Image 1: A comfortable mattress is essential for a good night’s sleep, and Vua Nem offers a wide range of options to ensure a restful slumber.

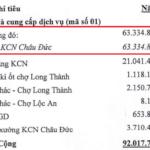

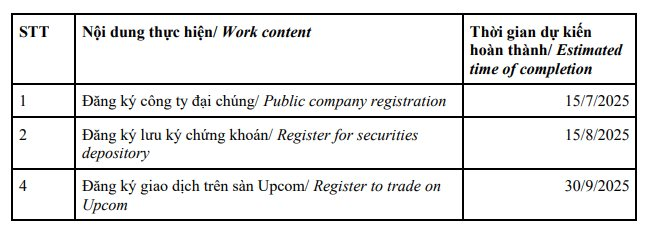

According to documents from JSC Investment Vua Nem, the parent company of JSC Vua Nem, the Board of Directors presented plans to the General Meeting of Shareholders for approval. These plans included registering as a public company with the State Securities Commission of Vietnam, registering securities custody with the Vietnam Securities Depository, and listing the company’s shares on the Upcom stock exchange with the Hanoi Stock Exchange.

The company aims to complete the public company registration by July 2025, securities custody registration by August 2025, and Upcom listing by September 2025.

Image 2: A visual representation of Vua Nem’s financial performance, showcasing their revenue and profit margins.

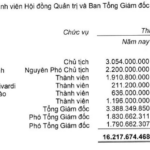

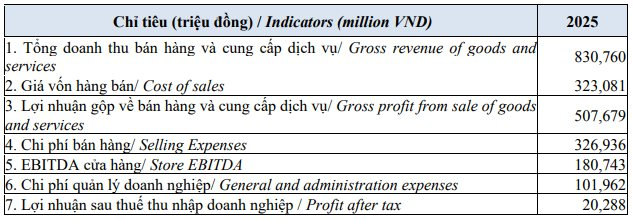

In 2024, Investment Vua Nem recorded a slight decrease in revenue, with sales reaching nearly VND 716 billion, a 2% drop from the previous year. However, due to reduced cost of sales, selling expenses, and management fees, the company turned a profit, earning over VND 10 billion in after-tax profit compared to a loss of VND 91 billion in the previous year.

For 2025, Investment Vua Nem sets ambitious targets, aiming for total sales revenue of nearly VND 831 billion and an after-tax profit of over VND 20 billion, representing a 16% and 98% increase, respectively, from the previous year’s performance.

Image 3: A chart illustrating Vua Nem’s growth trajectory and future plans for expansion.

At the 2022 Annual General Meeting of Shareholders, Investment Vua Nem also approved plans for dematerialization.

Vua Nem is renowned as one of Vietnam’s largest mattress retailers, boasting over 130 stores nationwide. They offer a diverse range of mattress brands, including Serta, Bedgear, Dunlopillo, Aeroflow, Tempur, Therapedic, Amando, Lien A, Kim Cuong, Gummi, and Goodnight, ensuring customers find their perfect sleep solution.

Vua Nem was established in 2007 by entrepreneurs Hoang Tuan Anh and Nguyen Vu Nghia. In 2017, the company received investment from Mekong Capital, leading to the creation of Vuanem.com and an expansion to 38 retail stores. The following year, Vuanem.com and Dem.vn merged to form a unified brand, Vua Nem.

JSC Investment Vua Nem was founded in August 2017, headquartered in Ho Chi Minh City’s District 6, with Mr. Hoang Tuan Anh as its Chairman. The company has a charter capital of over VND 54.7 billion, and its shareholder structure includes Future Changer Pte. LTD (Singapore) holding 58.84% of the charter capital, Craig David Schmeizer (USA) with 0.54%, Woods Samuel Adam (USA) with 0.8%, and Sanyo Teru Lue-Kim (Canada) with 7.31%.

Recently, on May 6, 2025, the State Securities Commission confirmed that JSC Investment F88, another company in Mekong Capital’s investment portfolio, has met the requirements to become a public company under the Securities Law. According to our sources, Mr. Phung Anh Tuan shared F88’s plans to list on the UpCom exchange as early as July, with aspirations to trade on HoSE within the next two years.

“D2D Announces 2024 Cash Dividend Payout: A Whopping 84% Yield”

Industrial Urban Development Joint Stock Company (HOSE: D2D) is pleased to announce its latest cash dividend offering to shareholders. On May 22nd, the company declared an 84% dividend yield, equivalent to VND 8,400 per share, with the payment expected to be made on June 10th. This announcement marks an exciting opportunity for investors, showcasing the company’s commitment to returning value to its shareholders.

“No Equity Issuance to Existing Shareholders in 2025-2027”

On May 9, 2025, DXG Corporation (HOSE: DXG) held its 2025 Annual General Meeting of Shareholders with a participation rate of 51.27% of the total outstanding shares as of 8:30 am.

“Investors Express Interest in Long-Term Partnership with BIG Post-Annual General Meeting”

The 2025 Annual General Meeting of Big Invest Group JSC (UPCoM: BIG) was arguably the most memorable event for shareholders since its listing on the stock exchange in early 2022. Aside from record-breaking growth figures, BIG garnered expressions of long-term commitment from numerous professional investors.

DGW to Pay Out $4.6 Million in Dividends in June

Digital World Joint Stock Company (HOSE: DGW) has just finalized its 2024 dividend payment plan, offering a 5% dividend rate (VND 500 per share). The ex-dividend date is set for May 23, with an expected payment date of June 4.