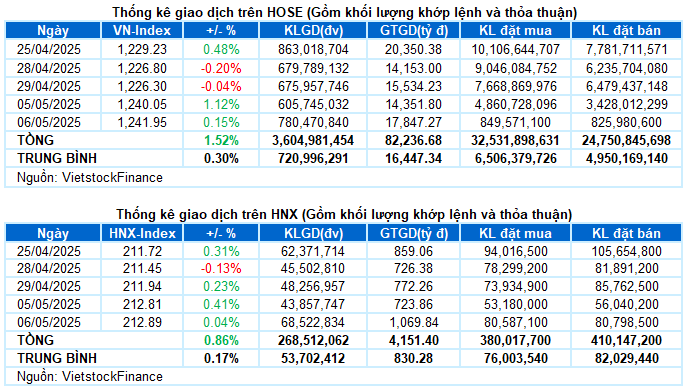

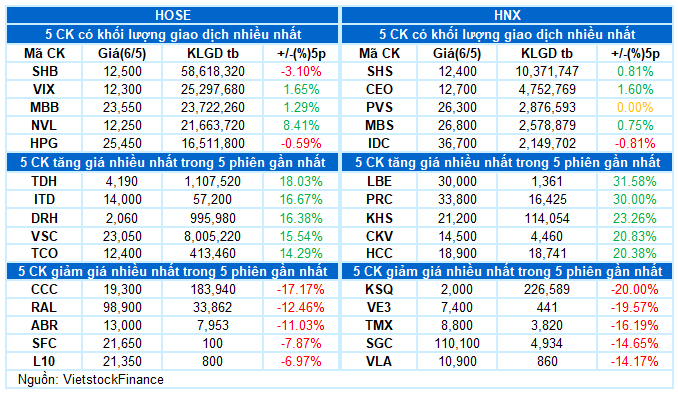

I. MARKET ANALYSIS OF SECURITIES ON 05/06/2025

– The main indices narrowed their gains during the trading session on May 6. The VN-Index increased by 0.15% to 1,241.95 points, while the HNX-Index reached 212.89 points, up slightly by 0.04%.

– Liquidity improved compared to the previous session’s low. The matched order volume on the HOSE floor increased by 29%, reaching over 723 million units. The matched order volume on the HNX floor reached nearly 66 million units, an increase of 61%.

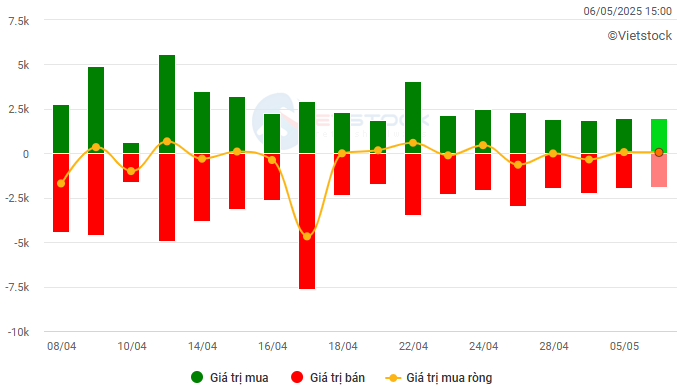

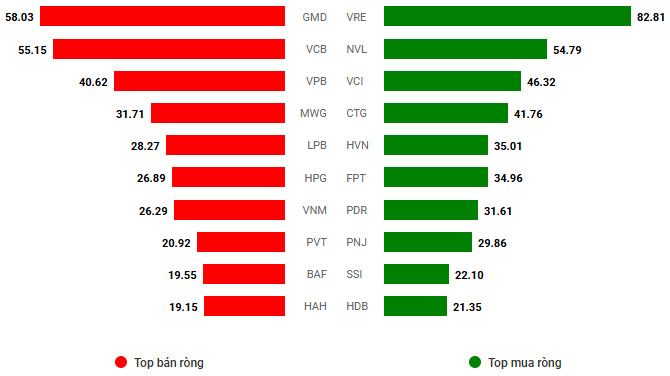

– Foreign investors continued to net buy lightly, with a value of more than 44 billion VND on the HOSE and nearly 21 billion VND on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: Billion VND

Net trading value by stock code. Unit: Billion VND

– The trading session on May 6 started on a positive note, with improved liquidity, and active cash flow in the early session, helping the green to spread quickly and widely. The upward momentum was maintained quite stable throughout the morning session and lasted until the beginning of the afternoon session, with the VN-Index up more than 10 points at one point. However, unexpected profit-taking pressure increased in the second half of the afternoon session, causing the index to reverse and lose most of its previous gains. At the close, the VN-Index edged up nearly 2 points to close at 1,241.95.

– In terms of impact, GAS, TCB, VPB, and HVN were the most positive contributors, helping the VN-Index gain 2.5 points. Meanwhile, the significant negative impact came from GVR, HPG, and BCM, which took away more than 1 point from the overall index.

– VN30-Index reversed to a nearly 1-point loss at the end of the session, reaching 1,319.66 points. The basket was quite divided with 12 gainers, 13 losers, and 5 stocks standing.

On the upside, BVH was the most prominent gainer, surging 3%. Following were GAS, VPB, TPB, and TCB, which also traded positively with gains of over 1%. In contrast, BCM and GVR were the worst performers, falling more than 2%.

The green still dominated in most sectors. Telecommunications and energy were the two groups that recorded the most outstanding gains, with the green spreading widely, typically in stocks such as VGI (+2.79%), CTR (+2.88%), SGT (+4.94%), ELC (+3.72%), TTN (+8.81%); BSR (+2.48%), PVD (+2.27%), PVS (+1.15%), and PVB (+1.57%).

The healthcare and information technology groups also rose more than 1% thanks to the main contributions of large-cap stocks in the sector, such as DHG (+4.04%), DVN (+4.98%), DCL (+1.2%), DVM (+1.47%); FPT (+1.01%), CMG (+2.94%), and ITD hitting the ceiling price.

On the other hand, the downward adjustment in HPG (-0.97%), GVR (-2.21%), DPM (-1.76%), HSG (-1.71%), NKG (-1.62%), etc., caused the materials group to close in the red. In addition, the essential consumer goods and industrial groups also recorded slight decreases.

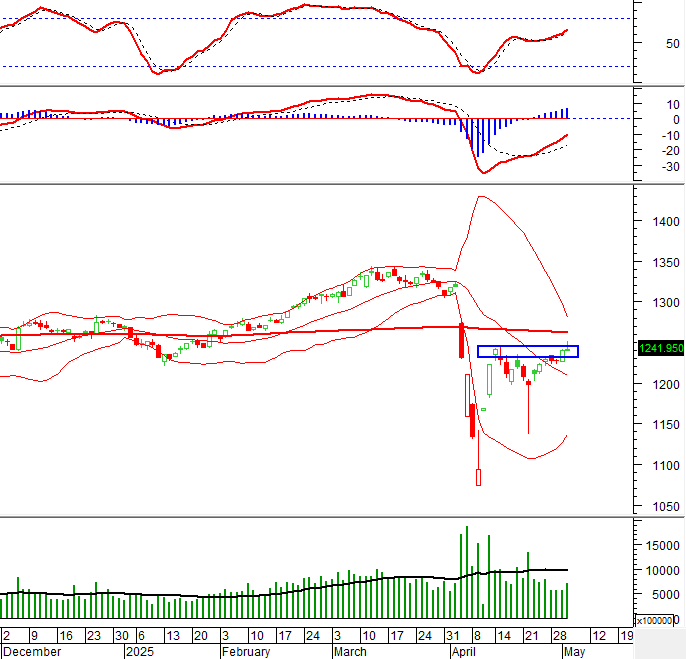

VN-Index narrowed its gains with the appearance of an Inverted Hammer candlestick pattern and has not yet surpassed the old peak formed in mid-April 2025 (equivalent to 1,230-1,245 points). In addition, trading volume remained below the 20-day average, indicating that investors remain cautious. In the coming sessions, the index needs to break above this threshold to continue its upward momentum. Currently, the MACD and Stochastic Oscillator indicators continue to point upwards after giving buy signals. If this state is maintained in the future, the short-term optimistic outlook will continue.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Inverted Hammer Candlestick Pattern Appears

VN-Index narrowed its gains with the appearance of an Inverted Hammer candlestick pattern and has not yet surpassed the old peak formed in mid-April 2025 (equivalent to 1,230-1,245 points). In addition, trading volume remained below the 20-day average, indicating that investors remain cautious. In the next sessions, the index needs to break above this level to maintain its upward trend.

Currently, the MACD and Stochastic Oscillator indicators continue to point upwards after giving buy signals. If this state is maintained in the future, the short-term optimistic outlook will remain.

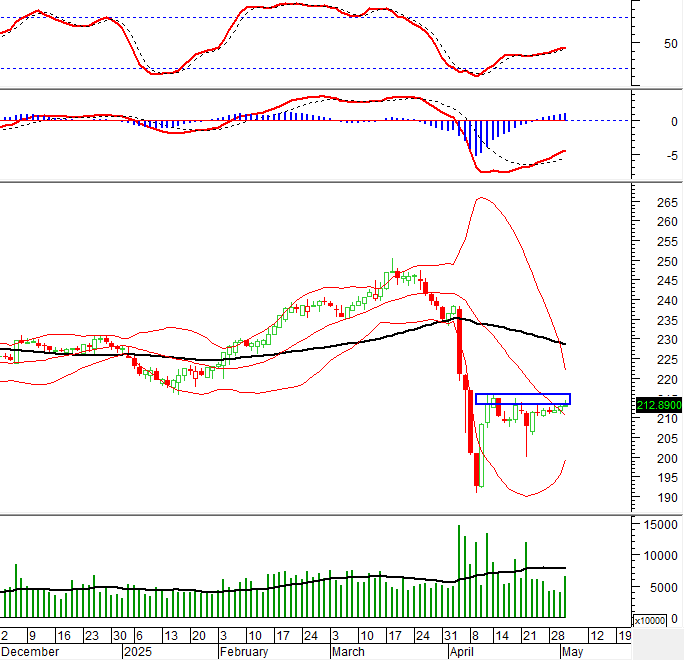

HNX-Index – April 2025 Peak as the Next Resistance Zone

HNX-Index increased while still holding above the Middle line of the Bollinger Bands. However, the appearance of the Inverted Hammer candlestick pattern indicates investors’ pessimistic sentiment. Currently, the index is trending towards the resistance zone formed in mid-April 2025 (equivalent to the 213-216-point zone). HNX-Index needs to break out of this zone, accompanied by improved liquidity, to maintain its upward trend in the future.

Currently, the MACD and Stochastic Oscillator indicators continue to point upwards after giving buy signals. This suggests that the short-term optimistic outlook will continue.

Analysis of Money Flow

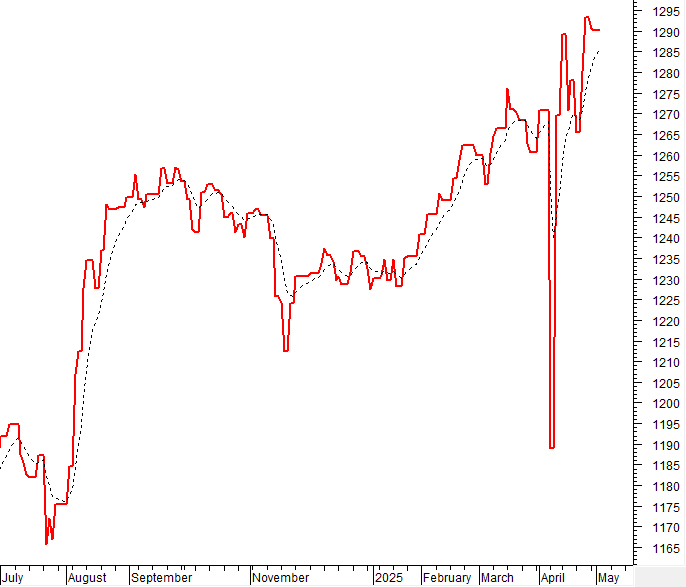

Fluctuation of Smart Money Flow: The Negative Volume Index indicator of VN-Index cut above the EMA 20 days. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuation of Foreign Capital Flow: Foreign investors returned to net buying in the trading session on May 6, 2025. If foreign investors maintain this action in the coming sessions, the situation will become even more optimistic.

III. MARKET STATISTICS ON 05/06/2025

Economic and Market Strategy Analysis Department, Vietstock Consulting and Research

– 17:21 05/06/2025

Market Beat: VN-Index Turns to Late Session Tug-of-War, Holding on to Green Tint.

The market closed with positive gains as the VN-Index rose by 5.88 points (+0.48%), settling at 1,229.23. Similarly, the HNX-Index witnessed an increase of 0.65 points (+0.31%), ending the day at 211.72. The market breadth tilted towards the bulls with 404 gainers versus 323 decliners. The VN30 basket also painted a positive picture, with 15 gainers outperforming the 13 losers, while 2 stocks remained unchanged, tilting the basket towards the green.

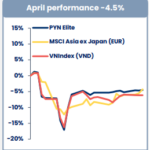

Shark PYN Elite: Deep-Value Adjustments Offer Golden Opportunity to Accumulate Quality Stocks

In PYN Elite’s April 2025 investment report, the large-scale foreign fund with approximately VND 22,000 billion in assets views the recent sell-off in the Vietnamese stock market as an opportunity to accumulate high-quality stocks at attractive discounts.

Stock Market Outlook for April 21-25, 2025: Returning to an Optimistic Mindset

The VN-Index concluded the week on a positive note, with a significant rise in trading volume, surpassing the 20-week average. This indicates a sustained influx of capital into the market. Moreover, foreign investors’ net buying, following an extended period of net selling, serves as a notable supportive signal, boosting investor sentiment and enhancing the short-term positive outlook.

Market Beat: Afternoon Euphoria Sends VN-Index Soaring by 20 Points

The VN-Index defied the morning’s tug-of-war, surging in the afternoon session to close at 1,269.8 points on May 8, a substantial gain of 19.43 points. Mirroring this positive trend, the HNX-Index climbed 1.8 points to 215.21, while the UPCoM-Index inched up 0.06 points to 92.98. Trading value accelerated, surpassing 20,718 billion VND.

Market Beat: Telecoms Shine as VN-Index Surges Over 13 Points

The trading session concluded with significant gains, as the VN-Index climbed by 13.87 points (+1.16%), reaching 1,211 points. Simultaneously, the HNX-Index experienced a notable surge, rising by 3.74 points (+1.8%) to close at 211.45. The market breadth tilted strongly in favor of advancers, with 636 tickers in the green versus 141 decliners. Dominating the VN30 basket, 23 constituents advanced, five declined, and two remained unchanged, painting a bullish picture across the board.