Specifically, the USD Index (DXY) rose by 0.45 points compared to the previous week, reaching 100.04 points.

The greenback strengthened after new data revealed that the US economy added 177,000 jobs in April. While this figure was lower than the March increase of 185,000 jobs (as revised), it still indicated a stable labor market. This development led investors to temper their expectations for an early Fed pivot on monetary policy.

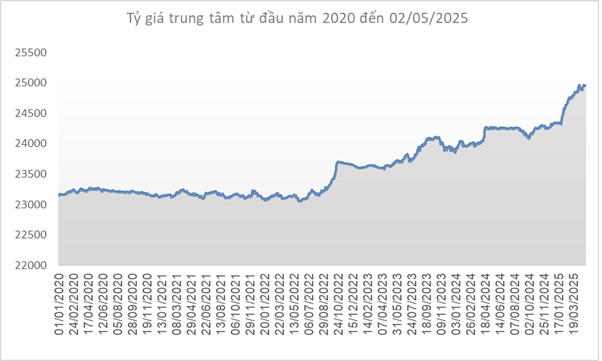

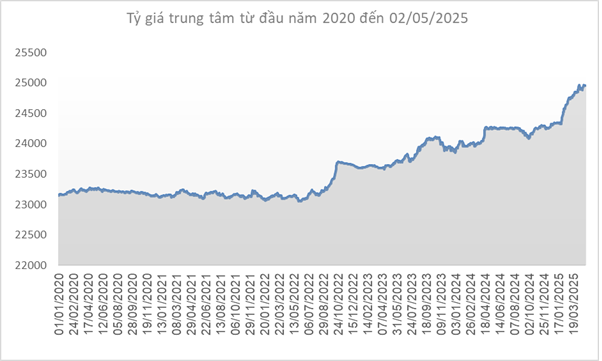

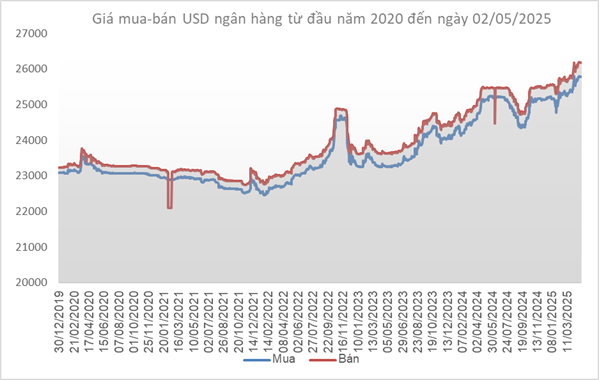

Source: SBV

|

Domestically, the central exchange rate of the Vietnamese Dong to USD increased by 8 VND compared to the previous week (as of April 25th), reaching 24,956 VND/USD on April 29th.

With a 5% margin, the allowable trading range for USD at commercial banks is between 23,708 and 26,204 VND/USD.

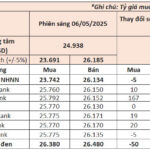

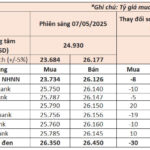

The State Bank of Vietnam’s reference exchange rates for USD/VND are 23,759 for buying and 26,153 for selling, a decrease of 6 VND on the buying side and 8 VND on the selling side compared to the previous week.

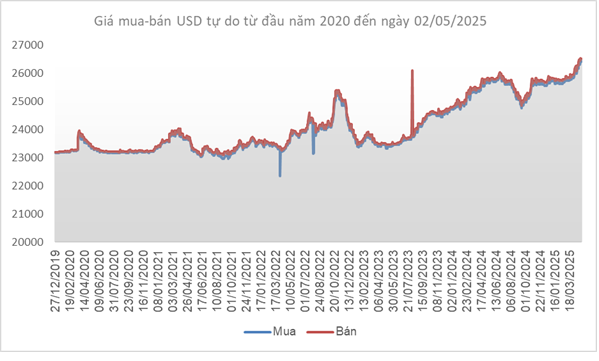

Source: VCB

|

At Vietcombank, the USD/VND exchange rate at the end of the day on April 29th was 25,790-26,180 VND/USD (buy-sell), a decrease of 15 VND on both buying and selling sides compared to the previous week.

Source: VietstockFinance

|

Meanwhile, the exchange rate in the free market increased by 100 VND on the buying side and 80 VND on the selling side compared to the previous week, reaching 26,410-26,510 VND/USD (buy-sell).

– 19:14 04/05/2025

“May 7: Central Bank’s Continued Drop in USD Rates, Gold Prices Soar to Record Highs”

The USD exchange rates at banks witnessed a mixed trend as the SBV lowered the mid-rate for the third consecutive session. Domestic gold prices remained anchored at record highs.

The Dollar Dips: Central Bank’s Intervention Causes a Stir as Gold Soars

The US dollar suffered a slump both domestically and internationally. In contrast, gold prices soared to record highs.