Vietnam Exhibition Fair Center JSC (VEF) Announces Ambitious Plans for 2025

The Vietnam Exhibition Fair Center JSC, with the stock code VEF, has recently released its annual general meeting documents for 2025, revealing bold plans for the upcoming year.

A staggering 9,565% increase in revenue target:

VEF’s management has set an impressive goal, aiming for a revenue of VND 44 trillion, a massive surge compared to the VND 4.6 billion achieved in 2024. Their projected after-tax profit is VND 16 trillion, nearly 17 times higher than the previous year’s figure.

The company intends to simultaneously develop three key projects in 2025: The National Exhibition Fair Center in Dong Anh district, Hanoi; a Commercial Services and Mixed-use Complex in Giang Vo, Ba Dinh, Hanoi; and the Urban Functional Area in Nam Tu Liem, Hanoi, along the Thang Long Avenue.

Among these, the National Exhibition Fair Center is envisioned to be a modern exhibition hub with regional and international appeal.

VEF also disclosed that the new urban area project in Dong Anh has received investment approval from the Hanoi People’s Committee, and land allocation was finalized in April 2024. Construction is progressing as planned. VEF has also completed the procedure for the project’s partial transfer to its partner as of March 31, 2025.

Shareholders to receive an impressive 435% dividend:

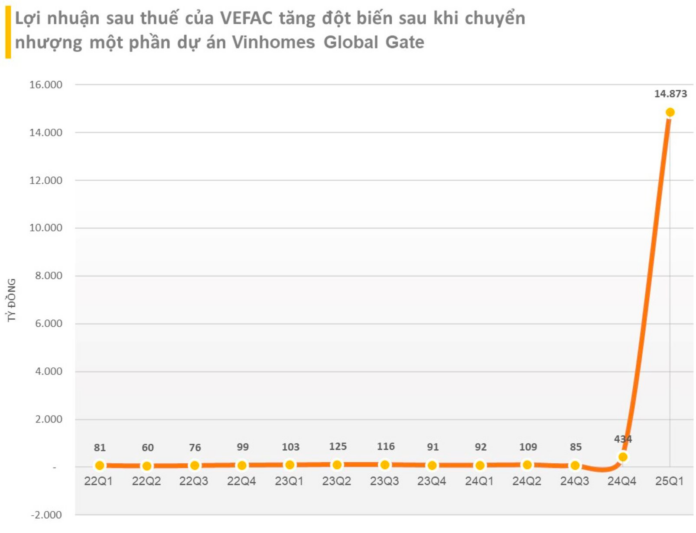

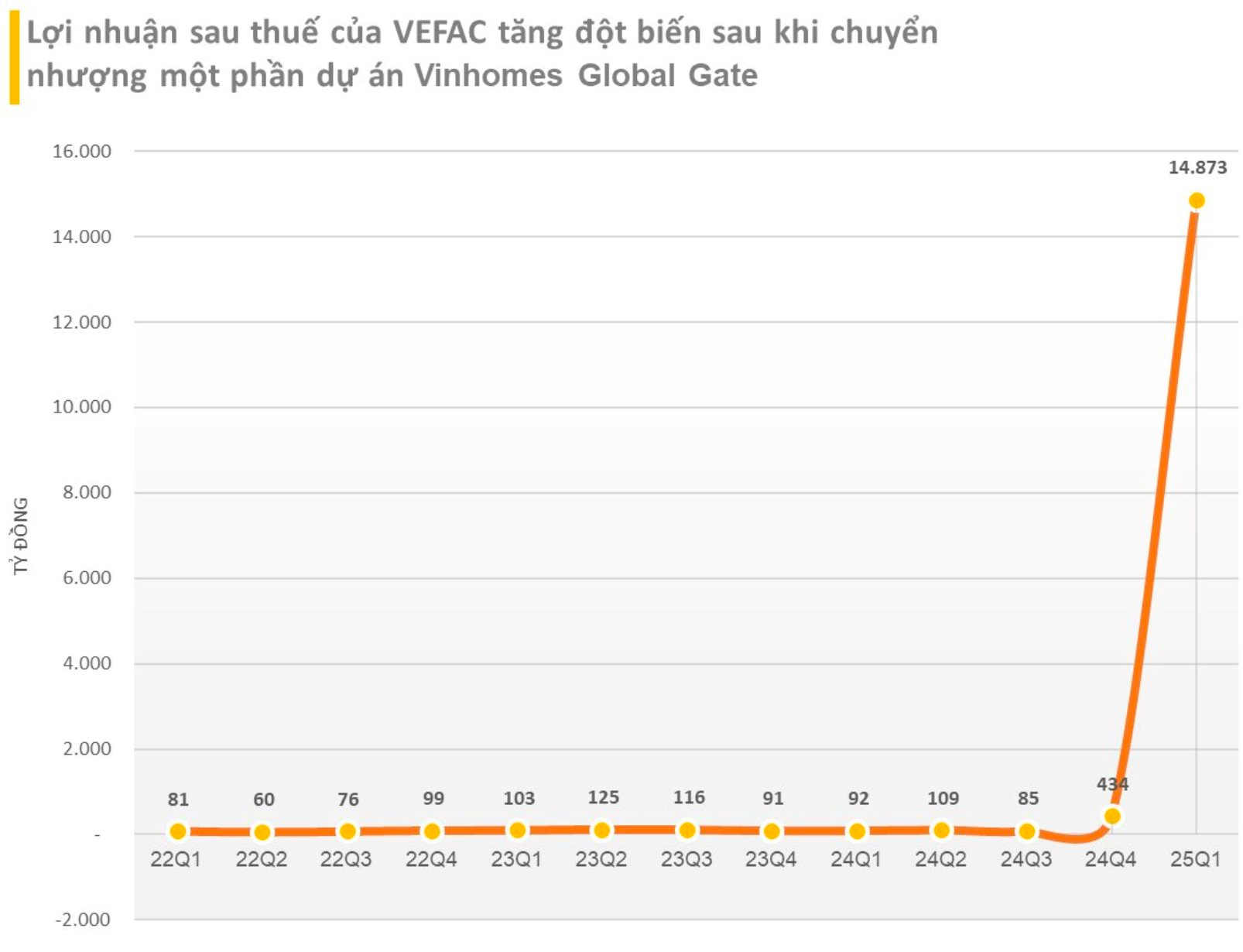

In 2024, VEF recorded a pure revenue of over VND 4.6 billion, half of the figure from 2023. However, their after-tax profit reached VND 942 billion, a significant increase of 117% from the previous year and VND 243 billion more than the unaudited report. The earnings per share (EPS) stood at VND 5,655.

Moving into the first quarter of 2025, VEF’s pre-tax profit soared to VND 18,605 billion, a staggering growth of 16,149% compared to the low base of VND 115 billion in the same period last year. This remarkable performance places VEF at the forefront in terms of both growth rate and absolute profit value.

The primary driver of this extraordinary surge is the revenue from the transfer of a portion of the Vinhomes Global Gate project, amounting to VND 44,560 billion.

VEF’s impressive performance in Q1 2025

Given these exceptional results, the Board of Directors proposes a dividend payout of 135% from the undistributed after-tax profit up to December 31, 2024 (VND 13,500 per common share), as well as an advance dividend of 300% from the after-tax profit of the first quarter of 2025 (VND 30,000 per share). Both dividends will be paid in cash. The company plans to execute these payouts within six months after the annual general meeting.

With over 166.6 million shares in circulation, VEF is expected to distribute a total of over VND 7,247 billion for these dividend proposals. Consequently, its parent company, Vingroup Joint Stock Company (VIC), which holds 83.32% of VEF’s capital, is in line to receive more than VND 6,000 billion in dividends from VEF.

“SCIC Inc. Surges Ahead at 2025’s Annual Shareholder Meeting: Turning Pressure into Propulsion.”

The government’s ambitious 8% GDP growth target sets a challenging precedent for businesses in what is predicted to be a difficult year. Companies with SCIC capital have demonstrated their unwavering determination during this shareholder season…

“D2D Announces 2024 Cash Dividend Payout: A Whopping 84% Yield”

Industrial Urban Development Joint Stock Company (HOSE: D2D) is pleased to announce its latest cash dividend offering to shareholders. On May 22nd, the company declared an 84% dividend yield, equivalent to VND 8,400 per share, with the payment expected to be made on June 10th. This announcement marks an exciting opportunity for investors, showcasing the company’s commitment to returning value to its shareholders.

“Investors Express Interest in Long-Term Partnership with BIG Post-Annual General Meeting”

The 2025 Annual General Meeting of Big Invest Group JSC (UPCoM: BIG) was arguably the most memorable event for shareholders since its listing on the stock exchange in early 2022. Aside from record-breaking growth figures, BIG garnered expressions of long-term commitment from numerous professional investors.