“The Asian Century: Unlocking the Wealth Management Potential in Vietnam”

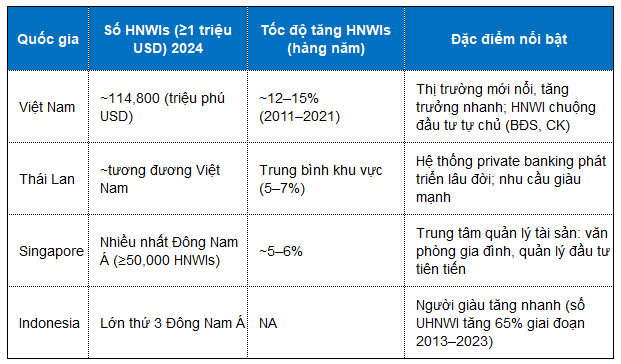

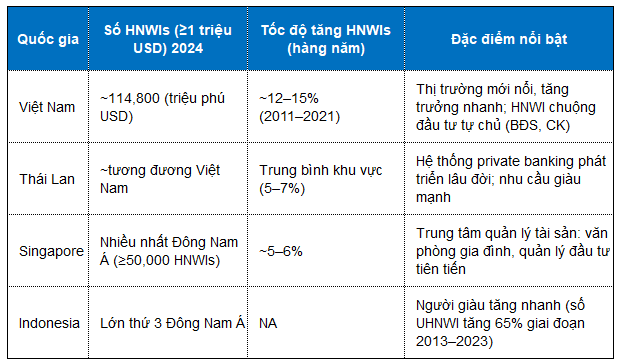

Asia’s high-net-worth families are facing a multigenerational wealth transfer wave of approximately $5.8 trillion between 2023 and 2030. Surveys indicate that Asian HNWIs are increasingly favoring discretionary portfolio management (DPM) and investing in alternative channels such as private equity, real estate, and hedge funds to diversify their portfolios and protect their assets. Meanwhile, wealthy younger generations demand tech-savvy, digitized experiences, digital banking conveniences, and personalized investment advice.

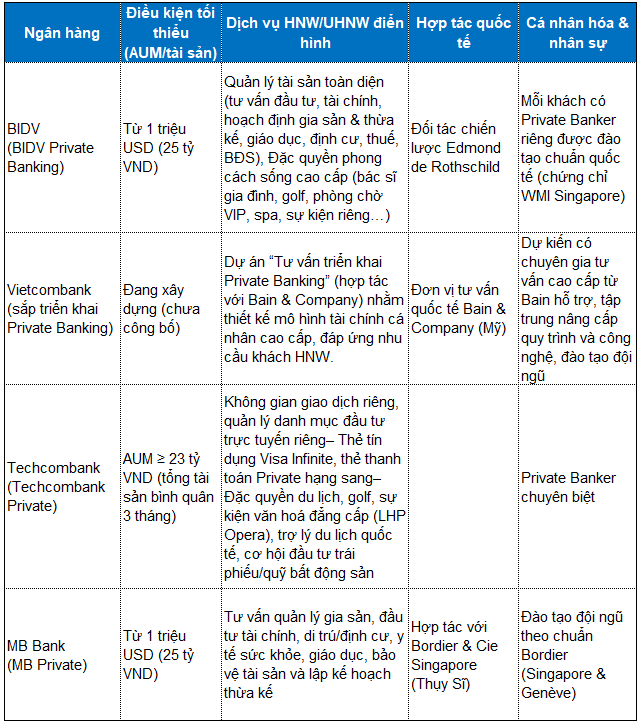

Recognizing the immense potential of this client segment, several banks in Vietnam have proactively launched private banking services to cater to the diverse and demanding needs of these wealthy individuals. MB, BIDV, and TCB are among the Vietnamese banks that have already established their presence in this domain. In January 2025, VPB, a top-ten bank in terms of total assets, also joined the race.

|

Comparing the services offered by these banks

|

When comparing the services offered by these banks to ultra-high-net-worth individuals (UHNWIs), the differences are not stark. Some banks, like MB and BIDV, leverage their collaborations with reputable organizations in the market as a competitive advantage. However, in terms of customer care, exclusive privileges (such as access to golf courses, healthcare services, and airport lounges), and preferential interest rates, there isn’t a significant differentiation among the banks.

|

Private Banking offers a specialized model of banking services tailored to clients with substantial assets. It encompasses wealth management solutions and addresses all financial and non-financial needs, including investments, inheritance planning, residency procedures, and healthcare. |

To create a significant point of differentiation, competitive edge, and exceptional customer experience, the key lies in enhancing the quality of advice provided by Private Bankers. This entails not just routine reminders about loan due dates or scheduling medical appointments but also encompasses strategic asset allocation, tax optimization strategies, and seamless wealth transfer advice.

Vietnamese HNWIs seek a holistic approach to financial planning from their advisors, going beyond mere investment solutions. They expect a combination of long-term goal setting, asset protection structures, and estate planning, all while ensuring a high level of personalization and professionalism. These clients place their utmost trust in wealth managers and look for internationally certified experts with extensive experience who always act in their best interests. However, Vietnam’s current challenge lies in the perceived lack of market knowledge and skills among Relationship Managers (RMs) to meet the complex financial demands of this discerning clientele.

To address this challenge, banks need to initiate changes from within. Firstly, they should evolve from a “seamless service model” to a more integrated approach, where RMs collaborate closely with product specialists (such as experts in stocks, bonds, and insurance) and investment/private banking advisors. This “one-bank” model enables each RM to efficiently manage 30-40 HNW clients with the support of a competent team, rather than shouldering all responsibilities alone.

Secondly, banks should focus on enhancing their training models and methodologies. While there is a large pool of RMs across branches, there is a noticeable gap in deep expertise, including financial advisory, needs assessment, and effective communication skills. Current training programs tend to emphasize client onboarding processes while neglecting the development of these critical skills. Experts recommend implementing structured training curricula to build and enhance the capabilities of existing RMs and attract new talent.

In summary, Vietnam’s ultra-wealthy individuals seek personalized, comprehensive, and reputable financial services. They are concerned not only with investment returns but also with asset preservation, succession planning, and exclusive experiences. Global trends such as DPM, alternative investments, family offices, and professional wealth transfer services are shaping the wealth management industry. Vietnamese banks have been proactive in adapting to these trends by establishing dedicated private banking/wealth management divisions, forging international partnerships, investing in senior advisor training, and offering diverse privileges.

However, challenges remain, including enhancing the credibility of advisors, deepening the expertise of product offerings, and guiding clients toward more diverse investment strategies. To fully capitalize on the growing HNWI market, Vietnamese banks should continue refining their service models, standardizing advisory processes, and expanding their product-service ecosystems to meet international standards.

|

High-Net-Worth Individuals (HNWIs) are defined as individuals or households with liquid assets ranging from $1 million to $5 million. Very-High-Net-Worth Individuals (VHNWIs) are those with liquid assets between $5 million and $30 million. Ultra-High-Net-Worth Individuals (UHNWI) refers to individuals or households with liquid assets exceeding $30 million. |

Chu Tuấn Phong

– 09:00 10/05/2025

“Cienco4 Barred from Bidding in Ha Nam Province Due to Document Forgery in University Project”

Cienco 4 has established itself as a key player in major infrastructure projects across Vietnam. With a proven track record in large-scale developments, the company has been instrumental in shaping some of the nation’s most significant transportation hubs. Their expertise and involvement can be witnessed in the Quang Tri Airport, a 5.8-trillion VND project, as well as the prestigious Long Thanh Airport, where they undertook Package 4.6, valued at 8.1 trillion VND. Additionally, their portfolio includes the Le Van Luong – Hanoi’s Ring Road 3 tunnel, further showcasing their capabilities in delivering complex and vital infrastructure projects.

New Oil Discovery Off the Coast of Vietnam: A Joint Venture Between Korean Chaebol SK and Murphy Oil of the US

For the second time in just three months, SK Earthon has struck oil in Vietnam. The company announced on May 8 that it has successfully discovered oil in lot 15-2/17, adding to its earlier find in the same country earlier this year in January.

The Capital’s Colossal Venture: Vingroup’s International-Scale Project Nears Completion for its Special Mission

As we approach the special occasion of National Day on the 2nd of September, all eyes are on the upcoming project by Vingroup. This prestigious development promises to be a landmark undertaking, with a unique mission that will be unveiled during the patriotic celebrations. Stay tuned for more details on this exciting venture, as we anticipate a remarkable showcase of expertise and innovation from one of the leading developers in the industry.