TNH Joint Stock Company Hospital Group (HOSE: TNH) is the largest private hospital system in the mountainous provinces of Northeast Vietnam. According to the company’s official website, the group’s hospital system includes Thai Nguyen International Hospital, Yen Binh General Hospital in Thai Nguyen, and TNH Viet Yen Hospital in Bac Giang Province.

TNH hospitals are conveniently located with easy access to transportation and are surrounded by populous areas and large industrial zones. This makes it convenient for patients seeking medical care and treatment at the hospitals.

In 2021, TNH’s stock officially became the first hospital stock to be listed on Ho Chi Minh City Stock Exchange (HOSE). The company has come a long way since its initial registered capital of nearly VND 27.7 billion. After 11 adjustments over the years, TNH’s charter capital has now surpassed VND 1,101 billion.

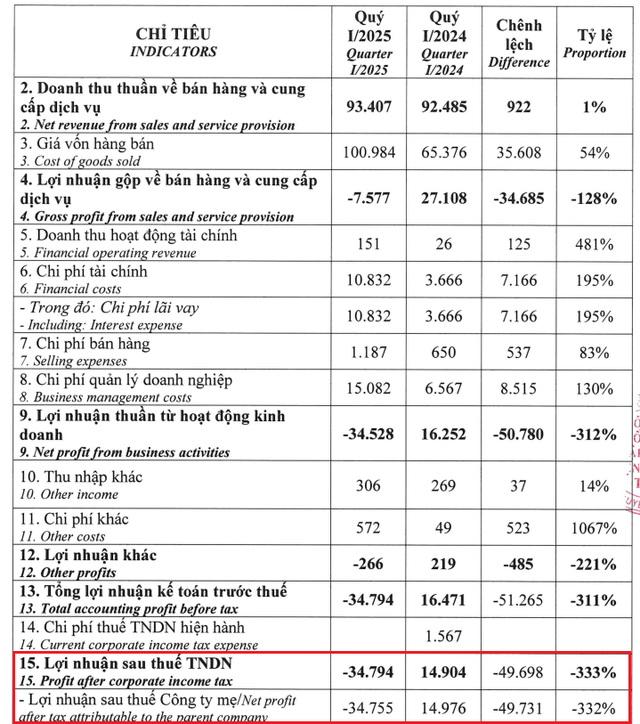

TNH recently released its financial report for the first quarter of 2025. The company’s net revenue from sales increased slightly by 1% compared to the same period last year, reaching VND 93.407 billion. However, the cost of goods sold increased by 54% to VND 101 billion.

According to TNH’s explanatory report, the increase in cost is attributed to the newly operational TNH Viet Yen Hospital, which incurred significant expenses for its new operations, including depreciation of new assets, high interest and personnel costs relative to the revenue generated during this period.

While TNH Viet Yen Hospital commenced operations in early November 2024, it officially started providing medical examination and treatment services under health insurance on March 1, 2025. As a result, the number of patients in the first quarter of 2025 was not high, impacting the overall profit of the company.

Additionally, selling expenses increased by 83% from VND 650 million in the first quarter of 2024 to VND 1.2 billion in the same period this year. The company’s management expenses also surged by 130% compared to the previous year, reaching VND 15.1 billion.

Compared to the first quarter of 2024, the company now has one additional operational hospital, resulting in increased personnel, consumable, depreciation, and marketing expenses for the new hospital.

The construction of TNH Lang Son Hospital, invested by TNH Lang Son Joint Stock Company – a subsidiary of TNH, is still in progress and has not yet generated revenue or contributed to the group’s profit.

Moreover, in the first quarter of 2025, the company incurred additional expenses to enhance the quality of healthcare services, standardize staff qualifications, digitize hospital data, and improve operational efficiency to align with the comprehensive digital transformation mandated by the Ministry of Health.

To ensure a dedicated and stable workforce, the company adjusted the income levels of its employees and reorganized its management structure, adding key leadership positions to support its business expansion strategy.

Overall, these factors led to a 333% decrease in post-tax profit in the first quarter of 2025 compared to the same period in 2024. While the post-tax profit in the first quarter of 2024 was nearly VND 15 billion, this year’s figure stands at a loss of VND 34.8 billion. This is the company’s largest loss in its operating history and the second consecutive quarterly loss.

Regarding its development strategy, TNH aims to become a leading healthcare group with a wide reach across Vietnam by 2030. The group aspires to provide high-quality and affordable healthcare services to a diverse range of customers.

TNH envisions a versatile and flexible healthcare system, comprising general and specialized hospitals, as well as senior care centers integrated with TNH hospitals in select locations where the group has a pioneering advantage. This vision also includes establishing a healthcare-focused training institution and a central hub for the group’s operations in Hanoi.

By the end of 2030, TNH plans to operate 10 general and specialized hospitals in various provinces and cities, with a total of 3,350 beds and an initial investment of VND 13,340 billion. The group targets 1.8 million patient visits per year, aiming for a 5% annual efficiency increase.

In a separate development, the State Securities Commission of Vietnam has approved an increase in the foreign ownership limit in TNH from 49% to 70%. This presents an opportunity to attract more international investment to support TNH’s ambitious goals.

The Power of Nuclear Energy: Unlocking the Essential Element.

“The development of nuclear power in Vietnam presents critical challenges, and according to Dr. Tran Chi Thanh, President of the Vietnam Atomic Energy Institute (VINATOM), one of the foremost concerns is the availability of skilled human resources. In an exclusive interview with Vietnam Economic Times/VnEconomy’s Phan Anh, Dr. Thanh underscored the importance of cultivating a talented workforce to support the country’s ambitious nuclear agenda.”

The Pearl of Vietnam’s Stock Market: Vinpearl’s HoSE Listing Leaves Rivals in the Dust

With a valuation of approximately 128 trillion VND, Vinpearl has surpassed veteran brands such as Vinamilk, ACB Bank, and the Masan Group to become one of the top-capitalized companies on the Vietnamese stock exchange.

“Unlimited Innovation”: Unlocking Private Sector Growth

The government has unveiled a series of strategic resolutions, known as the “Fab Four,” which are set to revolutionize Vietnam’s future. These include Resolution 57-NQ/TW, which focuses on breakthrough development in science, technology, innovation, and digital transformation; Resolution 59-NQ/TW on international integration; Resolution 66-NQ/TW, which aims to reform law-making and enforcement; and Resolution 68-NQ/TW, dedicated to fostering private economic growth. These resolutions are designed to work in harmony, creating a vibrant and innovative Vietnam, open to global opportunities, with a robust private sector and a legal system to match.

“Vietbank’s Q1 2025 Profit Soars: A Triple-Digit Surge in Core Income”

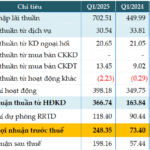

The consolidated financial statements for Q1 2025 reveal that Vietbank (VBB on UPCoM) recorded a remarkable performance with a pre-tax profit of over VND 248 billion, tripling its earnings from the previous year’s first quarter. This impressive growth is primarily attributed to the bank’s core income streams.

The Battle for Private Banking Supremacy in Vietnam

According to the Knight Frank Wealth Report 2024, Vietnam is home to approximately 5,459 individuals with liquid assets exceeding $10 million, accounting for 0.2% of the global high-net-worth individual (HNWI) population and ranking sixth in Southeast Asia. The Asia-Pacific region, hailed as the “Asian Century,” has witnessed robust economic growth, leading to a rapid increase in the number of HNWIs and ultra-high-net-worth individuals (UHNWI). Knight Frank predicts a 26% rise in Vietnam’s ultra-rich population (those with assets over $30 million) by 2026, reaching approximately 1,551 individuals, while the millionaire cohort is expected to grow from 72,135 to 114,807. Additionally, McKinsey estimates that Vietnam’s personal financial assets will reach around $600 billion by 2027, exhibiting a 15% annual growth rate between 2011 and 2021, double the regional average, underscoring the surging demand for comprehensive wealth management services.