After more than five months since the first trial, the case of the Commercial Transportation and Tourism Trading Joint Stock Company, known as Xuyên Việt Oil, which caused a stir in public opinion due to the involvement of several former officials and caused a loss of more than VND 1,400 billion, will be reviewed by the Ho Chi Minh City High-Level People’s Court from May 6 to May 12. Judge Chung Van Ket will preside over the appeal trial.

One of the focal points of the appeal is the consideration of the appeal of former Ben Tre Provincial Party Committee Secretary Le Duc Tho, who received the second-highest sentence (28 years in prison), after the main accused, Mai Thi Hong Hanh (former Director of Xuyên Việt Oil). Tho was sentenced by the Ho Chi Minh City People’s Court to 15 years in prison for “Taking Bribes” and 13 years for “Abusing position and power to influence others for personal gain”. Notably, the second charge, defined in Article 358 of the Criminal Code, is considered rare in legal practice due to the challenges in gathering evidence and quantifying the consequences as the act leaves no trace.

The defendants at the first trial

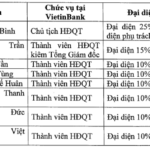

According to the indictment, during his tenure as Chairman of VietinBank’s Board of Directors (2018-2021) and later as Ben Tre Provincial Party Committee Secretary (from July 2021), defendant Le Duc Tho intervened to provide preferential credit treatment to Xuyên Việt Oil (increasing the credit limit to VND 100 billion with preferential interest rates and high unsecured loan ratio). In return, Tho received VND 600,000 USD and other assets worth more than VND 22 billion from defendant Mai Thi Hong Hanh. The first-instance court ruled that although Tho did not directly make credit decisions, he exerted indirect pressure on his subordinates. Tho has appealed for a reduced sentence, and the public is keenly awaiting the appellate court’s review of this rare charge.

Mai Thi Hong Hanh, who received the harshest sentence at the first trial (30 years in prison for “Violation of regulations on the management and use of state assets, causing waste and loss” and “Giving bribes”), has also filed an appeal. Hanh was found responsible for intentionally retaining VND 1,400 billion in environmental protection taxes collected on behalf of the state, mismanaging the price stabilization fund, and causing losses. However, she has only made restitution of VND 100 million. To maintain her business, Hanh also bribed eight individuals with a total of VND 22 billion on 22 occasions.

In addition to Hanh and Tho, five other defendants out of a total of 15 have appealed for reduced sentences, including former Deputy Director of Xuyên Việt Oil Nguyen Thi Nhu Phuong; former officials of the Ministry of Industry and Trade: Tran Duy Dong (former head of the Domestic Market Department), Hoang Anh Tuan, and Nguyen Loc An (former deputy heads of the Domestic Market Department); and Le Duy Minh (former head of Ho Chi Minh City Tax Department).

Among the defendants who took bribes, former Deputy Minister of Industry and Trade Do Thang Hai received USD 50,000 from Hanh to facilitate Xuyên Việt Oil’s operations. However, due to his full restitution of the bribe, his honest confession, and cooperation, Hai was sentenced to three years in prison for “Taking Bribes” and did not appeal.

A notable point from the first trial was the court’s observation that the former officials who received bribes from Mai Thi Hong Hanh did so without engaging in extortion or demanding anything in return. The investigation revealed that Hanh voluntarily gave gifts during holidays, birthdays, and other special occasions.

The Fate of Truong My Lan’s Capital Place 29 Lieu Giai

Considering the legitimate credit relationship between the owner of Capital Place, 29 Lieu, Ms. Truong My Lan, and the three foreign banks, the court has handed over the said building to the banks for debt recovery.

The Powerhouse Performer: VietinBank’s Stellar Growth with a Near 2.4 Million Billion Dong Total Asset Portfolio, Witnessing a 61% Surge in Pre-Tax Profit for Q4/2024

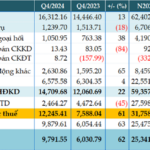

For the fourth quarter of 2024, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) reported a remarkable performance with a pre-tax profit of over VND 12,245 billion, surging by 61% year-on-year. This impressive growth is attributed to a significant reduction in credit risk provisions.

The Big Four Banks in Vietnam Report Impressive 2024 Financial Results: Agribank Leads with Outstanding Performance, VietinBank Posts Near 15% Loan Growth, BIDV and Vietcombank on Track to Meet Targets

At the recent 2025 Banking Task Deployment Conference, the leaders of the four largest banks in the system – Agribank, BIDV, Vietcombank, and VietinBank – unveiled their preliminary business results for 2024.

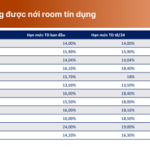

What are the 5 banks that have received a second credit limit increase?

On November 28, 2024, the State Bank of Vietnam (SBV) announced its decision to provide additional credit limits to banks that have utilized 80% of their previously allocated credit limits. This is the second time in 2024 that the SBV has taken such action, the first being in August 2024. With this move, the SBV demonstrates its unwavering commitment to achieving the ambitious 15% credit growth target for the year.