CASA, or demand deposits, are a cheap source of funding that banks prioritize to optimize profits and enhance competitiveness. It not only improves operational efficiency but also boosts a bank’s resilience to interest rate fluctuations, reinforcing its reputation and fostering sustainable growth.

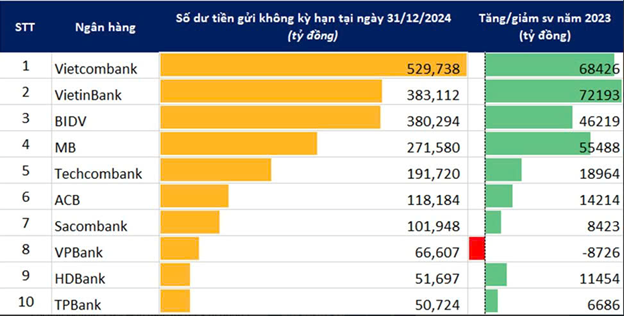

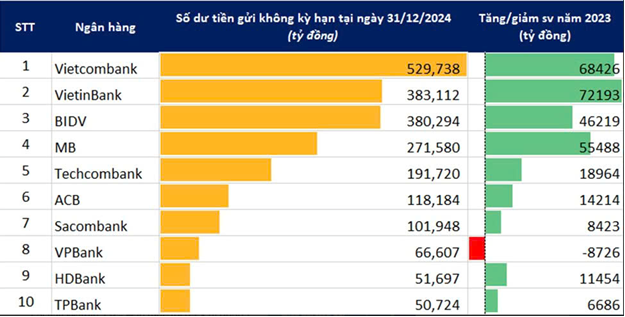

In recent years, Sacombank has been one of the fastest-growing banks in terms of CASA, consistently ranking among the leaders in CASA balances. In 2024, Sacombank recorded a CASA balance of over 101,948 billion VND, an increase of 8,423 billion VND compared to 2023 (a 9.3% surge).

The promising CASA performance, coupled with other crucial financial indicators, has contributed to Sacombank’s impressive business results. Specifically, its pre-tax profit in 2024 reached 12,720 billion VND, surpassing the plan set at the General Meeting of Shareholders by 20%. The bank significantly reduced its cost-to-income ratio (CIR), reflecting efficient operational optimization and cost management. The ROA and ROE ratios also witnessed improvements, increasing by 0.2 and 1.73 percentage points, respectively, to reach 1.42% and 20.03%, showcasing superior management and capital utilization capabilities.

Diverse Payment Ecosystem: The Driving Force Behind Sacombank’s CASA Growth

A large portion of CASA typically comprises demand deposits. Thus, one of the core factors contributing to Sacombank’s CASA growth is its diverse and modern payment ecosystem, which has attracted attention and made Sacombank the go-to account for many customers.

Sacombank currently offers over 20 types of bank cards with unique features. Notable examples include the Sacombank Platinum Cashback credit card, which appeals to smart spenders with its attractive cashback mechanism, and the Sacombank Visa Platinum O2 credit card, the first card in Vietnam made from recycled plastic, representing a green and dynamic lifestyle. Additionally, the Sacombank Mastercard Metro Pass and Sacombank Mastercard Multipass, launched during the inauguration of Metro Line 1 in Ho Chi Minh City, have gained immense popularity for their convenience and cultural significance. Last year, the number of Sacombank credit cards in circulation surpassed the 1 million mark, testifying to the popularity of the bank’s card products.

The Sacombank Mastercard Multipass, a collaboration between the Ho Chi Minh City Department of Transportation and Sacombank and Mastercard, offers commuters an additional payment option for public transportation.

|

Moreover, Sacombank’s ecosystem excels in payment acceptance methods. Its POS machine network has exceeded 230,000 units. Notably, Sacombank’s QR code payment solution has become a prominent strength, favored by SMEs and small businesses for its quick transaction statistics, error reduction, and enhanced management efficiency. Sacombank’s QR code payment system has expanded to countries like Laos, Thailand, and Cambodia, offering maximum convenience to its customers.

Last year, Sacombank became the first bank in Vietnam to implement multi-payment methods on a single device, ushering in a new era of flexible and convenient payments. With this technical prowess, Sacombank emerged as the payment solution provider for Ho Chi Minh City’s public transportation system, starting with Metro Line 1 and now expanding to buses and river buses. Customers can seamlessly pay using credit cards, debit cards, Apple Pay, Samsung Pay, or e-wallets, ensuring a modern and seamless experience.

Sacombank is the first bank in Vietnam to provide an open-loop payment solution for Ho Chi Minh City’s Metro Line 1.

|

This ecosystem not only facilitates customer payments but also encourages money flow within the Sacombank system, thereby continuously boosting the bank’s CASA balance.

Leading the Way with Comprehensive Service Packages and Attractive Promotions

In addition to expanding payment solutions, Sacombank focuses on developing comprehensive product packages to enhance customers’ access to financial services.

A notable example is Sacombank Pay, an all-in-one financial application that caters to almost all customers’ financial needs, including account opening, card issuance, QR payments, money transfers, savings, consumer loans, and even ticket purchases for transportation and movies. With its user-friendly interface and diverse features, Sacombank Pay has become indispensable to millions of customers, increasing service usage frequency and sustaining funds within the bank’s system.

Furthermore, Sacombank designs exclusive combo packages for corporate and individual customers, featuring simple registration and usage processes. The bank also regularly launches attractive promotions during festive seasons and significant holidays throughout the year. These programs not only stimulate service usage but also motivate customers to maintain healthy account balances, contributing to CASA growth.

Sacombank offers a diverse range of products, especially convenient combo packages, providing essential financial services for businesses and individual customers.

|

In a dynamic banking landscape, Sacombank has demonstrated its superior capabilities through its sustainable CASA development strategy. With a diverse payment ecosystem, intelligent bundled products, and a customer-centric approach, Sacombank optimizes its low-cost funding sources while establishing a solid foundation for long-term growth.

Sacombank’s journey serves as a testament to a bank’s ability to thrive even during restructuring, delivering sustainable value to its customers, shareholders, and the community.

– 15:45 05/05/2025

“Forging a Green and Intelligent Future”: Sacombank Champions Sustainable Transport Initiatives.

“As a bank born and bred in Ho Chi Minh City, Sacombank is proud to stand alongside the city and is committed to contributing to its growth. Our financial products and services are designed to bring high, sustainable, and practical value to the people. A testament to this is the open-loop payment solution that Sacombank is implementing with the city’s transport industry,” said Ms. Nguyen Phuong Huyen, Director of Sacombank’s Retail Banking Division.

Unlocking Sacombank’s Record-Breaking Success: A Dive into the Bank’s Impressive Q4 Performance and Annual Profits Surpassing 12,000 Billion VND

The bank’s estimated pre-tax profit for Q4 2024 stood at over VND 4,600 billion, a remarkable 68% increase compared to the same period last year. For the full year of 2024, the bank’s pre-tax profit is estimated to exceed VND 12,700 billion, the highest in its history and surpassing the target set by the Annual General Meeting of Shareholders.

“Sacombank: 33 Years of Solid Partnership with the People and Businesses of Vietnam”

After over three decades of groundbreaking work and continuous innovation, Sacombank has transformed itself with impressive growth potential, ready to embrace its 33rd year with confidence and an elevated stature.

Revolutionizing Urban Transportation: Sacombank’s Cashless Payment Solutions for a Greener Ho Chi Minh City

On December 22, the long-awaited Metro Line 1, connecting Ben Thanh and Suoi Tien, will officially open for commercial operations. This marks a significant step forward in the city’s transportation system, offering a fast and efficient way to travel. What’s truly remarkable is that passengers can now enjoy a seamless, cashless payment experience for their tickets through an innovative electronic ticketing system, powered by HURC1, Mastercard, and Sacombank. This cutting-edge Open-loop technology promises a convenient and secure journey for all commuters and tourists alike.