Vietnam’s National Comprehensive Financial Strategy aims to promote not only cashless payments but also the expansion of healthy credit access, especially for vulnerable groups. To achieve this, the first step is to increase bank account ownership among the population, particularly in remote areas.

Since 2021, opening a bank account has become increasingly convenient. As of June 2024, according to the State Bank of Vietnam, there were 193 million individual payment accounts opened in the country’s banking system.

It is expected that the number of payment accounts in Vietnam will surpass the 200 million mark in 2025.

Mr. Vu Thanh Trung, Vice Chairman of the Board of Directors of MB Bank and Chairman of the Board of Directors of MBV Bank, assessed that the proportion of the population with bank accounts is already very high, indicating that the initial phase of comprehensive finance and universal payment has been essentially completed.

The next step in the country’s financial inclusion, according to Mr. Trung, relates to credit. “Black credit is still operating in many places, so how do we eliminate it and promote comprehensive financial inclusion? Banks have an important role to play here,” said Vu Thanh Trung.

Mr. Vu Thanh Trung: “The comprehensive financial payment service has been very successful”. Source: MB |

According to Mr. Trung, to offer low-interest loan packages to vulnerable groups in society, it is crucial to first prevent bad debt from those who intentionally borrow and refuse to repay. “The interest rates that people have to pay when borrowing from banks today include a very high proportion to cover the losses from those who do not repay,” he said.

The Vice Chairman of MB’s Board of Directors believes that it is unfair for those who genuinely want to borrow, repay honestly, and improve their livelihoods to bear the costs of the fraudulent and deceptive groups who borrow and then default.

Therefore, in implementing comprehensive finance, the most important thing is to detect fraudulent and deceptive groups within the bank. At MB, the chosen solution is to lend through customer data.

For example, MB is utilizing data from the KiotViet sales management platform – a partner with approximately 200,000 micro-businesses – to classify customers into high and low credit reliability segments based on data analysis.

“When we lend to customers with high credit reliability, we can reduce the costs associated with non-repayment, thus improving financial access,” shared Mr. Trung.

MB is also testing a few lending models in rural, remote, and mountainous areas, aiming to reduce lending costs for customers in these regions.

“The State Bank of Vietnam has provided close guidance, and large banks need to take responsibility by leveraging data and new business models. We believe that, in addition to payment services, we will gradually popularize new financial products in the field of comprehensive finance,” said Vu Thanh Trung.

|

Decree No. 94/2025/ND-CP (Decree 94), which took effect on July 1, 2025, provides regulations on the controlled trial mechanism in the banking sector for the deployment of new products, services, and business models through the application of technology solutions. The goal of the trial mechanism is to promote innovation and modernization in the banking sector, thereby realizing the goal of financial inclusion for individuals and businesses in a transparent, convenient, safe, efficient, and low-cost manner. The results of the Fintech trial will serve as practical evidence for relevant state agencies to research, develop, and perfect the legal framework and management regulations if necessary. The financial technology solutions (Fintech solutions) included in the trial mechanism are: Credit scoring, Data sharing via Open API (Application Programming Interface), and Peer-to-peer lending. The subjects of application include: Credit institutions and branches of foreign banks as stipulated in the Law on Credit Institutions; Fintech companies; State agencies with competent authority; Customers and other organizations and individuals related to the trial mechanism. |

Tuân Nguyễn

– 06:15 05/03/2025

Launching the Strategic Human Resources Alliance for the Implementation of Resolution 57-NQ/TW

On May 7, 2025, the Forum on Developing New Impetus for the Nation and the Launch Ceremony of the Strategic Human Resources Alliance for the Implementation of Resolution 57-NQ/TW was held in Hanoi. This significant event, organized by FPT Corporation in collaboration with various ministries, departments, and organizations, aimed at contributing to the development of human resources to ensure the successful implementation of Resolution 57-NQ/TW.

“Vicostone’s First Quarter Net Profit Down Nearly 20% Year-on-Year”

As of Q1 2025, Vicostone recorded a revenue of over VND 1,018 billion, a 5.2% decrease compared to the same period last year. Despite this, the company managed to maintain a strong profit with an after-tax profit of nearly VND 164.6 billion, reflecting a resilient performance in a challenging economic climate.

“Speed Demons: The Owners of These License Plates Face Fines for Breaking the Limits”

On May 8th, the Cao Bang Provincial Police announced the results of their traffic violation detections through the traffic surveillance camera system.

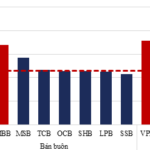

“Consumer Credit: Investment Opportunities Arising from the Easing Trend”

In the context of expected consumer recovery, the regulatory adjustments for credit management offer a promising path for consumer finance companies, and by extension, a potential profit recovery for retail-focused banks. With bank stock valuations at a low point, this presents an opportune investment landscape for 2025.