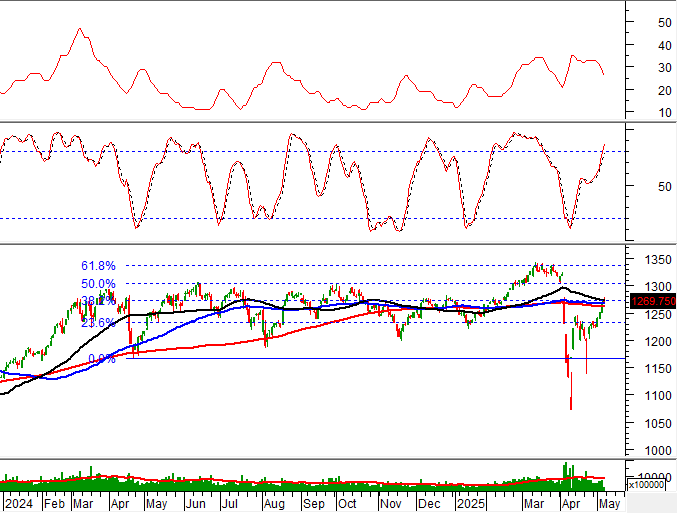

Technical Signals for the VN-Index

During the morning trading session on May 9, 2025, the VN-Index witnessed a decline and formed a Doji candlestick pattern, indicating investors’ indecision.

Additionally, the index is retesting the Fibonacci Projection 38.2% level (corresponding to the 1,245-1,265 point range) as the ADX indicator shows signs of weakening and a potential return to the gray zone (20 < ADX < 25)

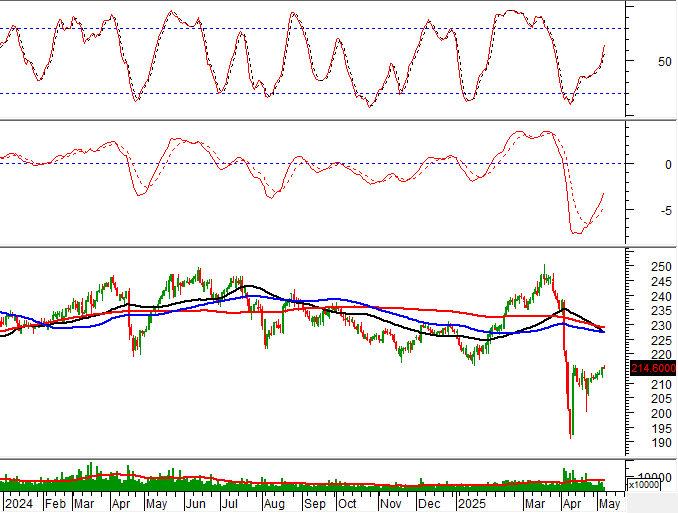

Technical Signals for the HNX-Index

On May 9, 2025, the HNX-Index declined, accompanied by a significant drop in trading volume during the morning session, reflecting investors’ cautious sentiment.

Currently, a ‘Death Cross’ has formed on the chart, with the 50-day SMA crossing below the 100-day and 200-day SMAs, suggesting that the mid-to-long-term outlook is gradually losing its luster.

CTR – Viettel Engineering Corporation

On the morning of May 9, 2025, CTR witnessed a price increase and formed a White Marubozu candlestick pattern, accompanied by a significant surge in trading volume during the morning session, indicating active participation from investors. It is expected to surpass the 20-day average volume by the end of the day.

The stock price is currently testing the Fibonacci Retracement 50% level (corresponding to the 93,500-98,500 range) as the Stochastic Oscillator continues upward, following a previous buy signal. If the stock price successfully breaks above this resistance level, the short-term uptrend may extend in the upcoming sessions.

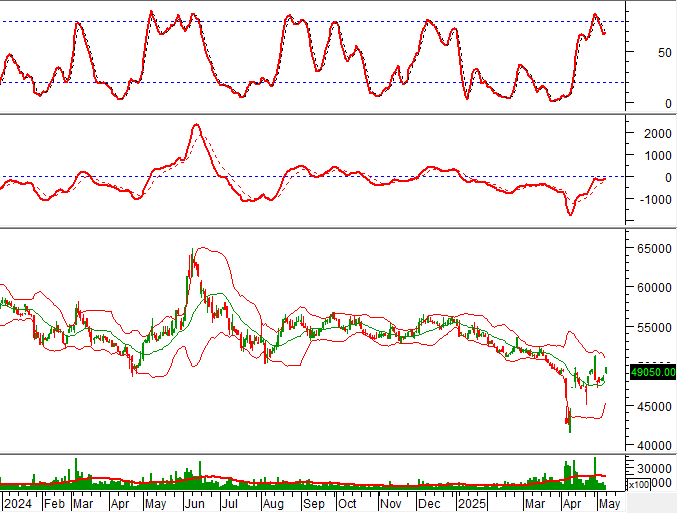

SAB – Saigon Beer, Alcohol and Beverage Corporation

During the morning session on May 9, 2025, SAB’s stock price rose, forming a Rising Window candlestick pattern, reflecting investors’ optimism.

Moreover, the price broke above the Middle Bollinger Band, and the MACD indicator continues to widen its gap with the Signal line after providing an earlier buy signal, suggesting that the recovery scenario is materializing.

Technical Analysis Team, Vietstock Consulting Department

– 12:05, May 9, 2025

SSI Research: Positive Trade Negotiation Developments to Spur Market Recovery

The SSI Securities Analysis Department’s strategic report highlights the need for positive developments in trade negotiations to sustain the market’s recovery momentum. The current blended P/E ratio remains low, and the estimated one-year market yield is attractive compared to deposit interest rates.

Market Beat: VN-Index Sees Extended Tug-of-War as Caution Prevails

The market closed with the VN-Index down 2.5 points (-0.2%), settling at 1,267.3. The HNX-Index followed suit, dropping 1.08 points (-0.5%) to 214.13. The day’s trading saw a slight tilt towards decliners, with 396 stocks falling against 353 advancing. The VN30 basket mirrored this trend, showing a sea of red with 15 decliners, 8 gainers, and 7 stocks holding steady.

“VNDIRECT Research: Cautiously Awaiting the Outcome of Vietnam-US Trade Talks”

VNDIRECT Securities Analysis Unit (VNDIRECT Research) forecasts that the VN-Index will fluctuate between 1,230 and 1,520 points by the end of 2025, depending on three main scenarios. The outcome will hinge on the trade negotiations between the US and Vietnam, the number of Fed rate cuts, the State Bank’s interest rate management, and the results of the FTSE’s market classification review in September.

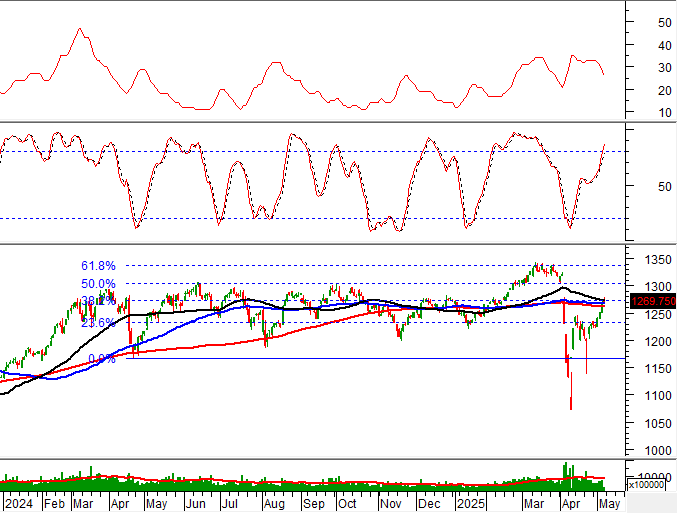

Stock Market Week May 5-9, 2025: Powerful Breakthrough

The VN-Index concluded a highly positive week of trading, recording gains in 4 out of 5 consecutive sessions and surpassing the 200-day SMA. The resumption of net foreign buying was a key factor in supporting this upward momentum. If this trend persists into the next week, coupled with stronger market participation, the VN-Index is poised to further consolidate and extend its gains.