The VN-Index closed the 19th trading week of 2025 at 1,267.3 points, a significant increase of 41 points or 3.34% from the previous week. This improvement was accompanied by a surge in trading liquidity, with the average matched transaction value rising by 29.4%. This was the first trading week following the official launch of the KRX system.

The average matched transaction value on the Ho Chi Minh Stock Exchange (HOSE) reached VND 15,758 billion, an increase of VND 3,581 billion compared to week 18/2025 (which had only two trading sessions before the holiday) but a decrease of 21.9% from the five-week average.

In terms of market capitalization, liquidity improved across all three groups, with the mid-cap group, VNMID, witnessing the most significant gains in both liquidity and points. Notably, the allocation of funds to the large-cap group, VN30, fell below 50% for the first time since mid-March 2025.

Across different sectors, liquidity rose broadly, with notable increases in both price and liquidity in Real Estate, Electrical Equipment, Information Technology, Oil & Gas Production, Aviation, Personal Goods, and Tires. On the other hand, Agriculture & Seafood and Retail sectors witnessed decreased liquidity and underperformed compared to the overall market.

Considering all three exchanges, the average transaction value during the 19th week of 2025 reached VND 19,263 billion, with the average matched transaction value at VND 17,146 billion, representing a 28.2% increase from the previous week but still a 22.2% decrease from the five-week average.

A notable feature of the past week was the strong and broad buying trend among foreign investors, significantly contributing to the rise of the VN-Index. Foreign investors net bought in 4 out of 5 trading sessions of week 19, focusing on Real Estate, Steel, Aviation, Personal Goods, and Banking stocks. However, they switched to net selling on Friday, mainly offloading Banking and Real Estate stocks.

Foreign investors net bought VND 1,260.7 billion, and their net buying on matched transactions was VND 1,168.4 billion. Their main net buying on matched transactions was in Real Estate and Basic Resources sectors. The top net bought stocks by foreign investors on matched transactions included DXG, VIC, NLG, MBB, MSN, HPG, CTG, HVN, PNJ, and HCM.

On the net selling side for matched transactions, foreign investors offloaded Information Technology stocks. The top net sold stocks by foreign investors on matched transactions were VCB, VHM, SSI, VPB, VNM, VCG, BWE, HAH, and CTD.

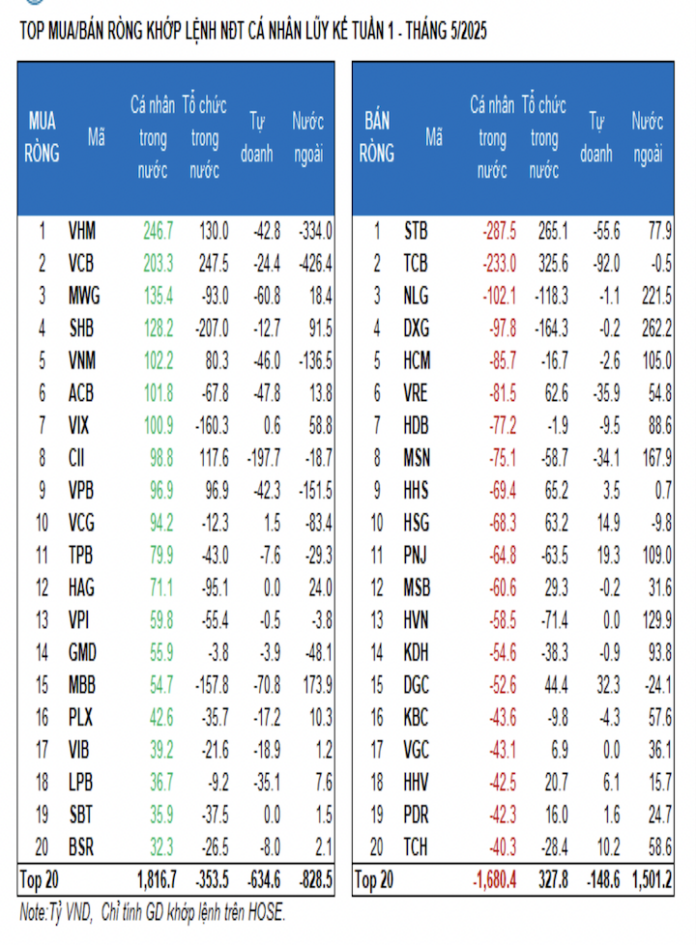

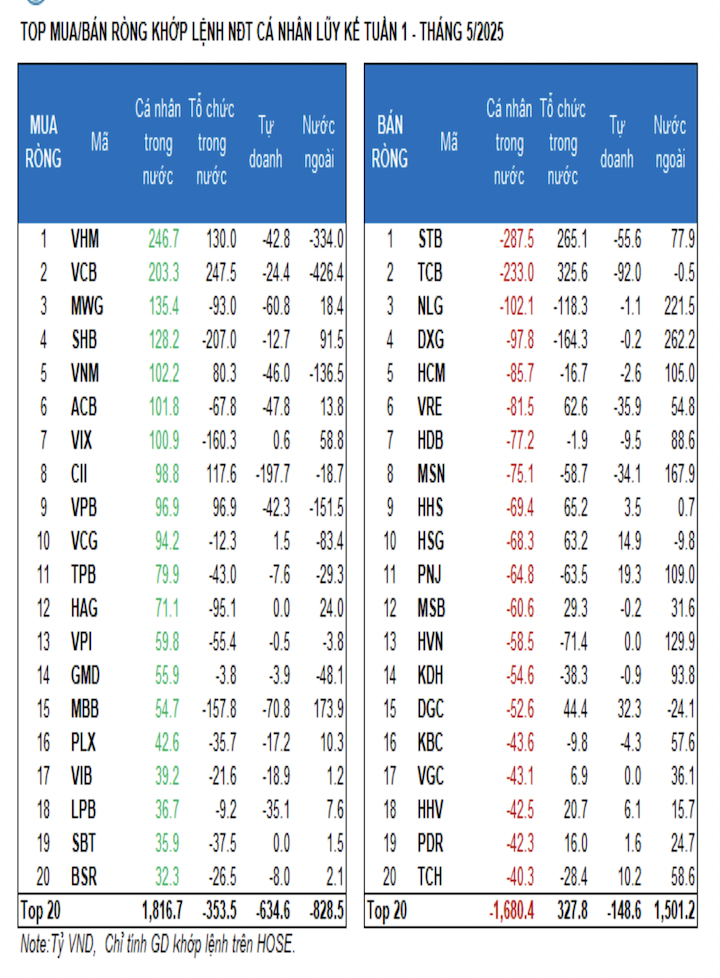

Individual investors net bought VND 189.1 billion, with a net buying value of VND 136.3 billion on matched transactions. On matched transactions, they net bought 10 out of 18 sectors, mainly in Food & Beverage. The top net bought stocks by individual investors included VHM, VCB, MWG, SHB, VNM, ACB, VIX, CII, VPB, and VCG.

On the net selling side for matched transactions, they offloaded 8 out of 18 sectors, mainly Real Estate and Basic Resources stocks. The top net sold stocks included STB, TCB, NLG, DXG, HCM, VRE, MSN, HHS, and HSG.

Proprietary trading arms of securities firms net sold VND 1,105.4 billion, with a net selling value of VND 1,012.5 billion on matched transactions. On matched transactions, they net bought only 5 out of 18 sectors, with the strongest net buying in Financial Services and Chemicals. The top net bought stocks by proprietary trading arms on matched transactions this week included FUEVFVND, DGC, FUEKIV3O, PNJ, HSG, VHC, TCH, VND, VTP, and E1VFVN30.

The top net sold stocks were in the Banking sector. The top net sold stocks by proprietary trading arms included ClI, TCB, HPG, MBB, MWG, STB, ACB, VNM, VIC, and VHM.

Domestic institutional investors net sold VND 344.4 billion, with a net selling value of VND 292.2 billion on matched transactions. On matched transactions, domestic institutions net sold 11 out of 18 sectors, with the highest value in Real Estate. The top net sold stocks by domestic institutions included SHB, VIC, DXG, VIX, MBB, CTG, NLG, HAG, MWG, and GEX. On the net buying side, they focused on the Banking sector. The top net bought stocks included TCB, STB, VCB, SSI, FPT, VHM, CII, VPB, BWE, and VNM.

The allocation of funds shifted towards Securities, Information Technology, Construction, Steel, Chemicals, Electricity, Aviation, Oil & Gas, and Textiles, while it decreased in Real Estate, Food, and Retail and remained unchanged in Banking.

Analyzing liquidity by trading value, notable improvements were seen in Real Estate, Electrical Equipment, Information Technology, Oil & Gas Production, Aviation, Personal Goods, and Tires sectors. Conversely, the Agriculture & Seafood and Retail sectors experienced reduced liquidity and underperformed compared to the overall market.

Examining the allocation of funds by market capitalization, the two large-cap sectors, Banking and Real Estate, witnessed a near-constant fund allocation in the low range and a decrease from the 10-week peak, respectively. In terms of price movements, Real Estate was the highlight of week 19, surging by 7.1% (outperforming the VNINDEX) thanks to strong net buying from foreign investors. In contrast, the Banking sector recorded a negligible increase during the past week (+1.2%) and in the last 20 sessions (+10.8% from the 1-year low on April 9, following the announcement of the US plan to impose reciprocal tariffs on imports).

Market Strength: Liquidity improved across all three market capitalization groups, but funds were more heavily allocated to the mid-cap group, VNMID, while the large-cap group, VN30, saw a decrease in allocation.

Analyzing the allocation of funds by market capitalization over the weekly frame, the large-cap group, VN30, accounted for 48.2% of the total, falling below the 50% threshold for the first time since mid-March 2025. Meanwhile, the mid-cap group, VNMID, attracted 38.1% of the funds, up from 34.2% in the previous week. The small-cap group, VNSML, witnessed a slight decrease in allocation to 9%.

In terms of liquidity improvement, the mid-cap group, VNMID, stood out with a remarkable increase of VND 1,836 billion, or 44.1%, in trading value, along with a 3.47% gain in points. The large-cap group, VN30, followed with an increase of VND 1,252 billion, or 19.7%, in trading value and a 3.25% rise in price.

The small-cap group, VNSML, recorded lower gains, with a 19% increase in trading value, amounting to VND 226 billion, and a 2.94% rise in points.

Market Beat: KRX Listing and AGM Season Spur VN-Index to Afternoon Rally

The afternoon session witnessed a remarkable rebound, with the market closing on April 24th at 1,223.35, a gain of 12.35 points. The UPCoM followed suit, ending the day up 0.17 points at 91.63. However, the HNX-Index remained in the red, dropping 0.38 points to 211.07. The momentum from the AGM season and the KRX’s launch date announcement contributed to the index’s positive performance.

“VN-Index Extends Gains, Yet Liquidity Remains Constrained”

The VN-Index witnessed a robust surge, despite trading volume remaining below the 20-day average. This indicates cautious participation amidst the index’s approach towards the nearest resistance zone formed in mid-April 2025 (1,230-1,245 points). Should the positive momentum persist, coupled with a significant improvement in liquidity in upcoming sessions, a breakthrough from this zone is plausible. Notably, the MACD indicator continues to signal a buy, reinforcing the strengthening market trend.