The reference exchange rate announced by the SBV on April 28, 2025, reached VND 24,960 per USD, a more than 2.5% increase compared to the beginning of 2025. Photo: T.L |

Mounting pressure on exchange rates

Since the beginning of 2025, the USD/VND exchange rate has been steadily climbing despite the SBV’s active intervention by selling foreign currencies. The reference exchange rate announced by the SBV on April 28, 2025, reached VND 24,960 per USD, a more than 2.5% increase compared to the beginning of 2025. This has pushed the selling price of USD in commercial banks above VND 26,000 per USD. Notably, the pressure on exchange rates tends to increase sharply in April, with a rise of more than 1% just in this month. However, it is important to note that the current pressure on exchange rates is mainly due to two short-term factors: trade disruptions in April following the US tariff policy announcement and internal pressure from excess liquidity in the interbank system.

Countervailing duty pressure “blows away” more than half of the Q1-2025 trade surplus

The tariff shock caused many export enterprises to temporarily suspend or reduce orders, especially in textiles, footwear, and electronics, leading to a sudden drop in the foreign currency supply to the market. While the trade balance of goods in Q1 achieved a surplus of USD 3.16 billion, in the first half of April alone (from April 1 to April 15), the trade balance shifted to a deficit of USD 1.94 billion (with a total import value of USD 18.69 billion and a total export value of USD 16.75 billion).

Thus, the disruption to export orders in the first half of April led to a sharp increase in the trade deficit, “blowing away” more than half of the trade surplus achieved in Q1-2025. Prolonged trade negotiations also mean that trade disruptions will continue in Q2 at the very least. This can be considered the main pressure causing exchange rate fluctuations in April and Q2. If the negotiations proceed smoothly and export orders return from the end of June, the trade balance may return to a surplus in Q3, helping to reduce pressure on foreign currency sources.

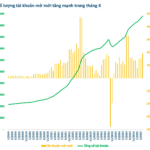

Excess liquidity and negative SWAP issues

The SBV is still maintaining a liquidity injection into the market through open market operations (OMOs). Abundant liquidity has kept Vietnam’s overnight interest rate (ON) at around 2.5%, lower than the US overnight interest rate (above 4%). The negative spread has led to a negative short-term USD/VND swap rate. Domestic financial investors are motivated to buy USD for immediate delivery and sell it forward to benefit from the spread, further increasing the demand for foreign currency and putting upward pressure on the exchange rate.

|

Short-term exchange rate pressure is notable but does not pose systemic risk. The current exchange rate pressure mainly stems from two short-term factors: a confidence shock (US tariffs) combined with a domestic currency liquidity shock (liquidity injection by the SBV) |

However, the issue of excess liquidity can be addressed soon as the SBV is gradually reducing open market operations to maintain moderate VND liquidity. Specifically, in the last week of April, the outstanding OMO volume decreased significantly from VND 113,000 billion on April 24 to VND 75,000 billion on April 28. New injections are also maintained at relatively small transaction volumes, so it is expected that the overnight interest rate will soon rebound, narrowing the interest rate differential between USD and VND and reducing speculation in SWAPs.

Variables to monitor

In general, the short-term exchange rate pressure is notable but does not pose a systemic risk. The current pressure on exchange rates mainly stems from two short-term factors: a confidence shock (US tariffs) combined with a domestic currency liquidity shock (liquidity injection by the SBV). While the foreign currency supply is experiencing a sudden drop due to trade disruptions, the demand for foreign currency is on the rise due to the interest rate differential and capital outflows.

However, a stable macroeconomic foundation with abundant foreign exchange reserves, sustainable FDI inflows, and well-controlled inflation is buffering the VND. In the context of short-term fluctuations, proactive exchange rate hedging and close monitoring of policy developments will help businesses mitigate risks and seize market opportunities.

|

DXY decline does not “ease” domestic exchange rates Another concern is whether the decline in the US Dollar Index (DXY) will help ease the pressure on the USD/VND exchange rate. The answer is no, as the DXY decline does not create bilateral pressure on the USD/VND exchange rate; the issue lies within the economy, where liquidity, the trade balance, and policy risks (tariffs, Fed rate hikes) continue to “weigh down” the VND. The DXY falling to 99-100 points does not have a significant soothing effect on domestic exchange rates. The composition of the DXY basket also does not reflect the exchange rate issues in the Asian region, especially for the VND. The DXY is mainly measured against the EUR (57.6%), JPY (13.6%), GBP (11.9%), and four other G7 currencies; this basket does not include currencies that directly impact Vietnam’s trade, such as CNY and KRW. |

Trịnh Hoàng

– 07:00 02/05/2025

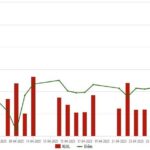

The Stock Market Shakes Things Up: Domestic Investors Rush to Open Accounts

“There has been a significant surge in the number of domestic investors opening securities accounts, marking the highest increase in an eight-month period. This surge comes amidst a volatile market, heavily influenced by external factors.”

“Vietstock Daily: Caution Prevails Ahead of Long Weekend”

The VN-Index witnessed a slight dip with trading volumes remaining below the 20-day average, indicating a continued cautious sentiment among investors. The recent peak formed in mid-April 2025 (approximately 1,230 – 1,245 points) now acts as a short-term resistance level for the index.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)