I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 05/08/2025

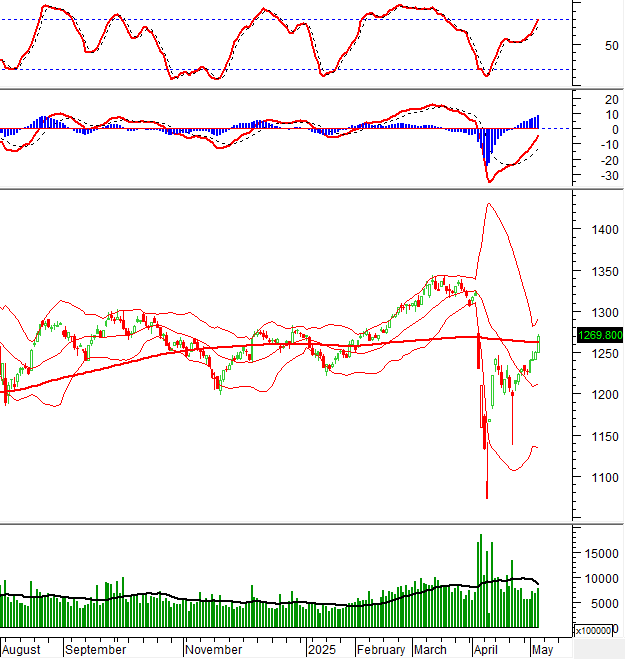

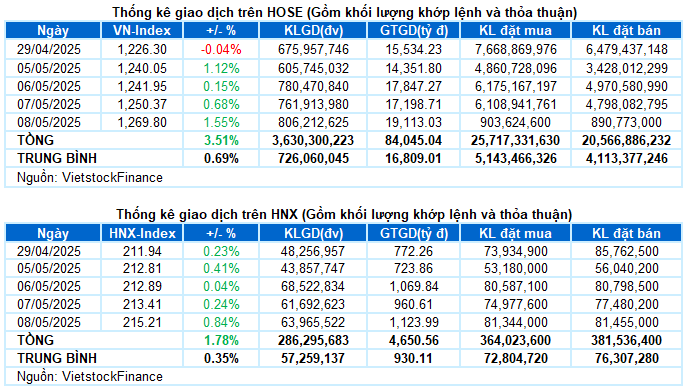

– The main indices continued to trade positively in the 05/08 session. VN-Index increased by 1.55%, reaching 1,269.8 points; HNX-Index reached 215.21 points, up 0.84%.

– Matching volume on the HOSE floor increased by 12%, reaching more than 780 million units. Matching volume on the HNX floor reached nearly 63 million units, up 6.6%.

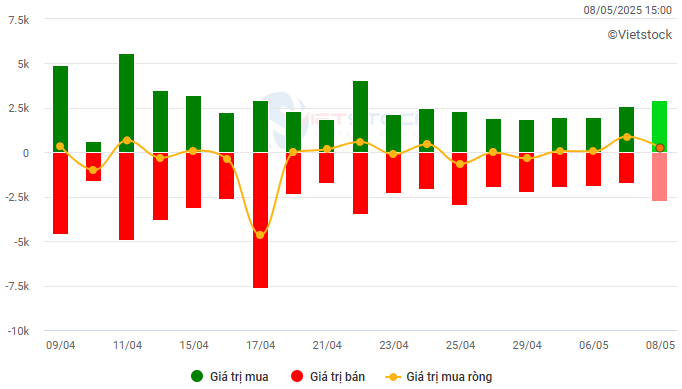

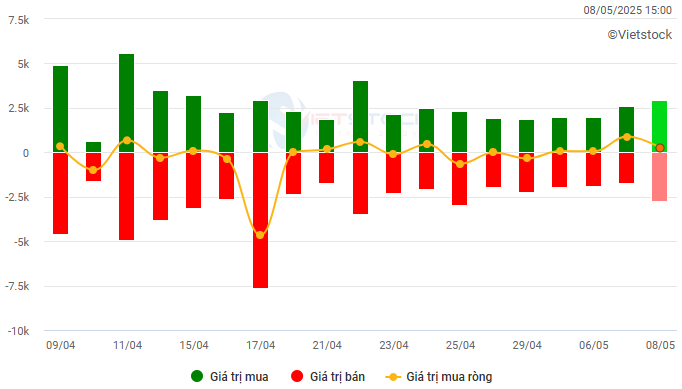

– Foreigners maintained a net buying status with a value of nearly VND 263 billion on the HOSE and more than VND 10 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by date. Unit: VND billion

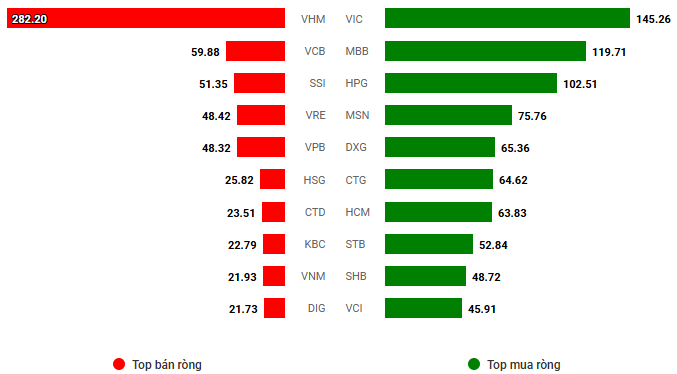

Net trading value by stock code. Unit: VND billion

– The Vietnamese stock market had its fourth consecutive gaining session. Although market liquidity has not improved significantly, buying force still showed a clear advantage. After VN-Index approached the 1,260-point threshold, the index showed signs of slowing down in the morning session. However, buying force once again returned stronger in the afternoon session, led by pillar stocks. Green covered a wide range, bringing VN-Index to close at 1,269.8 points, up 1.55%.

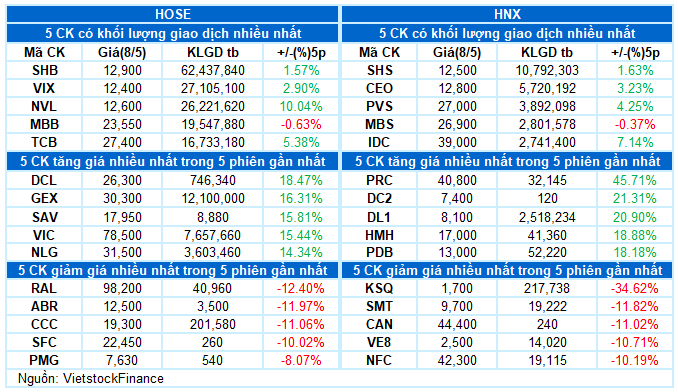

– In terms of impact, VIC continued to be the most prominent highlight of the market when this stock alone brought nearly 5 points to VN-Index. Following were GVR, FPT, and BID, which also contributed more than 4 points. The buying side was absolutely dominant when the 10 codes with the most negative impact also made VN-Index lose less than 0.5 points.

– VN30-Index spoke out strongly, breaking the 2% mark, reaching the milestone of 1,351.1 points. The breadth was completely tilted towards buying with 29 stocks rising, 1 falling, and 1 standing. Up to 20 codes increased by more than 1%, of which many codes recorded ceiling and near-ceiling increases such as VIC, GVR, and PLX. Only BVH stock went against the common trend, down 0.2% and VPB stopped at the reference mark.

Green covered all industry groups. The information technology group topped the list with an increase of more than 4% thanks to the main contribution of FPT (+4.19%), CMG (+1.5%), and POT (+3.25%). Notably, the real estate group continued its impressive winning streak with a series of stocks reaching the ceiling, such as VIC, HQC, ITC, SGR, along with TCH (+3.42%), NLG (+2.61%), NTL (+2.61%), KBC (+1.03%), SZC (+4.67%), BCM (+5.08%),…

In addition, the financial group also returned to the race with a 1% increase. Banking and securities stocks increased well with outstanding liquidity, including SHB (+2.38%), STB (+1.67%), TCB (+1.48%), MBB (+1.29%), BID (+1.58%), HCM (+3.16%), VIX (+2.06%), FTS (+3.2%), VND (+2.06%),…

VN-Index surged strongly with the appearance of a White Marubozu candlestick pattern while surpassing the SMA 200-day mark. This indicates that investors are very optimistic. If the index continues to hold above this threshold, accompanied by a strong increase in liquidity, the situation will become even more favorable. Currently, the MACD indicator is still signaling a buy and is likely to cut above the 0 threshold in the coming sessions. If this state is confirmed, the short-term optimistic outlook will continue to be maintained.

II. TREND AND PRICE MOVEMENT ANALYSIS

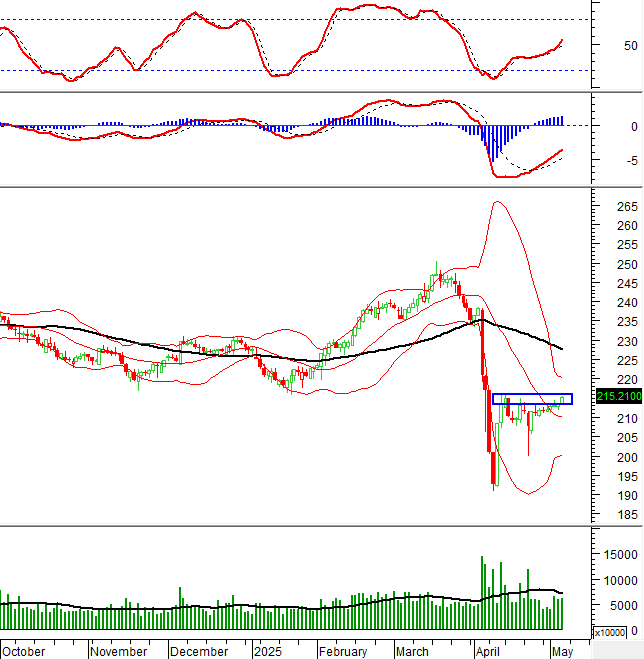

VN-Index – MACD indicator is likely to cut above the 0 threshold

VN-Index surged strongly with the appearance of a White Marubozu candlestick pattern while surpassing the SMA 200-day mark. This indicates that investors are very optimistic. If the index continues to hold above this threshold, accompanied by a strong increase in liquidity, the situation will be even more favorable.

Currently, the MACD indicator is still signaling a buy and is likely to cut above the 0 threshold in the coming sessions. If this state is confirmed, the short-term optimistic outlook will be maintained.

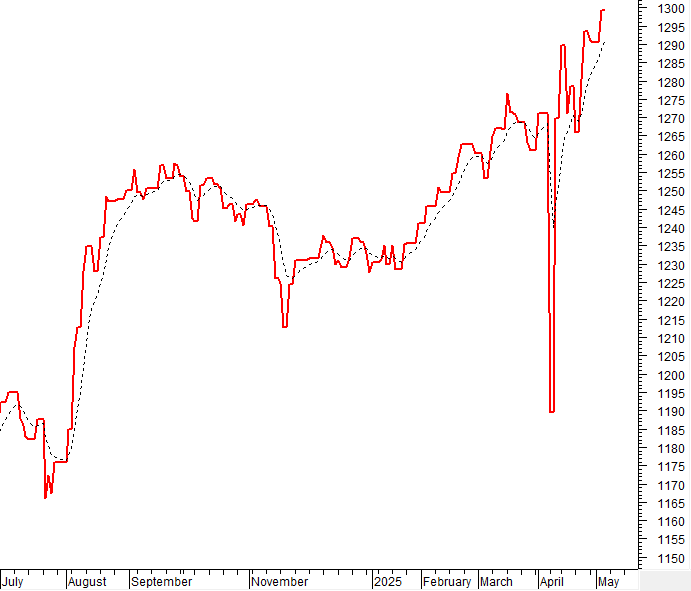

HNX-Index – Likely to surpass April 2025 peak

HNX-Index continued to maintain its upward momentum since breaking above the Middle line of the Bollinger Bands. At the same time, the index is testing the old peak of April 2025 (equivalent to the 213-216-point region). If in the coming sessions, the index breaks out of this region, accompanied by a clear improvement in liquidity, the uptrend will be further strengthened.

Currently, the MACD and Stochastic Oscillator indicators continue to point upwards after giving buy signals. This indicates that the short-term optimistic outlook remains.

Analysis of Capital Flows

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index cuts above the EMA 20-day line. If this state continues in the next session, the risk of sudden decline (thrust down) will be limited.

Fluctuation of capital flow from foreign investors: Foreigners continued to net buy in the trading session on 05/08/2025. If foreign investors maintain this action in the coming sessions, the situation will be even more optimistic.

III. MARKET STATISTICS ON 05/08/2025

Department of Economic Analysis & Market Strategy Consulting, Vietstock Consulting

– 17:17 05/08/2025

Deep Discounts, Stock Market Surges: 194,000 New Accounts Join the Fray.

As of April 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to Vietnam Securities Depository (VSDC). The country’s stock market boasted over 9.88 million accounts, reflecting an increase of 194,023 accounts since March. This remarkable growth marks the highest increase in the past eight months.

“UPCoM Liquidity Surges 13% in April”

The UPCoM market in April 2025 mirrored the listed stock market, plunging early in the month, then staging a mild recovery and trading sideways for the remainder of the period. Average trading volume rose 13% from March, reaching nearly 61.4 million shares per session, while average trading value climbed 11%, surpassing VND 803 billion per session.

SSI Research: Positive Trade Negotiation Developments to Spur Market Recovery

The SSI Securities Analysis Department’s strategic report highlights the need for positive developments in trade negotiations to sustain the market’s recovery momentum. The current blended P/E ratio remains low, and the estimated one-year market yield is attractive compared to deposit interest rates.