Petrolimex Shares Surge Despite Quarterly Profit Dip

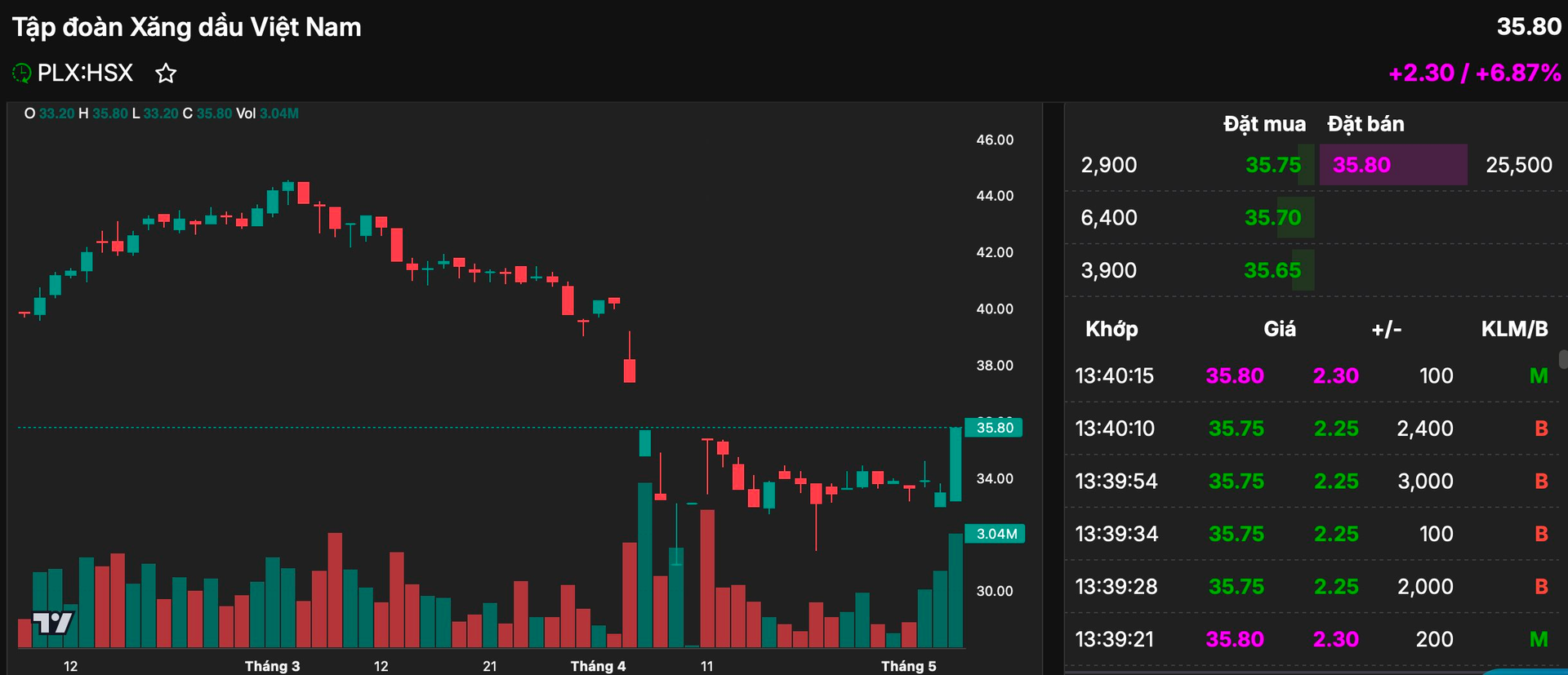

Shares of Vietnam National Petroleum Group (Petrolimex – code PLX) surged to the ceiling on May 8, 2025, reaching VND 35,800 per share, amid active trading. With a market capitalization of over VND 45 trillion, Petrolimex remains nearly 5% below its value at the start of the year.

Petrolimex’s share price performance

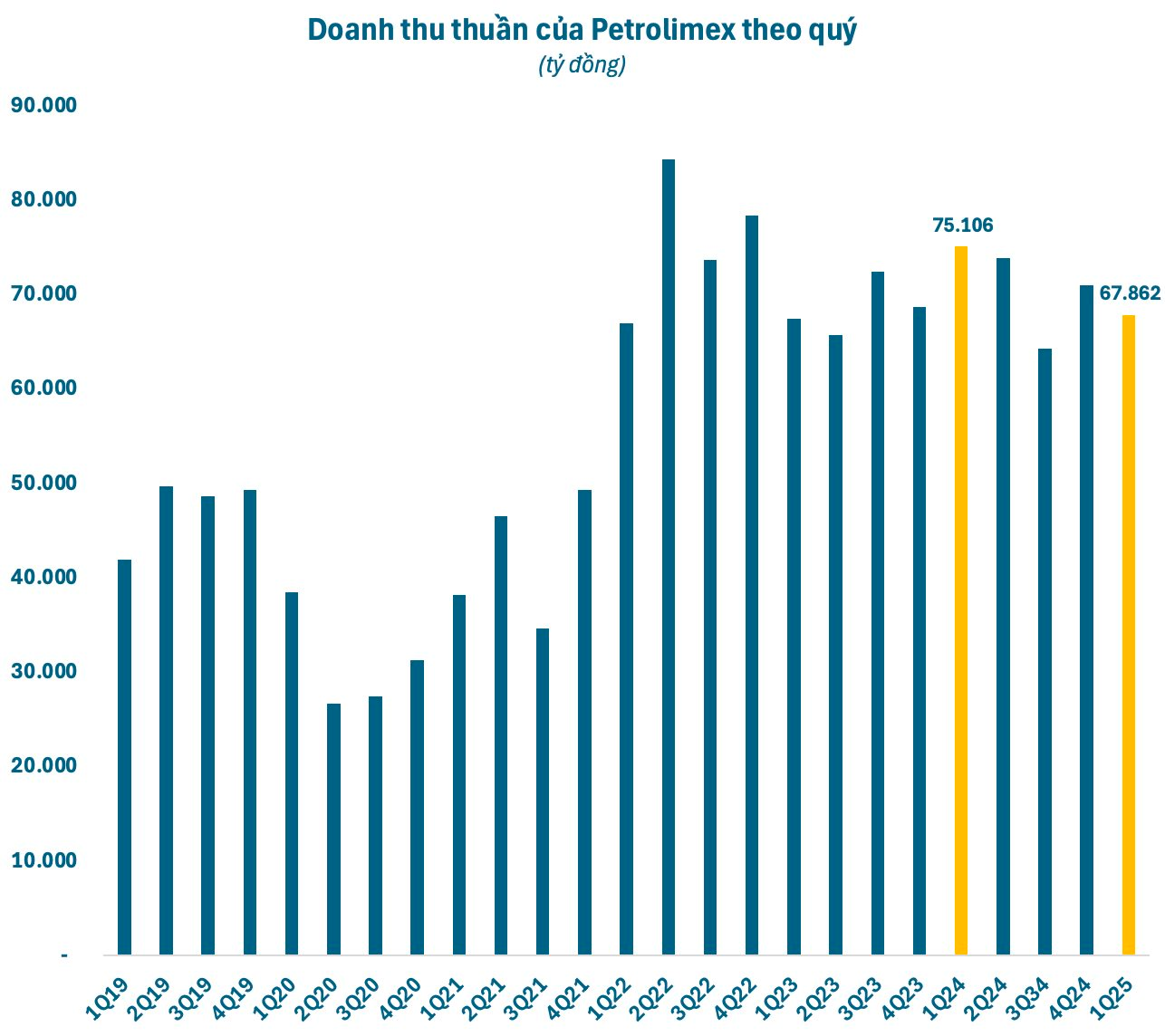

For the first quarter of 2025, Petrolimex recorded a revenue of nearly VND 67.9 trillion, a decrease of almost 10% compared to the same period in 2024. On average, the oil and gas giant earned VND 754 billion per day, nearly double that of Hoa Phat, The Gioi Di Dong, and Vietnam Airlines. Only Vingroup surpassed Petrolimex in terms of daily revenue on the stock exchange.

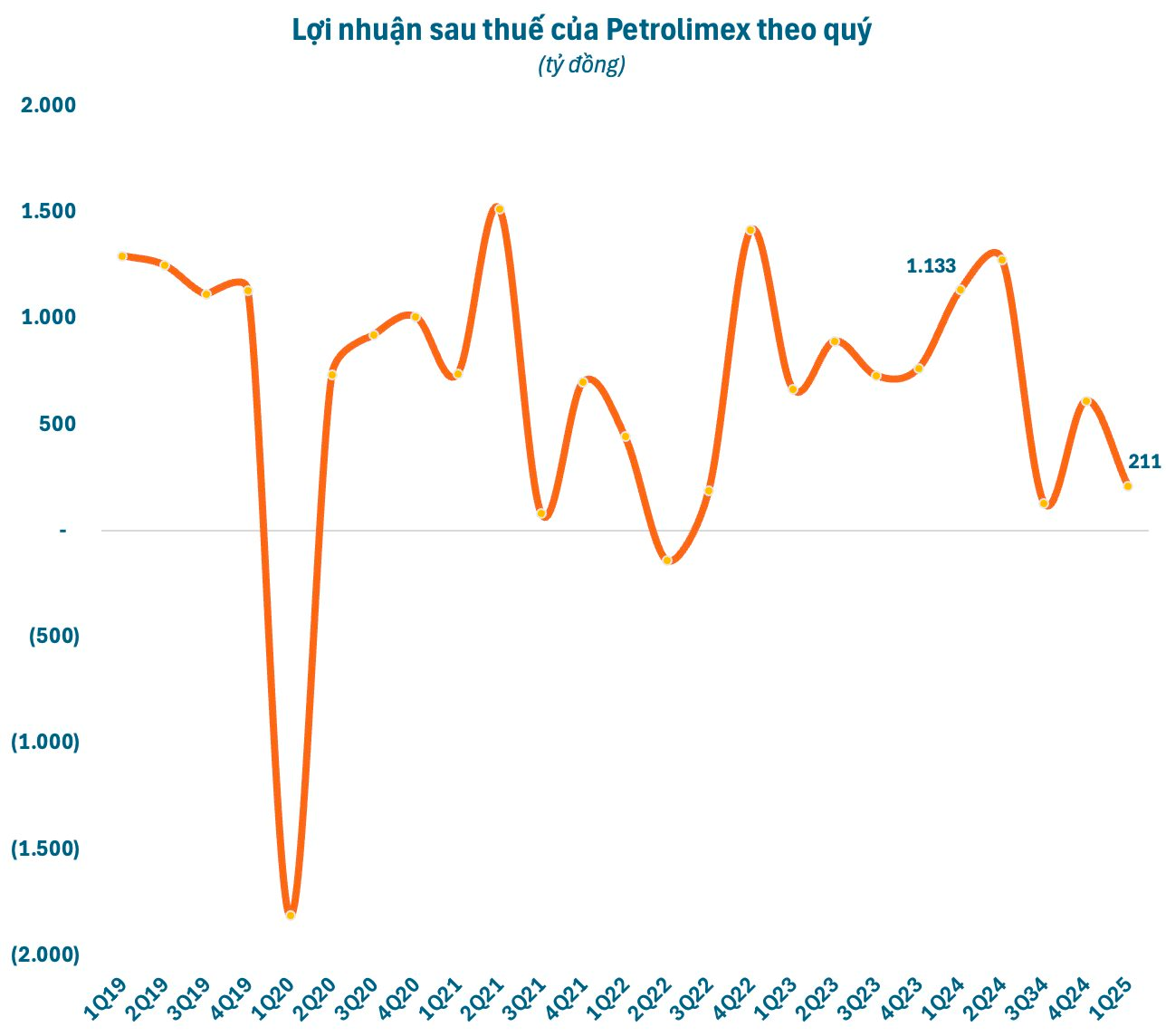

Despite the decline in revenue, selling and management expenses increased. As a result, Petrolimex’s after-tax profit fell 81% to VND 211 billion compared to the first quarter of 2024. This is the second-lowest profit in the past ten quarters for the retailer, slightly higher than the third quarter of 2024.

Petrolimex’s profit decline compared to Q1 2024

Petrolimex’s profit decline by segment

According to explanations, although the new decree on gasoline and oil business has not taken effect, business cost norms have increased according to the Ministry of Finance’s Official Dispatch No. 6808/BTC-QLG dated July 1, 2024, on announcing some norms in the base price of gasoline and oil. In addition, Petrolimex is the enterprise that is always assigned the largest source volume by the Ministry of Industry and Trade among 36 gasoline and oil trading enterprises.

Therefore, with the current oil price plunge, along with the lag in the gasoline and oil price adjustment cycle and exchange rate fluctuations, ensuring the largest source volume (from imported gasoline and oil and purchases from two domestic refineries) will cause Petrolimex’s 2025 profit to decrease. According to the 2025 allocation plan, Petrolimex must ensure a total minimum source volume of 11.939 million cubic meters, tons, which is many times higher than that of other gasoline and oil trading enterprises.

To cope with the predicted profit decline due to oil price volatility, oil and gas, and gasoline and oil enterprises are implementing a series of solutions, including closely monitoring market fluctuations for flexible business operations, drastically reducing operating costs, and streamlining the apparatus for more effective operations.

With a network of 5,500 stores nationwide, Petrolimex is Vietnam’s number one distributor and retailer of gasoline and oil, accounting for about 50% of the domestic market share. As of the first quarter of 2025, Petrolimex’s total assets stood at over VND 80 trillion, almost unchanged from the beginning of the year. The enterprise has over VND 30 trillion in cash and cash equivalents (cash, cash equivalents, and short-term deposits).

In another development, on May 6, the Ministry of Finance decided to temporarily suspend Mr. Dao Nam Hai, the state capital representative, a member of the Board of Directors and General Director of Petrolimex, from his position until the conclusion of the competent authority. At the same time, the Ministry temporarily assigned Mr. Pham Van Thanh, Head of the State Capital Representative Group, Chairman of the Board of Directors of Vietnam National Petroleum Group, to manage the state capital portion that Mr. Dao Nam Hai is holding.

“The Petrolimex and Pjico Partnership: A Review of Their Performance Under Mr. Dao Nam Hai’s Leadership.”

Prior to taking on the role of CEO at Petrolimex in March 2022, Mr. Hai served as the company’s Vice President for nearly five years and also held the position of CEO at PJICO Insurance for an extended period. With a strong background in leadership and a wealth of experience, he brings a fresh and dynamic perspective to the forefront of the industry.

HQC Shareholder Meeting: Halt 198-hectare Project with Hai Phat in Binh Thuan, Continue Seeking Land Opportunities for Social Housing with NVL.

HQC Chairman Truong Anh Tuan continued his “refrain” about the challenges that have prevented the company from achieving its goals for over a decade. The annual general meeting, held on the morning of May 10, 2025, saw lively discussions on addressing debts, implementing social housing projects, succession planning, and tackling ESG initiatives.

The Bank Stock Soars: Record-Breaking Trading Volume of Nearly 160 Million Shares

A deluge of capital inflows propelled trading volumes on this banking stock to record highs, marking a historic milestone since its listing.