On the occasion of the 50th anniversary of the Liberation of the South and National Reunification, to improve the quality of customer service, Ho Chi Minh City Book Distribution Joint-Stock Company (Fahasa, stock code FHS) has decided to renovate Tan Binh Bookstore and Thu Duc Bookstore.

Spending billions on renovating two nearly “30-year-old” bookstores

The total investment budget is nearly VND 5 billion, including:

+ Tan Binh Bookstore has an area of 1,000m2 located on Truong Chinh Street, with a total investment of VND 2.5 billion;

+ Thu Duc Bookstore has an area of 1,000m2 located on To Ngoc Van Street, with a total investment of VND 2.5 billion.

FHS representative said that Thu Duc Bookstore and Tan Binh Bookstore are two of the oldest cultural addresses, closely associated with a large number of readers in Ho Chi Minh City. Thu Duc Bookstore was established in 1998 and Tan Binh Bookstore was established in 2004. Fahasha itself is also one of the oldest brands associated with Ho Chi Minh City, established in 1976.

Currently, Fahasa is known as a leading book and bookstore business in Vietnam in terms of scale (with 106 bookstores nationwide) and sales. While Phuong Nam or ADC Book’s revenue did not reach VND 1,000 billion in 2023, Fahasa’s figure far surpassed it with nearly VND 4,000 billion. The key factor for the company’s survival and healthy growth, according to Fahasa, is its focus on specialization.

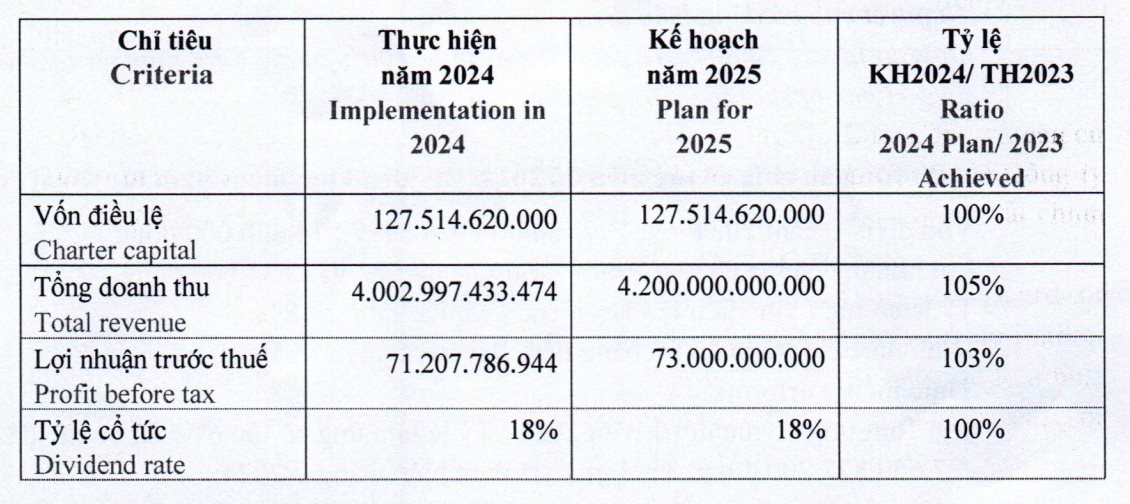

In 2024, Fahasa maintained revenue of over VND 4,000 billion and after-tax profit of nearly VND 60 billion. Last year, the company also renovated and invested in nearly a dozen new bookstores in the city.

As of December 31, 2024, the company’s total assets reached VND 1,456 billion, up 6% over the same period. Of which, owner’s equity is over VND 219 billion and liabilities are VND 1,236 billion.

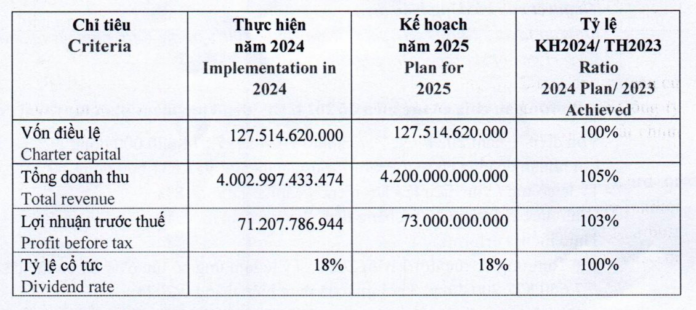

2025 revenue target of VND 4,200 billion

In 2025, Fahasa sets a target of VND 4,200 billion in revenue, up 5%, and pre-tax profit of VND 73 billion, up 3% compared to 2024. With this goal, the company plans to pay dividends at a rate of 18%.

In the context of market difficulties and competitive pressure (from both traditional bookstores and online sales channels), Fahasa said that it will focus on expanding its network (opening new bookstores in potential markets, upgrading existing ones), investing in developing e-commerce channels, as well as exploiting new items according to the trend of young people and promoting the sale of books.

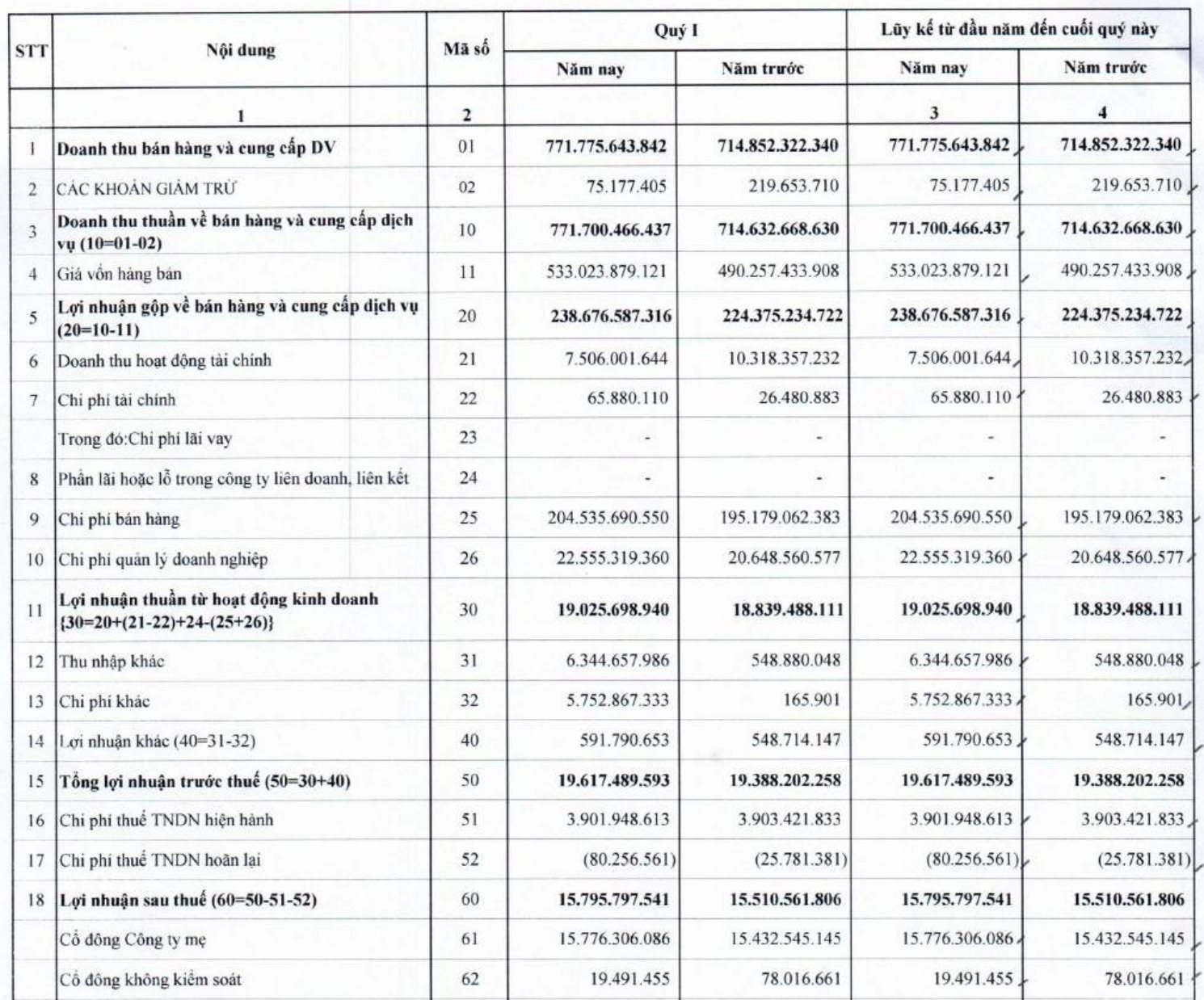

Q1/2025 revenue of VND 772 billion, equivalent to VND 26 billion/day

The company has just announced Q1/2025 business results with net revenue of VND 772 billion, up 8% over the same period last year. Accordingly, the company earns VND 26 billion per day.

The company’s gross profit reached VND 238.5 billion, up 7%.

After deducting expenses, Fahasa reported a pre-tax profit of VND 19.6 billion and after-tax profit of VND 16 billion. Compared to the full-year plan, the company has achieved about 27% of its pre-tax profit target.

As of the end of March 2025, Fahasa’s total assets reached VND 1,441 billion. The company maintains a significant amount of cash and bank deposits of VND 427 billion, generating more than VND 7.5 billion in financial revenue from deposit interest in the quarter.

Fahasa is one of the few large enterprises on the stock exchange that maintains a capital structure without using financial leverage, and currently, the company does not record any debt. The company’s equity capital reached VND 238 billion, including VND 67 billion in undistributed post-tax profits.

“SCIC Inc. Surges Ahead at 2025’s Annual Shareholder Meeting: Turning Pressure into Propulsion.”

The government’s ambitious 8% GDP growth target sets a challenging precedent for businesses in what is predicted to be a difficult year. Companies with SCIC capital have demonstrated their unwavering determination during this shareholder season…

“A Stellar 46% Profit Margin: Vietnamese FMCG Company Targets 35.5 Trillion VND in Revenue.”

In today’s ever-evolving market, businesses must continuously adapt and innovate to keep up with the diverse and ever-growing demands of consumers. Masan Consumer (UPCoM: MCH), a leading consumer goods company in Vietnam, is poised for a breakthrough in 2025. With its dominant position in the market, clear strategic vision, and strong growth momentum, Masan Consumer is well-equipped to seize a significant market share and take its success to new heights.

“KIDO Posts a Loss of Over VND 75 Billion in the First Quarter”

The Kido Corporation Joint Stock Company (HOSE: KDC) suffered a loss in the first quarter of 2025 despite a significant increase in revenue.