|

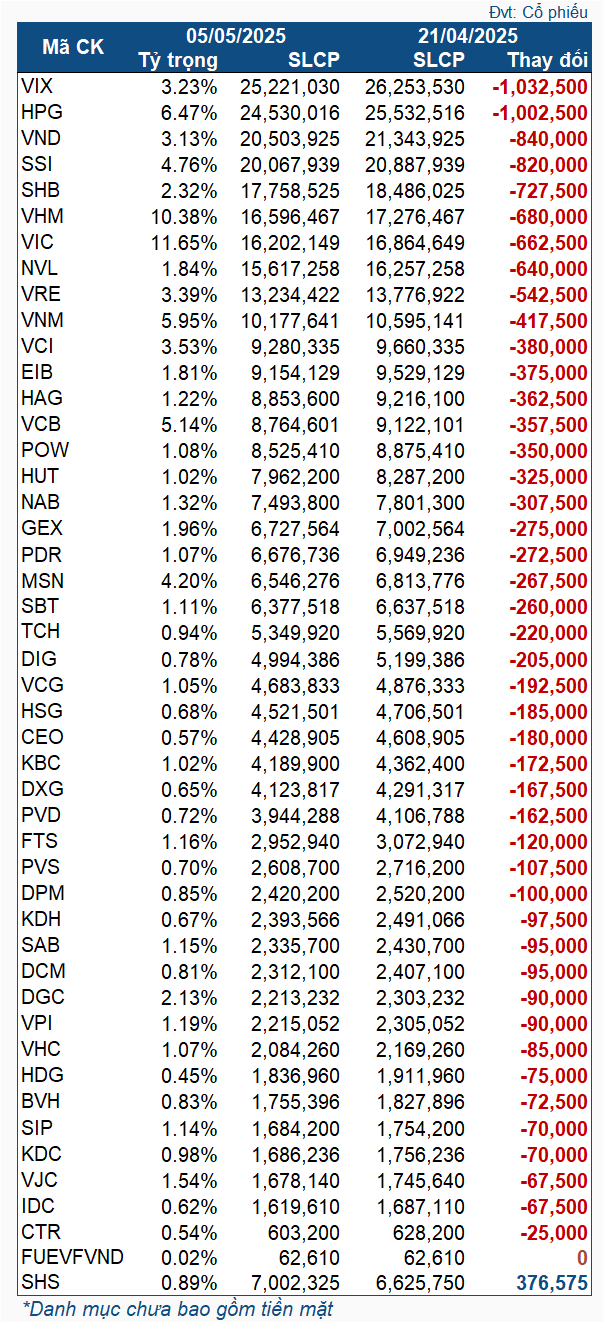

VNM ETF Stock Changes During the Period of 04/21-05/05/2025

|

Almost all the stocks in the VNM ETF portfolio experienced net selling. VIX and HPG remained at the top, with more than 1 million shares sold for each code. Following were VND, SSI, and SHB, with over 800,000, 700,000, and 600,000 shares sold, respectively. The two Vin stocks, VIC and VHM, also witnessed strong selling pressure, with 680,000 and nearly 663,000 shares sold, respectively.

Only SHS saw a positive change of 376,575 shares, likely due to two dividend and bonus issues with a total ratio of 10% from SHS. However, the actual increase was lower than the theoretical amount based on the above ratio, indicating that the Fund also sold SHS during this period.

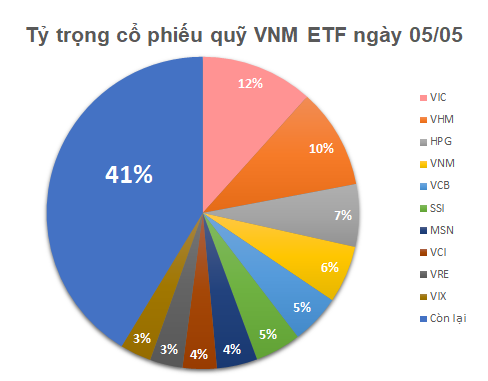

As of May 5, the total asset value of VNM ETF exceeded 375 million USD, a significant increase from the nearly 359 million USD recorded on April 21. These assets are allocated across 46 stocks, one fund certificate, and cash holdings. The top weights went to VIC (11.65%), VHM (10.38%), HPG (6.47%), VNM (5.95%), and VCB (5.14%).

– 08:00 05/08/2025

“Vietnam’s Largest Private Bank Prepares for an Imminent Cash Dividend Payout”

With a rate of 5% per par value (VND 500/share), the bank plans to allocate VND 3,967 billion for dividend distribution.

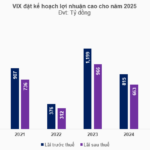

The Ultimate Guide to VIX’s Ambitious Plans: Targeting Billion-Dollar Profits with a Massive Share Offering of 73 Million.

The upcoming 2025 Annual General Meeting of VIX Securities Joint Stock Company (HOSE: VIX) is set to take place on the morning of May 23, 2025, with a packed agenda. Notably, the company plans to present its ambitious pre-tax profit target of VND 1,500 billion and a post-tax profit of VND 1,200 billion. Additionally, they will propose the issuance of nearly 73 million shares as dividends for the year 2024 and seek approval for changes to the board of directors, including the exemption and election of a new member.

The Hunt for Shark Money: Proprietary and Foreign Institutions Unite in Buying Spree, but Diverge on VIX

The April 18th session concluded with a net buying consensus from both proprietary securities companies and foreign investors, with respective figures of over VND 261 billion and VND 11 billion. VIX attracted attention as it was the top net buying stock for proprietary firms but led in foreign net selling.