Although the VN-Index suffered a slight loss during the weekend, it has had ten positive trading sessions since the sharp volatility on April 22nd. Numerous stocks have yielded impressive profits, with some even gaining 15-20%…

Experts attribute the current price increase to the prominent leadership of large-cap stocks like VIC, as well as the strong performance of mid-cap stocks. The market’s strong reaction and high liquidity on May 8th indicate that investors are eager and awaiting supportive information.

However, experts suggest that investors should go against this eagerness and gradually take profits on short-term positions that have yielded good returns. The market has reached the resistance zone of around 1270-1280 points and is in an overbought state. Sufficiently strong supportive factors have not yet emerged.

Regarding the high expectations of investors for negotiation results, as partially reflected on May 8th, experts advise caution with unverified information. Negotiations are a lengthy process and may not yield immediate results; challenges may still lie ahead.

Nguyen Hoang – VnEconomy

The most notable development last week was the strong increase on May 8th, accompanied by significant trading volume, as the market circulated unverified information about preliminary outcomes of trade negotiations between Vietnam and the United States. It appears that the market is desperately seeking supportive news. Are investors overly anxious about missing opportunities?

The market is in an information vacuum, with increased selling pressure at the 1280-point resistance and the emergence of FOMO sentiment, which could lead to a 5% market correction in the next two weeks. For short-term investors, I believe this is the time to take profits at the 60-70% level and wait for better buying opportunities.

Nguyen Viet Quang

Nguyen Viet Quang – Director of Business, Yuanta Securities

The VN-Index witnessed a strong trading session on May 8th, with high trading volume, forming a “White Marubozu” candlestick pattern and surpassing the SMA 200. This indicates a very positive market sentiment following the Vietnam-US trade promotion conference hosted by the Ministry of Industry and Trade in the afternoon of May 8th, despite the unverified nature of the negotiation outcomes.

This also suggests that the Vietnamese stock market is lacking supportive information, and investors are prone to expectations of early positive results. In my opinion, investors should not rush at this point because if the negotiation results are not favorable as expected, the market may experience a significant correction.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Despite the VN-Index’s positive momentum last week, especially on May 8th, the trading volume was relatively low, except for the holiday on April 30th. The weekly matching volume was the lowest in over a month, indicating that large capital has not yet actively participated, and the buying power may come from small domestic investors.

I believe there is a slightly optimistic and impatient sentiment regarding the trade negotiation results. As observed, major economies in Asia, such as Japan and South Korea, have taken a long time to reach comprehensive agreements with the US. Currently, India is expected to be the next country to reach a deal after the UK, but the tariff rates imposed by the Trump administration on India were 26%, while Vietnam faces higher rates of up to 46%. I assess that the upcoming developments will still present challenges in achieving a favorable agreement with the US.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

From a macroeconomic perspective, the tariff issue in the Trump 2.0 era is an external factor that poses significant risks to Vietnam’s GDP growth and critical macroeconomic aspects such as import-export and exchange rates. As the negotiation outcomes remain uncertain, any updates can trigger a strong market reaction. Therefore, in the absence of supportive factors and unified price drivers, even a circulated piece of information can have a substantial impact.

Le Duc Khanh – Analysis Director, VPS Securities

Investors are gradually recognizing the arrival of positive news, and the most challenging phase has passed. The market’s stability and subsequent strong gains have boosted investor confidence in disbursement. Of course, the phenomenon of price increases alternating between sectors – a differentiated development where each sector, such as banks, seaports, chemicals, and basic resources, takes turns to rise with stable growth rates – is also likely to occur.

In my opinion, opportunities will arise again, and investing early or buying before strong gains is better than buying late. During the accumulation phases in May, when the VN-Index mainly fluctuates within the 1260-1270-1280 range, investors don’t need to rush – selecting stocks to buy and hold with a stable mindset will be prioritized.

In the short-term trading strategy, many stocks have reached their target prices, and I believe it is appropriate to partially take profits. Investors can continue to hold the remaining positions and monitor the market’s movement as it approaches the 1270-point resistance level.

Nguyen Thi My Lien

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

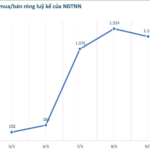

After the previous recovery, the market lacked supportive information and needed momentum to attract capital inflows. However, we can see that investors are optimistic about the market’s prospects during the strong session on May 8th. While foreign investors continue to sell, domestic investors have more positive assessments of the macroeconomic situation and the stock market.

Nguyen Hoang – VnEconomy

The VN-Index has had eleven positive sessions since the unexpected volatility on April 22nd – a session you described as a positive “shakeout.” The index is now only 4% lower than before the countervailing tax news. However, the strength of this increase relies heavily on large-cap stocks like VIC and VHM. If these leaders “exhaust” themselves, is there a risk of a short-term market correction? Technically, if a correction scenario occurs, what level of adjustment do you expect?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The large-cap stock groups, especially the Vingroup (VIC, VHM, VRE), have performed well during the index’s recovery, contributing significantly to the overall gain. I believe this is a regulatory move to boost market momentum rather than a “pump and dump” strategy. Capital flow also shows good dispersal in the Midcap group, with many stocks recovering and even reaching new highs. However, the strong gains may increase the tendency to take profits. If the large-cap stocks decline, putting pressure on the index’s movement, it could trigger profit-taking behavior. The short-term support level to watch is around 1235 points, and a deeper retreat below this level could push the index back to the psychological threshold of 1190-1200 points.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

The trading session at the end of the week showed investors’ tendency to take profits after the market’s strong gains in welcoming the KRX system. The market is currently in an information vacuum, and the negotiation-related news may take a few more weeks to unfold. The market is likely to trade sideways with low liquidity during this period. If a correction scenario occurs, the VN-Index will likely “test” the 1245-1265 range, and further down, the 1180-1200 zone.

Nguyen Viet Quang – Director of Business, Yuanta Securities

The VN-Index has had a positive and relatively impressive recovery since the volatility on April 22nd, now only 4% lower than before the countervailing tax news. However, in these eleven sessions, VIC and VHM have been the pillars, increasing by 29.7% and 8.2%, respectively, from April 22nd to Friday. The profit-taking pressure from these two stocks will undoubtedly affect the market, causing fluctuations and adjustments. According to my analysis, if a correction occurs in the short term, I expect the VN-Index to drop to the 1200-1220 range, corresponding to the support level at SMA200 and the recent accumulation zone.

The 10-20% recovery in less than three weeks has pushed many stocks into the overbought zone, while negotiation outcomes remain uncertain. I recommend taking partial profits on stocks that have exceeded short-term targets, realizing gains, and increasing cash reserves.

Nghiem Sy Tien

Le Duc Khanh – Analysis Director, VPS Securities

I believe the strong support zone is at most 1250-1260 points. The MA200 signal is also around 1260-1263 points. As accumulation is likely to occur early next week, the 1260-1265 zone will be crucial, especially since the market only slightly corrected on Friday, with stable trading volume and transactions across the market amid positive news from trade negotiation rounds between the US and its partners.

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

The VN-Index has shown a relatively positive recovery momentum since the recent low of around 1140 points. However, this recovery has been heavily reliant on a few large-cap stocks, resulting in an imbalanced internal force. If capital flow signals a cautious rotation towards the Midcap and Smallcap groups, a short-term correction scenario is likely to unfold. Technically, the 1250 (+-5) zone will act as the first support level. However, if selling pressure persists and buying response is weak, the more distant support zone at 1180 (+-20) will become a more solid buffer for the index.

Nguyen Hoang – VnEconomy

The KRX system officially launched at the beginning of May, and as you predicted, the market reaction was underwhelming, with the securities stocks performing poorly. Short-term capital seems to be choosing stocks based on individual stories rather than the overall context, especially when negotiation tax news dominates but lacks novelty, and the information vacuum may persist for several weeks. If engaging in short-term trading, which stocks do you find interesting?

Nguyen Viet Quang – Director of Business, Yuanta Securities

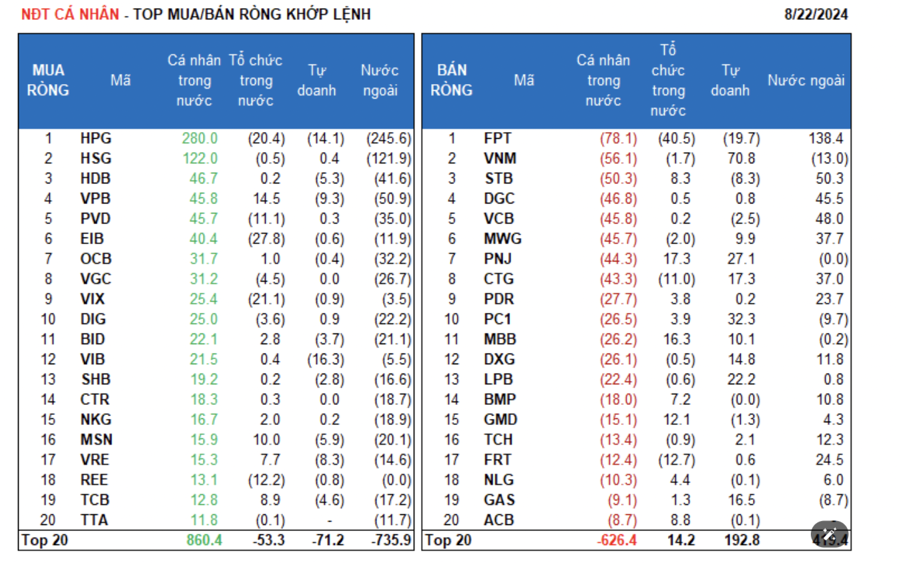

In the current market context, I prioritize stocks with unique stories, such as those with impressive Q1 financial reports and minimal or no impact from exports and tariff policies. In the basket of banking stocks, CTG and MBB, with outstanding Q1 profits, are my top choices. Additionally, I favor domestic consumer stocks like VNM, construction stocks like FCN, and industrial real estate stocks like KBC, as they meet the criteria of strong Q1 performance and minimal exposure to tariff policies.

Capital continues to focus on sectors with strong Q1 performance, such as retail, chemicals, basic resources, insurance, banking, and seaports…

Le Duc Khanh

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

This phase is relatively quiet in terms of news, as the Q1 earnings season has mostly been reflected in stock prices, and the trade negotiation process between Vietnam and the US will require more time. I suggest focusing on sectors less affected by international trade and firmly rooted in the domestic market, providing a safe haven from unexpected macroeconomic shifts. From this standpoint, my priority sectors for this period are Utilities (REE, GEX, POW), Pharmaceuticals (DHG, IMP), Public Investment (VCG, PLC), Banking (TCB, MBB), Real Estate (DXG, VRE), and Consumer Goods (MSN, DBC).

Le Duc Khanh – Analysis Director, VPS Securities

Stocks with strong Q1 performance and promising revenue and income prospects for 2025 are more attractive. Capital continues to focus on sectors with robust Q1 performance, such as retail, chemicals, basic resources, insurance, banking, and seaports…

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

In my opinion, blue-chip stocks are a good choice for short-term investment at this time, as capital flow mostly indicates a positive sentiment towards these stocks. However, it’s essential to be cautious about potential corrections when technical momentum indicators signal an overbought condition.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

As the KRX system officially launched, capital inflows were cautious, adopting a wait-and-see approach to assess the new system’s stability. Entering the new trading week with a lack of significant macroeconomic news, investors should focus on stocks with individual stories, strong internal capital flow, and minimal dependence on the overall market context.

Nguyen Hoang – VnEconomy

Preliminary statistics show that over 170 stocks in the VN-Index have increased by more than 10% since the April low, when the sell-off due to countervailing tax concerns peaked. If we count from the low of the volatile session on April 22nd until now, about 130 stocks have achieved similar gains. Some have even risen by 15-20% or more. In your opinion, should investors take profits, or should they continue to hold and await a favorable negotiation outcome?

The market is in an information vacuum, and negotiation-related news may take a few more weeks to unfold. The market is likely to trade sideways with low liquidity during this period.

Le Minh Nguyen

Nghiem Sy Tien – Investment Strategy Officer, KBSV Securities

The 10-20% recovery in less than three weeks has pushed many stocks into the overbought zone, while negotiation outcomes remain uncertain. I recommend taking partial profits on stocks that have exceeded short-term targets, realizing gains, and increasing cash reserves. For mid- and long-term positions, only retain stocks of fundamentally strong companies. Recovered capital can be redirected towards stocks with valuation upside potential or await a broader market correction to reinvest.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The active capital flow in the Midcap group recently has been a highlight, while the large-cap group’s performance heavily relies on the Vingroup’s leadership. The Midcap group’s outperformance has resulted in many stocks outpacing the index’s gains. Therefore, in the short-term trading strategy, it is appropriate to partially take profits on stocks that have reached their targets. Investors can maintain the remaining positions and monitor the market’s movement as it approaches the 1270-point resistance level. If

Market Beat: KRX Listing and AGM Season Spur VN-Index to Afternoon Rally

The afternoon session witnessed a remarkable rebound, with the market closing on April 24th at 1,223.35, a gain of 12.35 points. The UPCoM followed suit, ending the day up 0.17 points at 91.63. However, the HNX-Index remained in the red, dropping 0.38 points to 211.07. The momentum from the AGM season and the KRX’s launch date announcement contributed to the index’s positive performance.

“VN-Index Extends Gains, Yet Liquidity Remains Constrained”

The VN-Index witnessed a robust surge, despite trading volume remaining below the 20-day average. This indicates cautious participation amidst the index’s approach towards the nearest resistance zone formed in mid-April 2025 (1,230-1,245 points). Should the positive momentum persist, coupled with a significant improvement in liquidity in upcoming sessions, a breakthrough from this zone is plausible. Notably, the MACD indicator continues to signal a buy, reinforcing the strengthening market trend.

No Problem with Margins: Q1 Results Support VN-Index’s Uptrend

“Vietnam is highly regarded as a nation with immense potential to forge an early tariff agreement with the United States, according to Mirae Asset. The country’s consistent political stance and diplomatic policy flexibility are key factors in this favorable outlook.”