Vingroup’s Stock Surge: A Billionaire’s Rising Fortune

Vingroup’s stock (coded VIC) is creating a frenzy on Vietnam’s stock exchange, soaring to new heights. On May 8, 2025, VIC reached its daily limit of 78,500 VND per share, the highest since June 2022. In just two months, the stock has surged by 85%, outperforming its peers in the VN30 index.

VIC’s soaring stock price

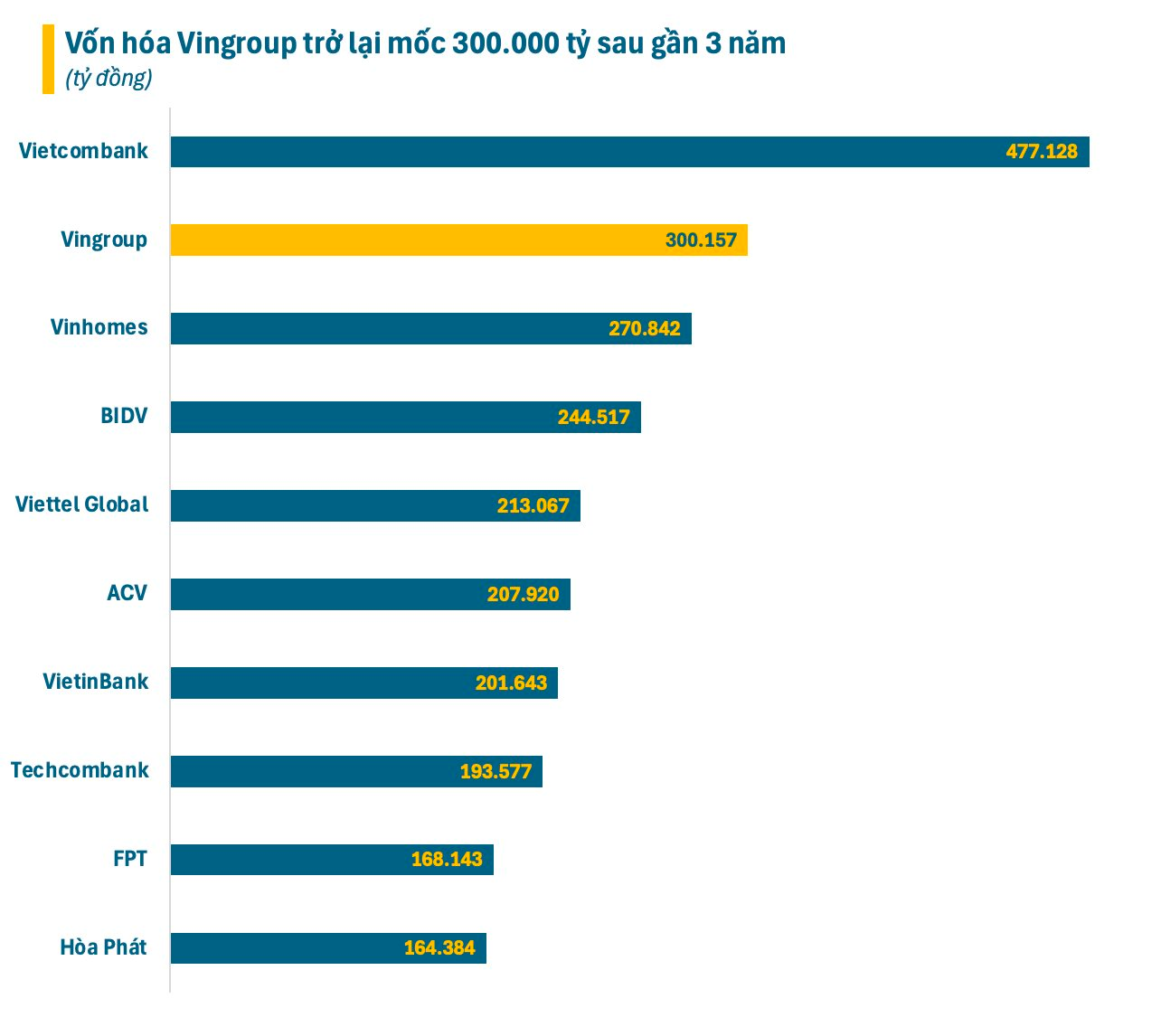

This surge has pushed Vingroup’s market capitalization to new heights, adding 145 trillion VND since the beginning of 2025 and surpassing the 300 trillion VND mark. For the first time in nearly three years, the conglomerate founded by billionaire Pham Nhat Vuong has reached this milestone. As a result, Vingroup remains the largest private enterprise on the stock exchange, second only to Vietcombank in terms of market capitalization across the entire market.

Vingroup’s market capitalization surpasses 300 trillion VND

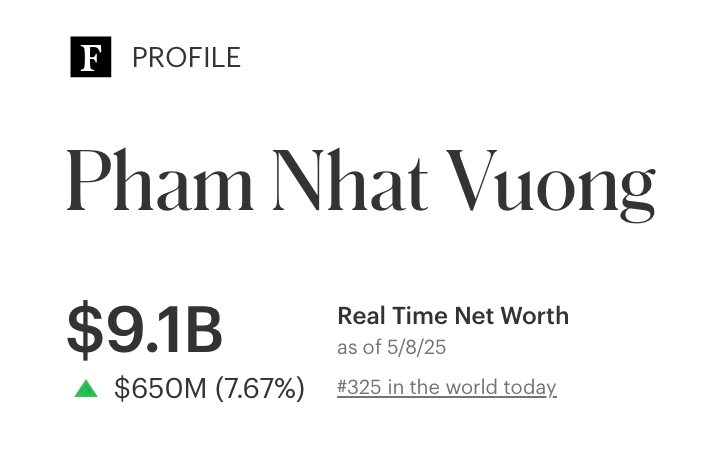

The skyrocketing VIC stock has propelled billionaire Pham Nhat Vuong’s wealth to new heights. It is estimated that his stock holdings in Vietnam are worth approximately 160 trillion VND (6.3 billion USD). According to Forbes’ latest update, Pham Nhat Vuong is the 325th richest person in the world, with a net worth of 9.1 billion USD as of May 8, 2025. This is the first time a Vietnamese national has reached this figure, according to Forbes’ calculations. It is important to note that calculating the net worth of billionaires is challenging, and Forbes’ estimate is only indicative.

Pham Nhat Vuong’s global ranking according to Forbes

Apart from his holdings in Vietnam, a significant portion of Pham Nhat Vuong’s wealth lies with VinFast, a company listed on the Nasdaq. VinFast is currently Vietnam’s best-selling automotive brand and is among the top 10 most valuable electric vehicle companies worldwide, with a market capitalization of 8.7 billion USD (according to companiesmarketcap). In addition to VinFast and Vingroup, the ecosystem under Pham Nhat Vuong’s leadership includes multiple billion-dollar enterprises such as Vinhomes (VHM), Vincom Retail (VRE), and VEFAC (VEF). Soon, another entity will join this prestigious list: Vinpearl (VPL).

On May 13, 2025, over 1.79 billion VPL shares will be officially listed on the HoSE. The reference price for the first trading day is set at 71,300 VND per share, valuing the company at nearly 130 trillion VND (~5 billion USD). This valuation places Vinpearl among the most valuable companies on the stock exchange. Vingroup, as Vinpearl’s largest shareholder, holds over 1.5 billion VPL shares, equivalent to 85.5% of its charter capital. Based on the listing price, the market value of these shares is nearly 110 trillion VND.

In 2025, Vingroup, led by billionaire Pham Nhat Vuong, sets ambitious targets. The conglomerate aims for approximately 300 trillion VND in revenue from production and business activities and 10 trillion VND in after-tax profit. These targets represent a 56% and 90% increase, respectively, compared to the previous year. In the first quarter, Vingroup achieved 28% of its revenue target and 22% of its profit goal.

Vingroup’s impressive performance in Q1 2025

Specifically, Vingroup recorded a record-high quarterly revenue of 84,053 billion VND in Q1, a 287% surge compared to the same period in 2024. This remarkable growth is attributed to the positive performance of its industrial production and real estate development and investment sectors. Vingroup’s after-tax profit reached 2,243 billion VND, a 68% increase compared to Q1 2024.

The First Vietnamese Person to Amass a Fortune of $9 Billion, Surpassing the Chairman of Samsung

It is important to note that Forbes’ calculations may not reflect the billionaire’s actual real-time net worth.

The Pearl of Vietnam’s Stock Market: Vinpearl’s HoSE Listing Leaves Rivals in the Dust

With a valuation of approximately 128 trillion VND, Vinpearl has surpassed veteran brands such as Vinamilk, ACB Bank, and the Masan Group to become one of the top-capitalized companies on the Vietnamese stock exchange.