The morning trading session opened with a drop in gold bar prices across major jewelers compared to yesterday’s closing.

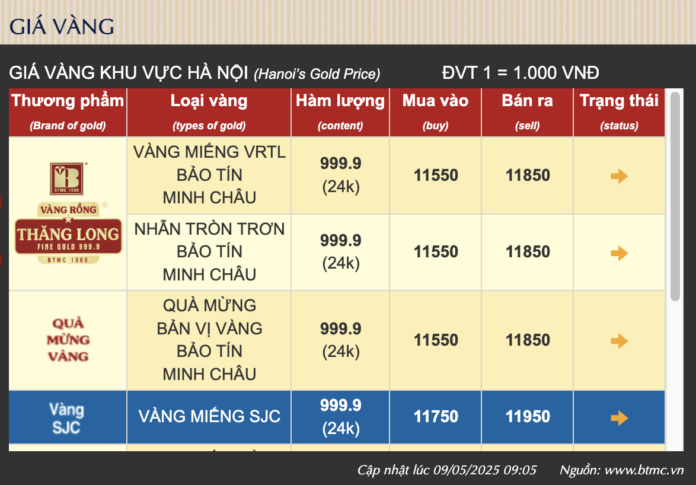

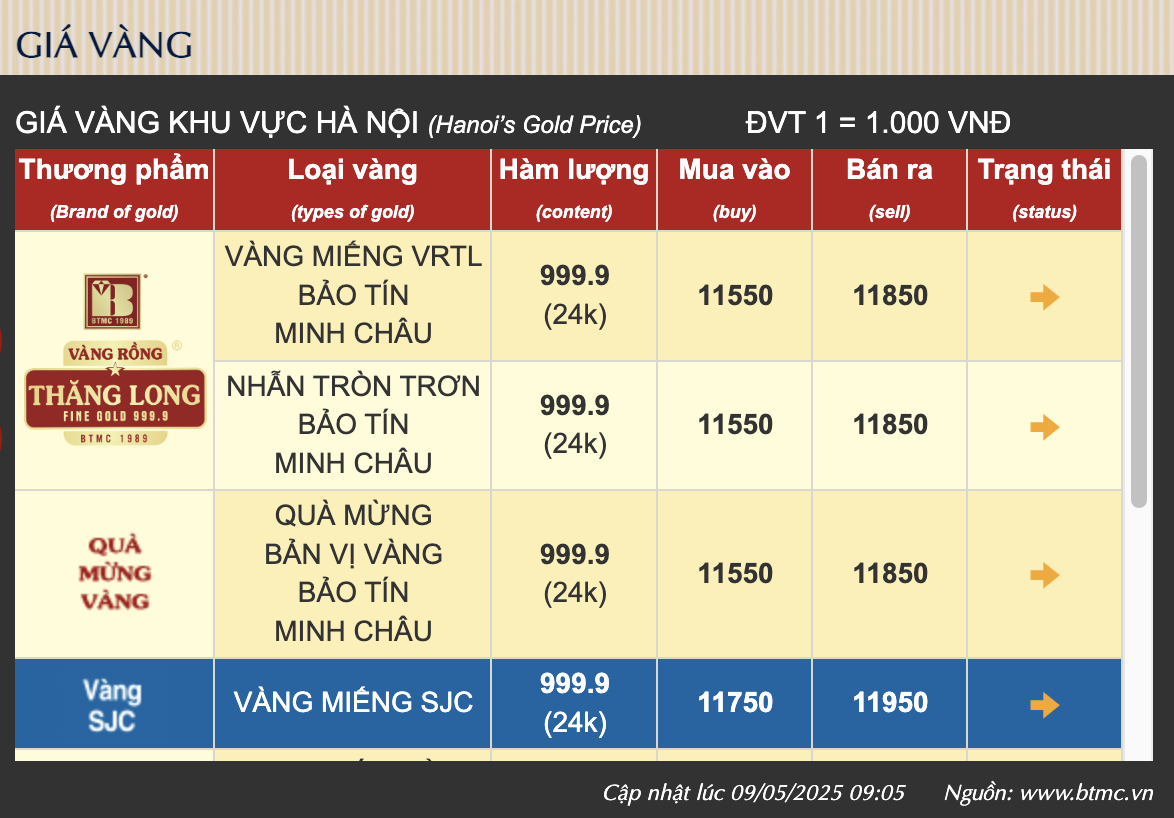

At 9 am, Bao Tin Minh Chau, PNJ, SJC, and DOJI all adjusted their buying and selling prices to 117.5 – 119.5 million VND per tael, a decrease of 1 million VND per tael for both buying and selling sides compared to yesterday’s closing, and a drop of 3.2 million VND per tael from the peak of 120.7 – 122.7 million VND per tael recorded at the same time yesterday morning.

Gold ring prices also saw a decrease of 500,000 – 1 million VND per tael compared to yesterday’s closing, and a drop of about 2.5 million VND per tael from the same time yesterday morning. Currently, PNJ is offering gold rings at 113.5 – 116.1 million VND per tael, while SJC, DOJI, and Bao Tin Minh Chau are at 113.5 – 116 million VND per tael, and 115.5 – 118.5 million VND per tael, respectively.

In the global market, the spot gold price dipped to $3,286 per ounce as of 9:35 am Vietnamese time, a 0.5% decrease from the latest closing price.

The market’s optimistic sentiment, fueled by trade agreement announcements between the US and the UK, has dampened the appeal of gold as a safe-haven asset, resulting in a nearly 4% decline over the past two days. This improved market mood indicates a boost in trader confidence regarding potential future trade deals for the US. Investors are now keenly awaiting the meeting in Switzerland on Saturday, where US and Chinese delegations will discuss tariffs.

The positive developments in trade relations have eased investor concerns, buoying the US stock market and the US dollar, both of which have exerted pressure on gold prices.

Meanwhile, the robust US labor market reinforces the Fed’s stance on maintaining unchanged interest rates. Fed Chairman Jerome Powell reiterated at a press conference on Wednesday that the Fed would not rush into cutting rates.

“May 6th: VietinBank’s Aggressive USD Buying Pushes Gold Prices to Record Highs”

The US dollar rate at banks tends to increase despite the State Bank of Vietnam’s decision to decrease the central exchange rate. Domestic gold prices skyrocketed by 2.5 – 3 million VND per tael during the morning session, setting a new record high.

“US Products in High Demand in Vietnam”

“A plethora of prominent Vietnamese corporations have been importing a diverse range of products from the United States, spanning from aircraft and machinery to power plant turbines, electrical transmission systems, GPU chips, and essential raw materials. These imports from the USA are valued at several billion dollars, showcasing the significant economic relationship between the two nations.”

The Golden Gamble: Speculation, Price Manipulation, and Profiteering in Vietnam’s Gold Market

The domestic and global gold price discrepancy can be attributed to speculation and price manipulation by certain individuals and businesses aiming to profit from the volatility.

The Golden Crash: When World Gold Prices Plummet and Bitcoin, Stocks Soar.

The gold price took a significant dip following US President Donald Trump’s announcement of a trade deal with the UK, sparking hopes of similar breakthroughs with other nations. Global stock markets, cryptocurrencies, and oil prices rebounded, indicating a shift towards a more positive investor sentiment.