Department, Vietstock Consulting

– 12:00, May 8, 2025

The Elusive Pivot: VN-Index Retreats Amid Cash Crunch

The VIC’s sharp decline has poured cold water on yesterday’s enthusiasm. Despite standouts like FPT and LPB, particularly the latter’s strong performance, its limited market cap prevents it from being considered a pillar, weakening the overall market support. Additionally, the money flow has turned notably cautious, with the breadth tilting towards the red and liquidity declining by 13%.

The Market Tug-of-War: Heavyweight Stocks Hold the Line, Foreign Investors Surprise with Strong Buying

The VN-Index struggled to maintain its highs this morning as blue-chip stocks continued to diverge and weaken. Only 5 out of the top 10 largest capitalization codes increased, fortunately including VIC and GAS. Trading volume decreased by 10% compared to yesterday morning, with a balanced breadth confirming a tug-of-war state. A bright spot was that foreign investors unexpectedly net bought 367 billion VND after 16 consecutive net selling sessions.

The Market Wary of Tariff Talks: Foreign Investors Turn Net Sellers

This morning, the market witnessed a significant cautious sentiment as preliminary and unofficial news regarding the first meeting on tariff issues was circulated. Despite an impressive surge in VIC, the second-largest market cap stock, the VN-Index fluctuated and posted a modest gain amid declining liquidity and a strong net sell-off by foreign investors.

The Big Money Rush: Stocks Soar as VN-Index Recovers from Tariff Trauma

The lethargic morning trading pace took an unexpected turn within the first 15 minutes of the afternoon session. Leading stocks, notably FPT, witnessed a dramatic surge in volume, swiftly triggering a frenzied buying spree. HoSE’s afternoon matching volume skyrocketed by 66% compared to the morning session, with the VN-Index closing at its strongest gain in 16 sessions.

“Stocks Slide as Selling Pressure Weakens, Blue-chips Rebound Ahead of Derivatives Expiry”

The market witnessed a positive shift in the afternoon session as selling pressure eased. Prices gradually climbed, especially after 2:15 pm when the VN30-Index calculations started influencing the final settlement prices. A steady ascent of blue-chip stocks propelled the VN-Index and VN30-Index to surpass the reference levels and close at their highest points for the day.