Mr. Nguyen Ngoc Quang, a member of the Board of Directors of Hoa Phat Group (coded HPG), has registered to sell 8.5 million HPG shares with the purpose of agreeing to sell to his son and family members. The transaction is expected to take place between May 14, 2025, and June 12, 2025. After the transaction, Mr. Quang’s ownership will decrease from 113.1 million units (1.77%) to 104.6 million units (1.63%).

On the stock exchange, HPG shares have been trading sideways after a strong rebound from long-term lows. At the close of the May 8, 2025, session, HPG’s market price stood at VND 25,700/share, with a market capitalization of over VND 164 trillion. Based on this price, the value of the shares that Mr. Quang transferred to his family members is estimated at VND 220 billion.

In a related development, Hoa Phat recently announced a resolution of the Board of Directors on the detailed implementation of the 2024 dividend payment plan, with a ratio of 20% in shares (shareholders owning 5 shares will receive 1 new share). With nearly 6.4 billion shares currently in circulation, Hoa Phat will issue an additional 1.28 billion new shares, equivalent to an issuance value of VND 12,793 billion at par value.

The issuance is scheduled to take place in May 2025, after obtaining approval from the State Securities Commission of Vietnam. Following the issuance, Hoa Phat’s charter capital will increase to VND 76,755 billion, the largest among non-financial enterprises listed on the stock exchange. In fact, this number is only lower than a few top banks.

Previously, in the materials for the 2025 Annual General Meeting, Hoa Phat planned to pay a 2024 dividend of 15% in shares and 5% in cash, but this was changed to an entirely share dividend of 20% when the meeting took place. Chairman of the Board of Directors, Tran Dinh Long, stated that the adjustment was made based on a cautious approach to ensure cash flow in the context of international fluctuations, such as the import tax countervailing policy of President Donald Trump.

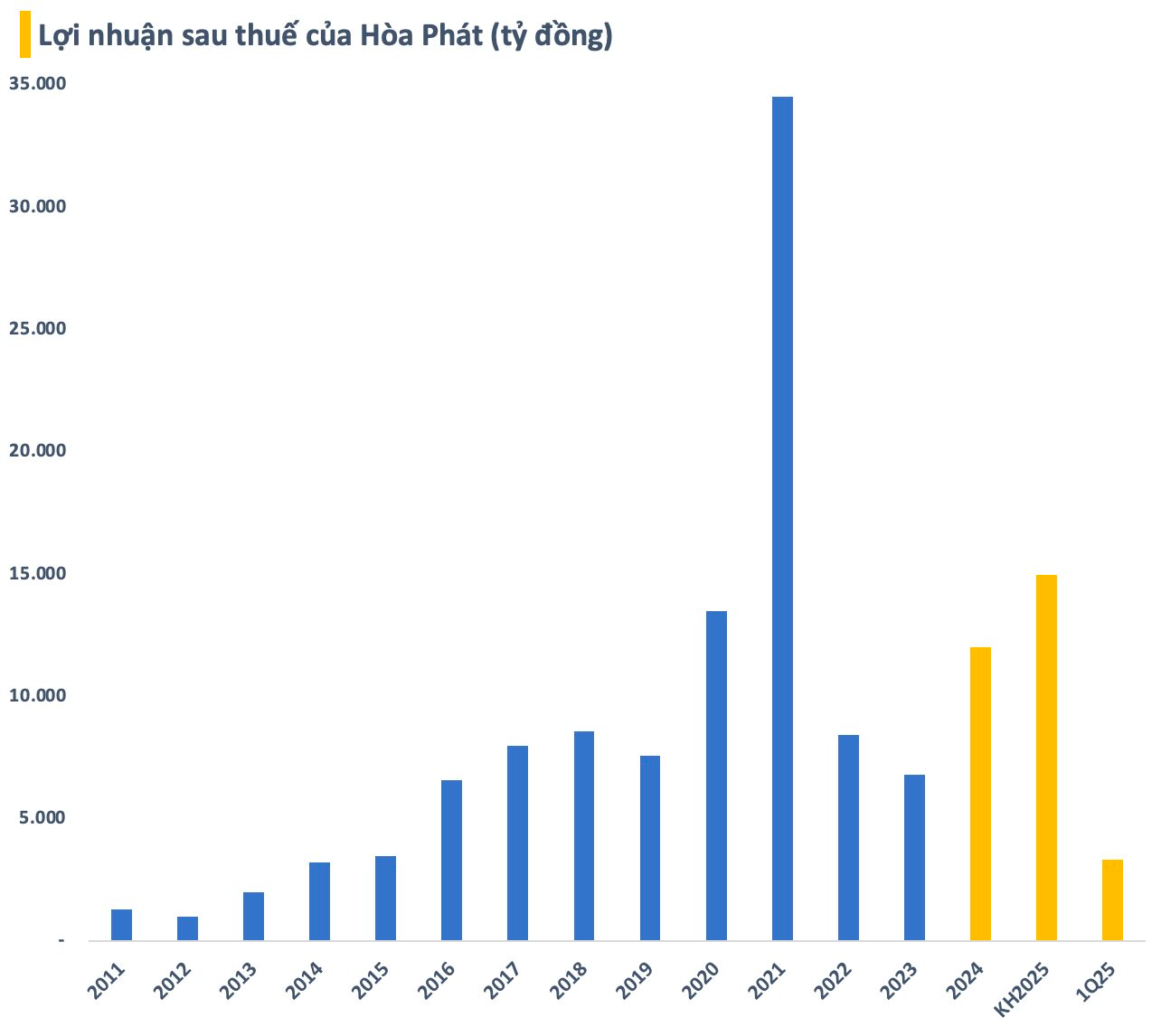

In terms of business results, Hoa Phat recorded over VND 37,900 billion in revenue and VND 3,300 billion in after-tax profit in the first quarter, up 22% and 16%, respectively, compared to the same period in 2024. During this period, the Hoa Phat Group produced 2.66 million tons of crude steel, an increase of 25% year-over-year. Sales volume of hot-rolled coil, high-quality steel, construction steel, and billet reached 2.38 million tons, up 29% compared to the first quarter of 2024.

For the full year 2025, Hoa Phat set an ambitious business plan with revenue and after-tax profit targets of VND 170,000 billion and VND 15,000 billion, respectively, representing increases of 21% and nearly 25% compared to 2024. Thus, after the first quarter, the company has completed approximately 22% of its annual revenue and profit targets.

Stock Market Pre-Trading Session on November 5th: PXM Hit With a Hefty Fine

PXM is currently trading on the UpCOM exchange at just VND 500 per share, but there has been little to no trading activity for months.