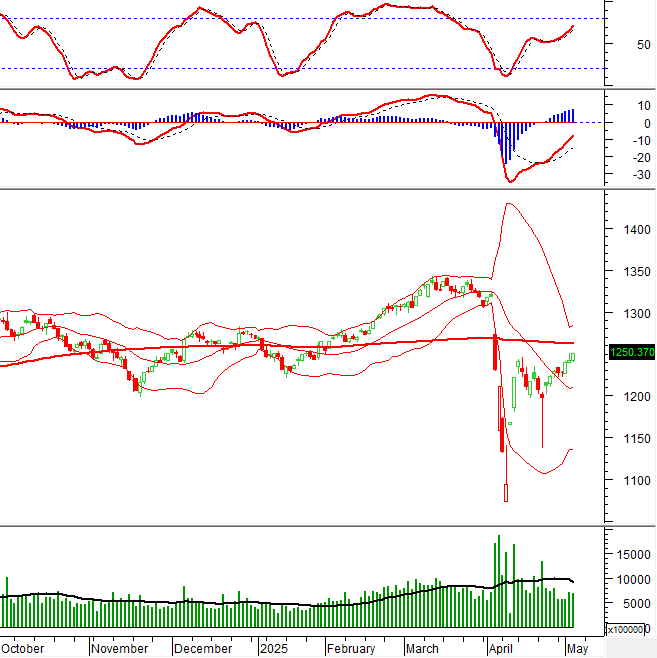

This positive momentum is an important driver for the VN-Index to aim for the next resistance level, the SMA 200-day moving average. Currently, the Stochastic Oscillator is trending upwards, providing a buy signal, while the MACD is likely to cross above the zero line. If this state is confirmed in the coming sessions, the short-term outlook remains optimistic.

I. MARKET ANALYSIS OF STOCK EXCHANGE ON 07/05/2025

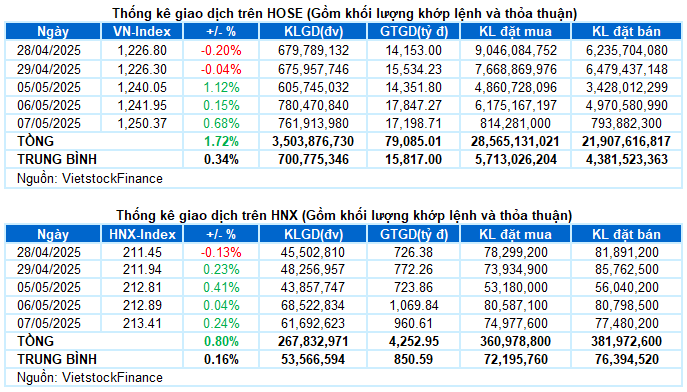

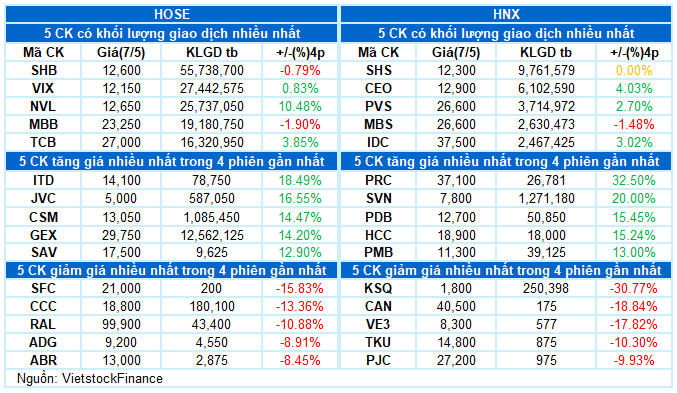

– The main indices posted gains during the trading session of 07/05. VN-Index rose by 0.68%, reaching 1,250.37 points; HNX-Index reached 213.41 points, up by 0.24%.

– Matching volume on the HOSE slightly decreased by 3.7%, reaching over 696 million units. Matching volume on the HNX reached nearly 59 million units, down by 10.3%.

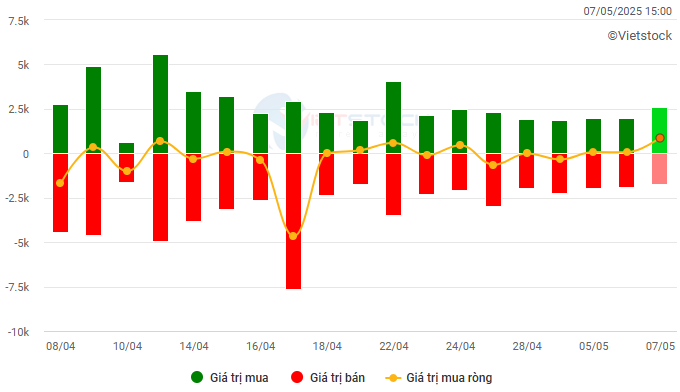

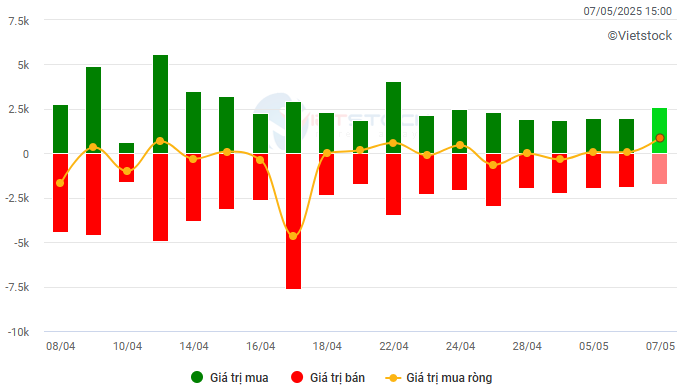

– Foreign investors continued net buying with a value of nearly VND 900 billion on the HOSE and over VND 4 billion on the HNX.

Trading value of foreign investors on the HOSE, HNX, and UPCOM. Unit: VND billion

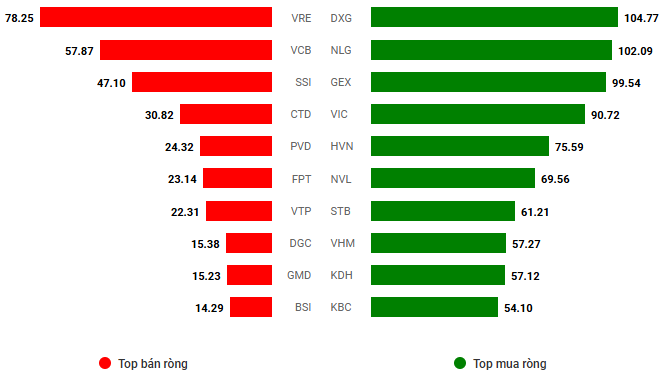

Net trading value by stock. Unit: VND billion

– The green color was maintained during the trading session of 07/05. Although the market showed significant signs of slowing down after the VN-Index approached the 1,250-point mark in the morning session, the strong leadership of the real estate group helped the index successfully conquer this threshold in the afternoon session. In addition, the net buying by foreign investors was also a notable highlight. At the close, the VN-Index closed at 1,250.37 points, up 0.68%.

– In terms of impact, the duo of VIC and VHM contributed the most, bringing nearly 4 points to the VN-Index. Following were BSR, HVN, and GVR, which also added a total of more than 2 points. Meanwhile, only MBB and MSN had a significant negative impact, taking away nearly 1 point from the overall index.

– VN30-Index increased by more than 5 points, reaching 1,324.8 points. However, the basket showed some divergence with 14 stocks rising, 11 falling, and 5 remaining unchanged. On the upside, VIC and BVH stood out with outstanding gains of 4.1% and 3.2%, respectively. Additionally, GVR, BCM, VHM, GAS, and LPB also attracted positive momentum, recording gains of over 1%. In contrast, selling pressure focused on MSN, HDB, SSI, MBB, and PLX as these stocks lost more than 1%.

In terms of sectors, the energy sector recorded the strongest gains, driven mainly by BSR, which hit the ceiling price, along with PVS (+1.14%), PVD (+1.11%), PVC (+2.25%), and PVB (+1.54%). However, the real estate group was the highlight of today’s session as they broke out strongly in the afternoon. In addition to VIC and VHM taking the lead, many other stocks also posted impressive gains, including DXG (+4.58%), NVL (+3.27%), KBC (+3.4%), PDR (+2.79%), DIG (+2.29%), KDH (+5.54%), HDC (+5.64%), and especially NLG, which also hit the ceiling price.

The utilities group also made positive gains with many stocks performing well, such as POW (+4.1%), GAS (+1.51%), NT2 (+3.58%), CLW (+5.14%), HND (+1.68%), and DTK (+7.44%).

On the other hand, the telecommunications group witnessed a broad correction, falling by 0.66%. The financial and consumer essentials groups also ended the session slightly in the red with mixed performances.

The VN-Index posted positive gains and surpassed the previous peak formed in mid-April 2025 (equivalent to 1,230-1,245 points). However, trading volume needs to surpass the 20-day average to further reinforce the upward momentum. This positive momentum is an important driver for the VN-Index to aim for the next resistance level, the SMA 200-day moving average.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – MACD likely to cross above the zero line

The VN-Index posted positive gains and surpassed the previous peak formed in mid-April 2025 (equivalent to 1,230-1,245 points). However, trading volume needs to increase above the 20-day average to further reinforce the upward trend. This positive momentum is crucial in pushing the VN-Index towards the next resistance level, the SMA 200-day moving average.

Currently, the Stochastic Oscillator is trending upwards, providing a buy signal, while the MACD is likely to cross above the zero line. If this state is confirmed in the upcoming sessions, the short-term outlook remains optimistic.

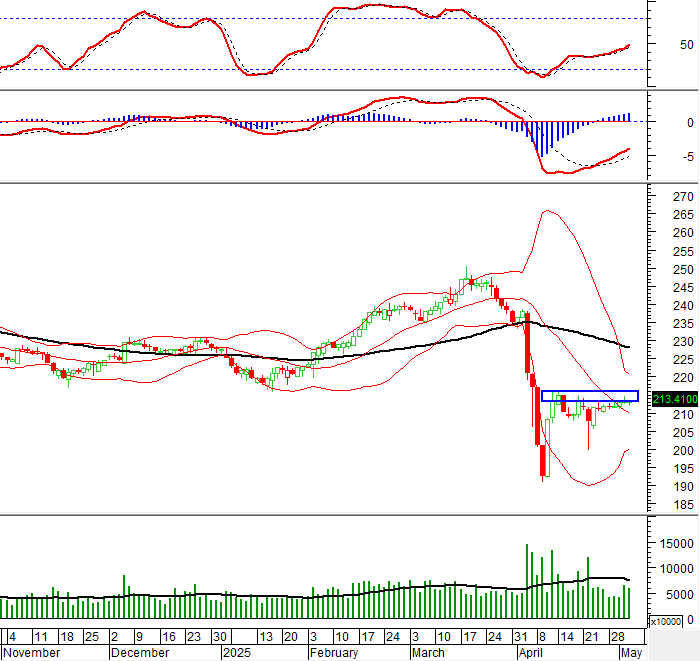

HNX-Index – Testing the April 2025 peak

The HNX-Index returned to a rising trajectory with four consecutive gaining sessions, testing the April 2025 peak (equivalent to the 213-216 range). However, the trading volume remains unconvincing as it stays at low levels. In the future, the index needs to break out of this range with a significant improvement in trading volume to sustain the upward trend.

Currently, the MACD and Stochastic Oscillator are trending upwards, providing buy signals. This indicates that the optimistic outlook in the short term will likely persist.

Analysis of Money Flow

Movement of smart money: The Negative Volume Index of the VN-Index crossed above the 20-day EMA. If this state continues in the next session, the risk of a sudden downturn (thrust down) will be limited.

Foreign capital flow: Foreign investors continued net buying during the trading session of 07/05/2025. If foreign investors maintain this action in the coming sessions, the situation will become even more optimistic.

III. MARKET STATISTICS ON 07/05/2025

Economic and Market Strategy Analysis Department, Vietstock Consulting and Research

– 17:08 07/05/2025

SSI Research: Positive Trade Negotiation Developments to Spur Market Recovery

The SSI Securities Analysis Department’s strategic report highlights the need for positive developments in trade negotiations to sustain the market’s recovery momentum. The current blended P/E ratio remains low, and the estimated one-year market yield is attractive compared to deposit interest rates.

Market Beat: VN-Index Sees Extended Tug-of-War as Caution Prevails

The market closed with the VN-Index down 2.5 points (-0.2%), settling at 1,267.3. The HNX-Index followed suit, dropping 1.08 points (-0.5%) to 214.13. The day’s trading saw a slight tilt towards decliners, with 396 stocks falling against 353 advancing. The VN30 basket mirrored this trend, showing a sea of red with 15 decliners, 8 gainers, and 7 stocks holding steady.

“VNDIRECT Research: Cautiously Awaiting the Outcome of Vietnam-US Trade Talks”

VNDIRECT Securities Analysis Unit (VNDIRECT Research) forecasts that the VN-Index will fluctuate between 1,230 and 1,520 points by the end of 2025, depending on three main scenarios. The outcome will hinge on the trade negotiations between the US and Vietnam, the number of Fed rate cuts, the State Bank’s interest rate management, and the results of the FTSE’s market classification review in September.

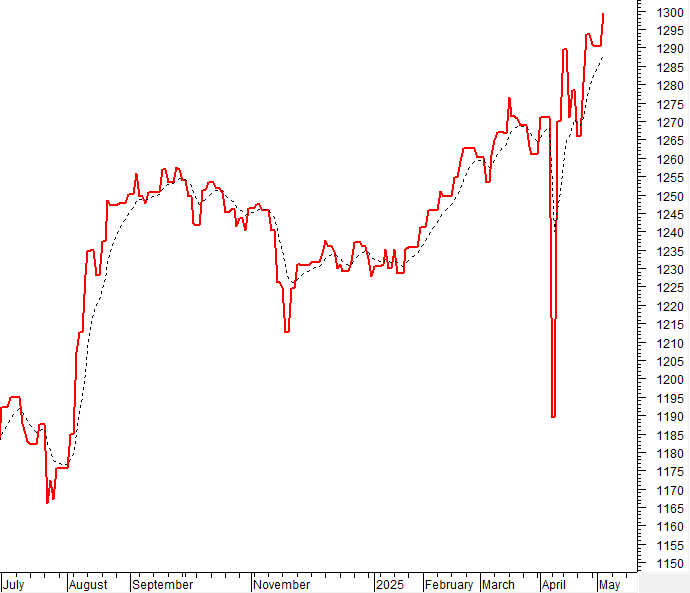

Stock Market Week May 5-9, 2025: Powerful Breakthrough

The VN-Index concluded a highly positive week of trading, recording gains in 4 out of 5 consecutive sessions and surpassing the 200-day SMA. The resumption of net foreign buying was a key factor in supporting this upward momentum. If this trend persists into the next week, coupled with stronger market participation, the VN-Index is poised to further consolidate and extend its gains.