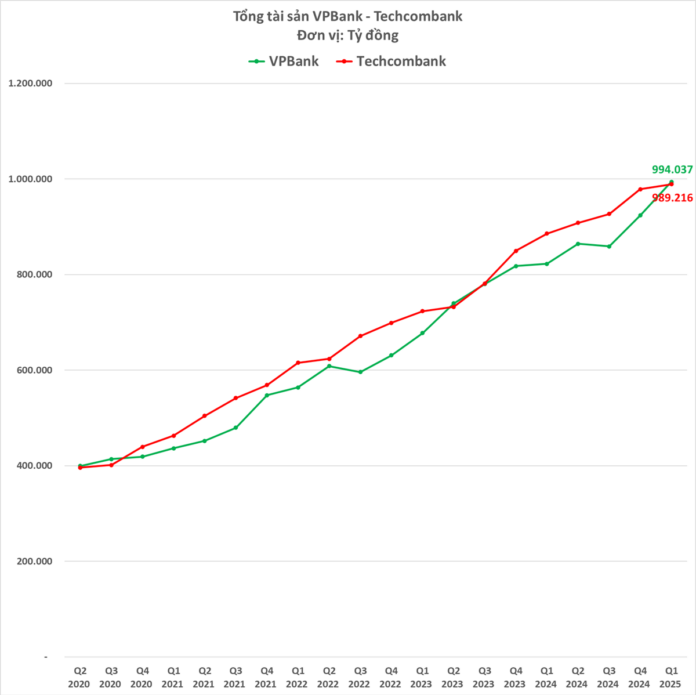

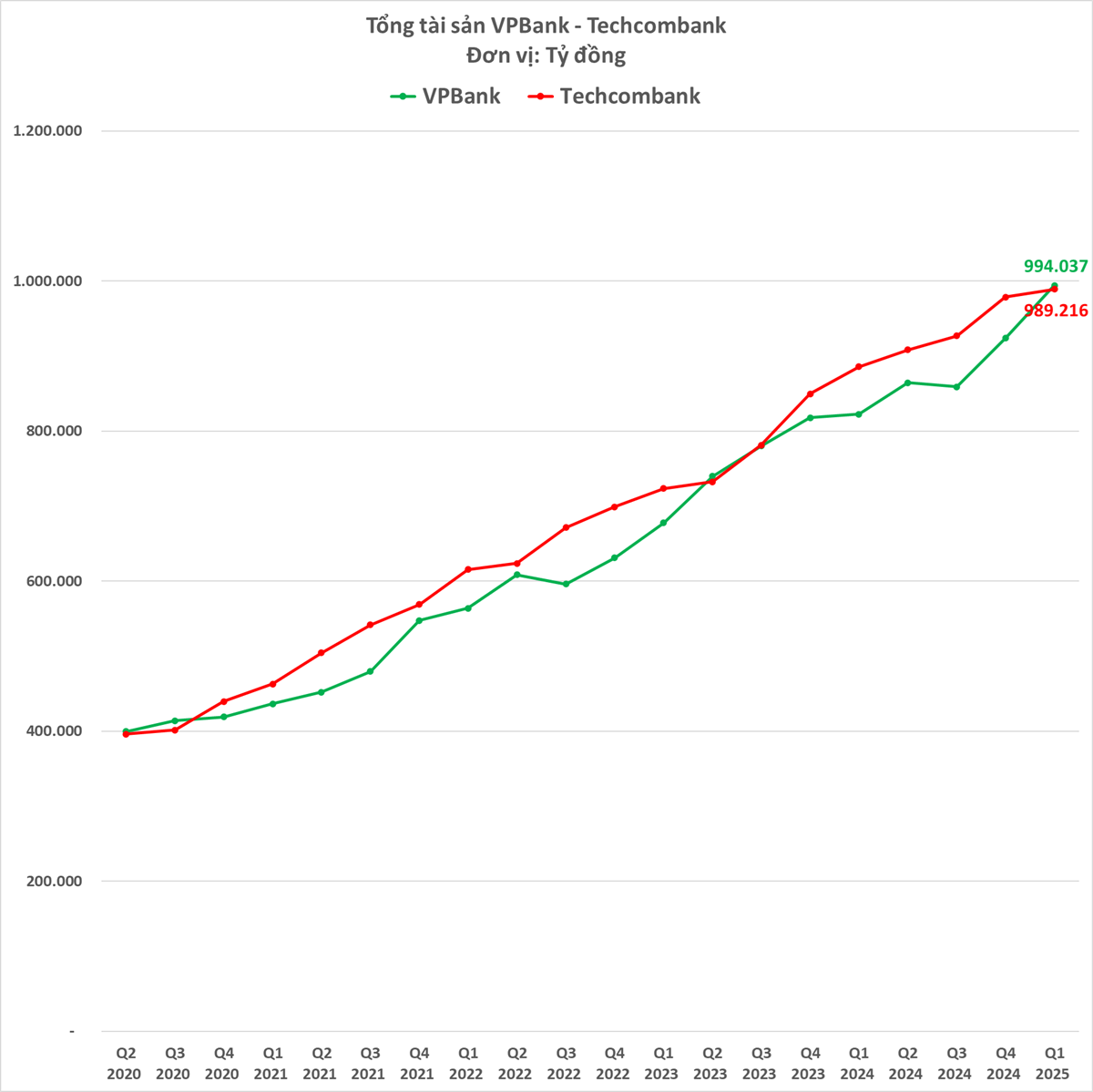

The private banking sector in Vietnam is witnessing a fierce competition between Techcombank and VPBank, with both institutions striving for dominance. These two powerhouses are neck-and-neck in terms of total asset size and are on the verge of becoming the first private banks in Vietnam to surpass the impressive milestone of 1 quadrillion VND in total assets. As of the first quarter of 2025, VPBank’s consolidated total assets exceeded 994 trillion VND, while Techcombank is hot on their heels with nearly 990 trillion VND.

Beyond their rivalry for the top spot, both Techcombank and VPBank share a common ambition to transform into comprehensive financial groups. They are actively expanding into the insurance sector and strengthening their presence in securities and asset management.

At the 2025 Annual General Meeting of Shareholders, VPBank approved a plan to contribute capital to establish a life insurance company. The projected chartered capital of this subsidiary is 2 trillion VND, with the specific amount to be determined by the bank’s board of directors based on agreements. The company will offer a range of life insurance products, including basic life insurance, health insurance, and linked insurance, along with other insurance operations permitted by law and approved by the Ministry of Finance.

Previously, in 2022, VPBank acquired OPES, propelling it to become one of the leading non-life insurance companies in Vietnam.

Techcombank, on the other hand, has also made strategic moves in the insurance sector. Earlier this year, they announced their contribution of capital to establish a life insurance company as a subsidiary. Techcombank is currently awaiting the completion of licensing procedures from the Ministry of Finance and the State Bank of Vietnam.

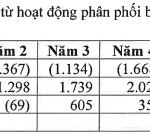

According to Techcombank, this initiative aims to enhance their services and products, increase financial benefits, and boost competitiveness. They believe that the Vietnamese life insurance market holds significant potential for growth and development, allowing them to proactively offer diverse and superior products to their customers. This move will also bring financial benefits, including competitive fee income and an increase in total asset value from the bank’s capital contribution to the life insurance company.

“We strongly believe that now is the right time to establish a life insurance company, and we are confident in our ability to make a difference,” said Techcombank’s CEO at a recent press conference following the Annual General Meeting of Shareholders.

Additionally, Techcombank plans to repurchase shares to make TCGIns, a non-life insurance company, a subsidiary, recognizing the significant potential of this business segment. Techcombank’s investment in TCGIns is expected to increase consolidated pre-tax profits annually.

Interestingly, both leading private banks in Vietnam have unveiled ambitious plans to strengthen their insurance businesses in 2025. Moreover, VPBank and Techcombank have their sights set on the securities sector, already owning top securities companies, TCBS and VPBankS, respectively.

Techcombank intends to proceed with the IPO of TCBS in 2025. Currently, TCBS leads the market share in corporate bond issuance advisory services, holding 40% of the market (excluding bank bonds). Additionally, TCBS ranks among the top three securities companies in terms of brokerage market share on the HoSE and occupies the second position on the HNX.

“We will choose the right timing, but it will be soon. Our Board of Directors has already developed plans and outlined various scenarios, and we have engaged consultants,” shared Techcombank’s Chairman, Ho Hung Anh.

VPBankS, benefiting from its affiliation with VPBank, has entered the top 10 securities companies with the highest lending volumes. As of March 31, 2024, VPBankS’s lending balance reached nearly 9 trillion VND, more than triple the figure at the end of 2022, marking the most substantial growth among the top 10 securities companies with the largest margin lending volumes in the market…

At the 2025 Annual General Meeting of Shareholders, VPBank approved a plan to contribute capital, acquire capital contributions, and purchase shares to establish a fund management company as a subsidiary. “This is part of the bank’s strategy to develop VPBank into a comprehensive financial group,” emphasized Bui Hai Quan, VPBank’s Vice Chairman. “Life insurance and fund management are essential components of such a group.”

VPBank Secures a Record-Breaking $1 Billion in Syndicated Foreign Loans

On May 5, 2025, VPBank, or Vietnam Prosperity Joint-Stock Commercial Bank, announced the successful closing of an international syndicated loan facility initially valued at USD 1 billion, with an option to upsize depending on the bank’s future capital requirements.

The Future of Banking: Techcombank Unveils Its New Branch in Vung Tau

On April 3rd, Vietnam Technological and Commercial Joint Stock Bank officially inaugurated its next-generation branch model in Vung Tau, featuring a unified, distinct, and superior design and identity. This strategic milestone marks the beginning of the recently announced plan to comprehensively renovate the branch network, aiming to pioneer and set a new standard for bank branch models in Vietnam, embracing digitalization, modernity, and a green and sustainable future.

The Eighth Wonder of the World: Unlocking Double Interest with VPBank NEO

Albert Einstein once referred to compound interest as “the eighth wonder of the world”, believing that “he who understands it, earns it”. Today, VPBank has brought the power of compound interest closer to everyone, thanks to the application of modern technology, innovation, and a deep understanding of customer needs. With just a few simple steps on VPBank NEO, you can unlock the wonders of compound interest and watch your money grow.

Techcombank Invests in a Life Insurance Company with VND 1,300 Billion

The Board of Directors of Vietnam Technological and Commercial Joint Stock Bank (Techcombank, HOSE: TCB) has approved a plan to contribute capital and purchase shares to establish Vietnam Technological and Commercial Life Insurance Joint Stock Company – TCLife.