On the morning of October 28, the State Bank of Vietnam set the central exchange rate at 24,252 VND/USD, a slight decrease of 3 VND from the previous weekend (October 25) and the second consecutive decrease after eight consecutive increases. The ceiling rate was 25,464 VND/USD, and the floor rate was 23,039 VND/USD.

STATE BANK RESUMES USD SUPPLY TO THE MARKET

On October 28, Vietcombank’s exchange rate also decreased slightly by 3 VND in both buying and selling prices but remained at the ceiling rate set by the State Bank of Vietnam: 25,164 – 25,464 VND/USD for buying and selling, respectively.

Consequently, most commercial banks also listed their selling prices at the ceiling rate set by the State Bank.

At the opening of the morning session on October 28, the free market USD rate dropped sharply by 300 VND per transaction compared to the previous session, trading at 25,400 – 25,500 VND/USD, but quickly recovered to close at 25,600 – 25,700 VND/USD, a decrease of only 100 VND compared to October 27.

“There were signs of cooling in the exchange rate last Friday (October 25), in addition to the return of some USD supply sources, thanks to the State Bank’s market stabilization measures, which are gradually taking effect. ACB’s Financial and Banking Market Block predicts that the exchange rate will continue to fluctuate around 25,350 – 25,400 VND/USD at the beginning of this week before cooling down by the weekend.”

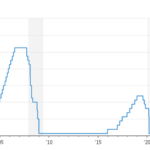

Last week (from October 21 to 25), the central exchange rate was adjusted upwards by the State Bank in most sessions, except for a slight decrease on the last day. On October 25, the central exchange rate was set at 24,255 VND/USD, an increase of 42 VND compared to the previous weekend.

The interbank exchange rate also witnessed a significant increase last week. On October 25, the interbank rate closed at 25,376, a rise of 216 VND compared to the previous weekend.

The free market exchange rate also experienced a strong increase last week. On October 25, the buying and selling rates in the free market rose by 440 VND compared to the previous weekend, trading at 25,700 VND/USD and 25,800 VND/USD, respectively.

As mentioned in previous VnEconomy news reports, the recovery of the DXY index in October 2024, along with the surge in domestic foreign currency demand (foreign debt repayment, import of raw materials, and profit repatriation by FDI enterprises) have led to an imbalance in the foreign currency supply and demand in the country, which are the main factors driving the strong rebound in exchange rates.

According to VnEconomy’s update as of October 24, the official and free market exchange rates have increased by 3.4% and 2%, respectively, compared to the end of the previous month. Compared to the beginning of the year, the VND has depreciated by about 4.2-4.7% in both the official and free markets.

According to analysts, in addition to better-than-expected economic data, the narrowing gap in the polls between the two US presidential candidates has also boosted the US dollar’s value.

The US presidential election will take place on November 5, 2024, Vietnam time, between the two candidates: Vice President Kamala Harris (Democratic Party) and former President Donald Trump (Republican candidate).

In the short term, experts believe that the movement of the DXY index largely depends on the upcoming US election. Bank of America’s statistics show that the DXY index often rises during the two months before the US election in 10 out of 13 election periods. Notably, as the odds of Mr. Donald Trump winning in the battleground states increase, the DXY index may also rise before and after the election if he wins.

In response to the short-term exchange rate pressure, the State Bank has (1) absorbed VND through the issuance of bills since October 18 and (2) resumed USD supply since October 24 at an exchange rate of 25,450, addressing the current market’s shortage of foreign currency supply.

THE STATE BANK ABSORBS OVER 124,600 BILLION DONG FROM OCTOBER 1-25

In the open market week from October 21 to 25, the State Bank offered a 7-day term with a volume of 17,000 billion VND at a fixed interest rate of 4% in the collateral channel. There was a successful bid of 13,014.57 billion VND, with no maturities during the week.

The State Bank offered two terms of 14 and 28 days for the SBV bills, with interest rates determined by auction. The 14-day term had a successful bid of 13,400 billion VND, with interest rates ranging from 3.74% to 3.6% and closing at 3.7% on the last day. The 28-day term had a successful bid of 41,250 billion VND, with interest rates of 4% for the first four days and 3.99% on the last day.

Thus, the State Bank absorbed a net amount of 41,635.43 billion VND from the market during the week of October 21-25 through the open market operations channel. There was a circulation of 13,014.57 billion VND in the collateral channel and 66,950 billion VND in SBV bills in the market.

As a result, the total amount of SBV bills issued as of October 25 was approximately 67,000 billion VND, including 17,800 billion VND in 14-day bills (nearly 27% of the total issued bills) and the remainder in 28-day bills. Although the State Bank has resumed bidding in the term purchase channel in recent days, the total amount of money supplied through the collateral channel maturities at the beginning of the month has resulted in a net absorption of approximately 57,600 billion VND. In summary, the State Bank has absorbed a net amount of approximately 124,600 billion VND during the period from October 1 to 25.

After the State Bank resumed bill issuance, the interbank VND interest rates increased sharply across all tenors up to one month.

On October 25, interbank VND interest rates traded at: overnight 3.92%, up 1.19 percentage points (pp) from October 18; one-week 4.03% (+1.07 pp); two-week 4.22% (+0.98 pp); and one-month 4.3% (+0.63 pp).

USD interbank interest rates remained stable across all tenors. On October 25, USD interbank interest rates closed unchanged from October 18 at: overnight 4.83%; one-week 4.88%; two-week 4.92%; and one-month 4.94%.

Currently, although the exchange rate has risen close to the previous peak, and interbank VND interest rates have increased sharply, Rong Viet Securities Company (VDSC) assesses, in its October 2024 monetary market update, that the pressure on the banking system’s liquidity from the State Bank’s actions is not significant.

VDSC forecasts that the overall net absorption scale of the current phase may be lower than that of the May-June 2024 period.

First, regarding the term of the bills, the State Bank has issued 14-day and 28-day bills instead of continuously issuing 28-day bills, as in the previous phase. The net money absorption through the bill channel has also gradually decreased in recent days.

Second, the State Bank has balanced the VND liquidity by resuming money injection through the collateral channel.

Third, interbank interest rates have remained relatively stable.

Silver Price Today: Rebounding Alongside Gold

The domestic and international silver prices rebounded, painting the town green after the previous session’s decline.