“Forewarned is Forearmed”: A Cautionary Tale of Crypto, FOMO, and the Elusive Quest for Quick Wealth

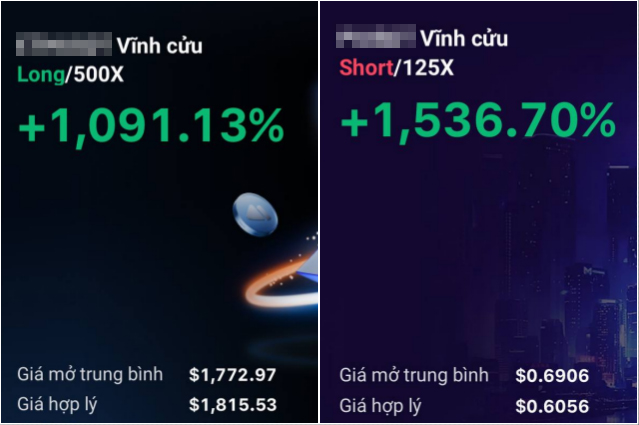

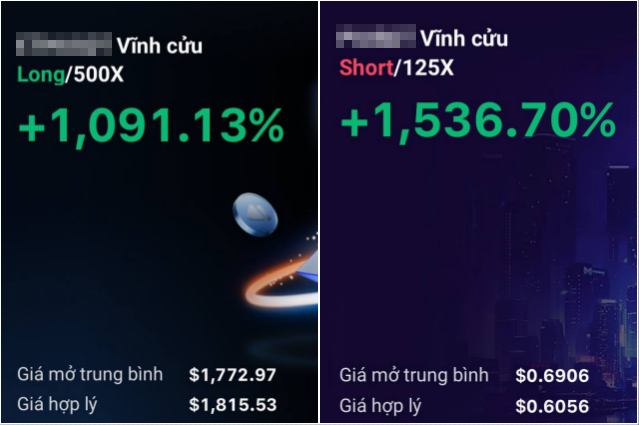

Mạnh once again found himself lured by the promises of crypto wealth, despite his previous painful experiences. He joined online communities, where he witnessed fellow traders flaunting their astronomical profits, sparking a desire to rejoin the crypto market.

The allure of crypto profits can be a double-edged sword.

|

However, this time, Mạnh approached the market with a newfound caution. He educated himself on technical analysis, market trends, and trading strategies. Yet, there was one crucial aspect he overlooked: the psychology of trading.

Psychology plays a pivotal role in any investment endeavor. Traders often seek quick profits while fearing losses, which can lead to a fragile relationship with the market. Mạnh fell prey to the ubiquitous FOMO (Fear of Missing Out), a potent driver of impulsive decisions.

Mạnh’s strategy revolved around leveraging futures contracts to amplify his gains. He targeted prominent coins like BTC (Bitcoin) and ETH (Etherium), known for their relatively clear trends.

Nevertheless, his rushed learning curve left him with insufficient technical analysis skills. While he could discern long-term trends, pinpointing entry and exit points proved challenging. Moreover, the modest fluctuations in BTC and ETH’s prices contrasted with the more volatile nature of altcoins and memecoins.

Influenced by his peers’ trades, Mạnh frequently ventured into altcoins and memecoins, hoping to catch the next big wave. However, his timing was often off, resulting in what traders jokingly call “island entries,” where he bought at local tops or sold at local bottoms.

Timing the market can be tricky, often resulting in tough choices between cutting losses or hoping for a rebound.

|

Crypto markets are notoriously volatile, with prices whipsawing sharply even within established trends. Additionally, trends can abruptly reverse, rendering predictions futile. As a result, Mạnh frequently found himself holding losing positions, desperately hoping for a turnaround.

FOMO can lead to ill-timed entries, often resulting in unfavorable positions.

|

Compounding the issue was Mạnh’s desire for rapid wealth, leading him to trade with substantial positions, sometimes leveraging up to 5,000–10,000 USDT. This amplified the psychological burden, as larger positions often heighten risk aversion. With his “island entries,” Mạnh found himself in a constant state of anxiety, hoping to minimize losses rather than seeking profitable exits.

His fear of deeper losses often led to delayed exit decisions, resulting in larger drawdowns. Conversely, when trades moved in his favor, he tended to exit prematurely, booking modest profits. This dynamic led to a pattern of small wins overshadowed by substantial losses, eroding his capital.

Even the seemingly stable coins like ETH underwent harrowing drops, with ETH plunging 20% within a month during Mạnh’s trading stint. His FOMO-driven long positions turned into painful losses, ultimately decimating 90% of his NAV within a fortnight.

ETH’s price chart showcasing the steep decline during Mạnh’s trading journey. Source: CoinMarketCap

|

Mạnh’s journey culminated in a bitter realization about the perils of FOMO in trading.

The lessons learned from this traumatic experience include:

1. Patience: Resist the urge to chase trends when prices have already skyrocketed or plummeted. Wait for price retracements to more favorable levels before considering entry.

2. Technical Proficiency: Master analytical tools like Moving Averages (MA) and indicators like the Relative Strength Index (RSI) to better time your entries and manage risk.

3. Risk Management: Pre-define take-profit and stop-loss levels before entering a trade. Discipline and emotional detachment are crucial when markets fluctuate.

4. FOMO Awareness: Recognize that FOMO clouds judgment. Remember, not entering a trade means not losing money.

Châu An

The VN-Index Surges by 41 Points Post-Holiday Week

“For the week of May 5th to May 9th, the VN-Index witnessed a robust upward trend, with four out of five trading sessions ending in the green. On May 9th, the index witnessed a slight dip, closing at 1,267.3 points, which still marked a notable 41-point increase compared to the closing value on April 29th.”

The Art of the Crypto Deal: The Trumps Talk Binance Investment

The Wall Street Journal (WSJ) reports that representatives of the Trump family are in negotiations to acquire a financial stake in the US arm of the cryptocurrency exchange, Binance. This move would bring Trump into a business relationship with a company that pleaded guilty to violating anti-money laundering regulations in 2023.

“Binance Founder Denies Negotiations with the Trump Family”

Changpeng Zhao, the founder and former CEO of Binance, the world’s largest cryptocurrency exchange, has publicly denied rumors suggesting that the Trump family is negotiating to purchase a stake in Binance’s American division. This denial comes just a day after the Wall Street Journal (WSJ) published an article on March 13th, sparking speculation and interest from the public.