Synchronizing multiple solutions in monetary policy management

Throughout 2024 and the early months of 2025, the State Bank of Vietnam (SBV) demonstrated its proactive and flexible role in monetary policy management amidst complex global economic fluctuations. By coordinating various policy tools, the SBV has helped curb inflation within target ranges, stabilized the monetary and foreign exchange markets, and strengthened the macroeconomic foundation, ensuring the economy’s major balances.

The SBV has flexibly managed open market operations, aligning with market dynamics to regulate currency flows. This has contributed to monetary stability and the achievement of monetary policy objectives. Accordingly, the SBV conducts daily term-bid auctions of securities through open market operations, offering appropriate volumes to meet the funding needs of credit institutions (CIs). They have also diversified and extended the maturity of these auctions to provide longer-term support to the system.

SBV implements multiple solutions to stabilize the monetary market and ensure the economy’s major balances.

Additionally, the SBV has maintained low policy rates to guide the market towards reducing lending rates, supporting businesses and individuals. They have also instructed CIs to reduce operating costs, enhance information technology applications, embrace digital transformation, and explore other solutions to strive for lower lending rates. Direct interactions and official directives have been issued to the entire CI system to stabilize deposit rates and reduce lending rates, thereby fostering economic development.

As a result of these swift and decisive directives to commercial banks, lending rates have continued their downward trend. CIs have published lending rate information on their websites to provide additional references for customers seeking loan access. As of April 10, 2025, the average lending rate for new transactions of commercial banks stood at 6.34%/year, a 0.6%/year decrease compared to the end of 2024.

Regarding exchange rates and the foreign exchange market, the SBV faces significant, multifaceted, and rapidly changing pressures due to unpredictable international economic and political developments, particularly the tax policies of the US administration. The SBV has responded by flexibly managing exchange rates and coordinating monetary policy tools (liquidity regulation and interest rates) while intervening when necessary to stabilize the foreign exchange market. This has contributed to macroeconomic stability and inflation control. Consequently, the foreign exchange market has remained stable, with smooth foreign currency liquidity, and the economy’s legitimate foreign currency needs have been fully and promptly met. The VND exchange rate has fluctuated bidirectionally, consistent with the overall trend of international currencies against the USD. As of April 22, 2025, the trading rate hovered around 25,896 VND/USD, a 1.64% increase compared to the end of 2024.

According to the SBV, the monetary policy management has contributed to curbing inflation. In 2024, Vietnam’s inflation faced upward pressure in the first half due to the impact of rising global food prices, electricity, healthcare, and rental costs. However, the decline in energy prices and the stabilization of food prices since the beginning of the third quarter slowed down inflation (inflation compared to the same period in December 2024: 2.94%; July 2024: 4.36%; December 2023: 3.58%). The SBV assesses that inflationary pressures are within control, as evidenced by the following figures: For the whole of 2024, average inflation was 3.63% – below the set target; core inflation was 2.71%, lower than headline inflation.

In the first quarter of 2025, inflation remained well-controlled despite pressures from rising food prices, adjustments in state-managed commodities and services (electricity and healthcare), and seasonal holiday factors. Additionally, the decline in domestic fuel prices, following the global trend, was a contributing factor in easing inflationary pressures in the first quarter of 2025. On average, during the first three months of 2025, headline inflation was 3.22%, and core inflation was 3.01%.

Overall, the SBV has synchronously and flexibly managed monetary policy tools to regulate currency flows and stabilize the monetary market. In practice, the SBV and the Ministry of Finance regularly exchange information on the monetary market, the government bond market, and the state treasury’s cash flow management to enhance coordination between monetary policy and fiscal policy.

Pressures from complex factors in the international market

While acknowledging the achievements, the SBV recognizes the challenges in monetary policy management due to complex domestic and global economic conditions.

Specifically, inflation faces potential upward pressure as Vietnam’s economy is highly open, and global commodity prices fluctuate due to complex geopolitical developments, rising trade protectionism, food security concerns in various countries, the roadmap for adjusting prices of state-managed commodities and services, climate change, and extreme weather events, among others.

Pressures in monetary policy management due to unpredictable global economic developments.

The SBV also explains that there are multiple factors contributing to the pressure on interest rates in the past year.

Firstly, lending rates have already shown a significant downward trend.

Secondly, the demand for credit for production, business, and consumption is expected to increase significantly in the coming period to meet the economic growth target for 2025. However, the system-wide capital mobilization of CIs may be affected and face competition from other investment channels, such as real estate and the stock market.

Thirdly, while global interest rates have shown a downward trend, they remain relatively high, and the global financial market is challenging to predict following the US’s countervailing duty policy announcement.

Moreover, in the near future, exchange rates and the foreign exchange market are likely to continue facing substantial pressure from complex factors in the international market, such as the Trump administration’s tariff policies, which are expected to negatively impact the global economy, the Fed’s unpredictable monetary policy roadmap, geopolitical events, and commodity price shocks. Domestic challenges also play a role, including the interest rate differential between VND and USD and the economy’s persistent high foreign currency demand.

Looking ahead, the SBV will continue to closely monitor market developments and domestic and international economic conditions to proactively, flexibly, timely, and effectively manage monetary policy. This will be done in coordination with fiscal policy and other policies to prioritize promoting economic growth while maintaining macroeconomic stability, controlling inflation, and ensuring the economy’s major balances.

“VietinBank Boosts Credit Package, Invests in Forestry and Fisheries”

“Following the directives of the Government and the Prime Minister’s Resolution No. 46/NQ-CP dated March 8, 2025, and Directive No. 05/CT-TTg dated March 1, 2025, VietinBank, in alignment with the guidance of the State Bank of Vietnam, has introduced a preferential credit program for the forestry and aquatic product sectors. With a scale of up to VND 12,000 billion, this initiative aims to alleviate challenges faced by businesses and individuals, ultimately driving economic growth.”

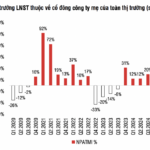

Listed Companies Aim for a 13.6% Revenue Increase in 2025

Based on the 2025 statistical plan of 104 large-cap listed companies, which account for approximately 70% of market capitalization, the total revenue plan for 2025 shows an increase of about 13.6% compared to the revenue realized in 2024.

The Capital Injection Conundrum: Why Are Businesses Still Struggling to Secure Loans Despite Banks’ Efforts?

The banking sector injected nearly VND 200,000 billion into the economy in the first few months of the year, yet businesses still cry out for easier access to this capital. Experts assert that directing this bank funding towards businesses requires a harmonious interplay between governing policies, strategic banking initiatives, and proactive enterprise from businesses themselves.

The New Interest Rate Cuts: A Strategic Move by Banks to Boost Their Economy.

As per the State Bank of Vietnam’s (SBV) update on deposit interest rate movements at commercial banks from February 25 to March 18, 2025, a significant 23 banks adjusted their deposit interest rates, with reductions ranging from 0.1% to 1% per annum, depending on the term. Notably, the SBV also recorded up to six instances of banks lowering their interest rates within this period.