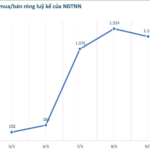

After a prolonged period of holding cash, SGI Capital’s Ballad Vietnam Growth Equity Fund has started to deploy its capital aggressively. Accordingly, the fund’s February 2025 report showed a cash and cash equivalents position of 45.2%, a significant decrease from the previous month’s 69.4%. By March, the fund’s cash position had further decreased to 36.3%.

And in April, the fund made a significant deployment, bringing its cash position down to just 7.1%. This is one of the rare occasions when this investment fund is fully invested.

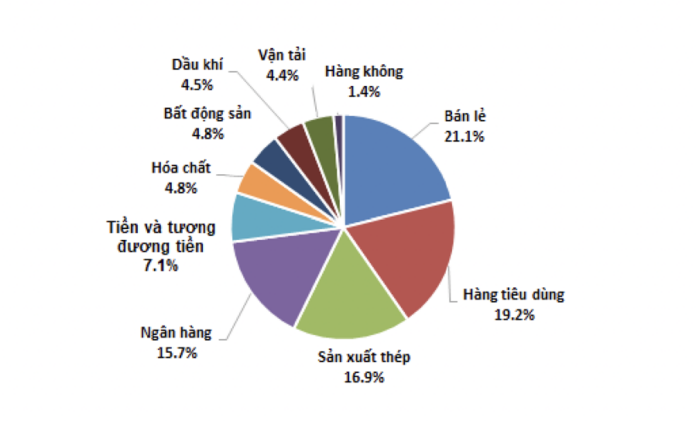

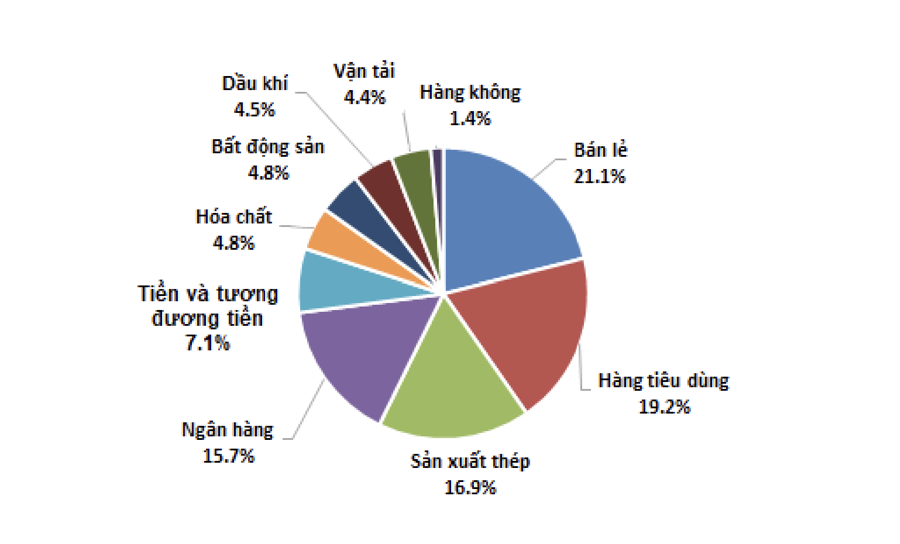

The fund’s portfolio is mainly focused on the retail sector with the largest allocation of 21.1%; followed by Consumer Goods at 19.2%; Steel Production at 16.9%; Banking at 15.7%; and Real Estate, Chemicals, Oil & Gas, Transportation, and Aviation. The 17 stocks in the portfolio include HPG with the largest weight of 16.94%; MWG second at 11.67%, and PNJ third at 9.44%. The remaining stocks are DGC, DXG, TCB, PVS, VIP, VPB, ACB, VNM, FMC, TLG, QNS, SAB, MBB, and ACV.

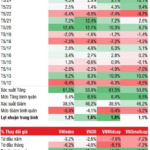

SGI Capital assesses that since April 2, 2025, when the US announced retaliatory tariffs that rocked global financial markets, stock markets have gradually recovered: the S&P is down only 1.8%, Germany’s DAX index has risen 0.47%, Japanese stocks are up 2.03%, China’s Shanghai Composite index is down just 2.12%, South Korea’s Kospi index is up 2.03%, and Vietnam’s VN-Index is the furthest from its peak at 6.95%.

The 90-day suspension of retaliatory tariffs, except for China, has helped stabilize financial markets and the ongoing negotiations are restoring market confidence in more reasonable tariff levels. As a result, businesses and consumers will adjust their investment and consumption plans and adapt to the new order.

Financial markets will also be able to quantify the impact of tariffs on different groups of businesses. SGI Capital maintains its base case scenario with an average tariff rate much lower than initially announced: for industries that are not a priority in the US (textiles, footwear, etc.): 10%-15%; and for industries that the US prioritizes for protection and promotes production: 20%-25%.

The continuous release of information on the prospects of negotiations with key trading partners on the US President and Treasury Secretary’s social media also indicates the pressure to finalize deals soon. Vietnam is currently among the six countries prioritized for negotiations and could finalize a deal within the next 1-2 months.

The US GDP decline of -0.3% in Q1 2025 came as a surprise and raised concerns about an impending recession. However, the main contributor to the GDP decline was a surge in imports to avoid tariffs. Other critical components, such as consumption and investment, remain strong. The most negative reaction from the stock market would be if the GDP decline were accompanied by a significant increase in unemployment, creating a downward spiral of reduced spending, decreased investment, and rising bankruptcies. These crucial indicators remain healthy and do not indicate an imminent risk of recession.

Market sentiment currently remains concerned about instability and expects inflation to rise due to high import tariffs. This could soon change as upcoming tariff agreements indicate that final tariff rates may not be too high, and the one-time impact on CPI may not be severe. Oil prices and some commodities and food prices are also falling, causing inflation measures to gradually approach the Fed’s 2% target.

The correlation of weak growth and declining inflation will open a new cycle of easing in the second half of 2025. The Fed may cut interest rates and halt QT in the June-July meetings. Major central banks like the ECB and BPoC have already taken the lead by starting to ease monetary policy to support their economies and financial markets.

With the current tariff scenario, analysts have started to lower the EPS growth forecast for US-listed companies to 8% for 2025. However, a potential Fed interest rate cut of around 1% by the end of the year could enable the US stock market to stabilize and maintain a less volatile price channel for the remainder of the year.

SGI Capital observes that the US Dollar Index has fallen 10% from its peak in early 2025, ending a four-year bull market since 2021. This period coincided with surging inflation, prompting the Fed to tighten monetary policy and maintain high-interest rates.

As the Fed ends QT and moves towards lowering interest rates, it could mark the beginning of a weaker US dollar era and a shift in global capital flows away from favoring US financial assets. This was a key reason for the record outflow of capital from emerging markets, including Vietnam, which experienced an outflow of $8 billion since 2021.

A Fed rate cut and a weaker US dollar are essential conditions for central banks worldwide to proactively manage their monetary policies. It may also attract FII capital back to emerging markets, initiating a phase of improved growth for global financial markets and economies, including Vietnam.

Regarding the domestic stock market, after three years, many listed companies continue to grow their profits and accumulate intrinsic value, but their stock prices do not reflect these changes. As a result, P/E and especially P/B ratios are now at historically low levels.

Essentially, market valuations have become much more attractive compared to past peaks of 1200. In investing, cheap valuations are a prerequisite for ensuring low risk and high returns. “The once-feared 1200 threshold of the VN-Index has now become a strong support level. Compared to other asset classes, stocks are once again becoming an investment channel with a more attractive risk/return correlation,” SGI Capital emphasizes.

The Great Tariff Tightrope: Strategies for Businesses to Navigate the Complex World of Tariffs.

The recent wave of import tariffs imposed by the US administration on China and a host of other countries is sending shockwaves through the business community. In Vietnam, large companies are realigning their operational and financial strategies to mitigate the risks that are beginning to spread.

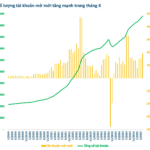

The Stock Market Shakes Things Up: Domestic Investors Rush to Open Accounts

“There has been a significant surge in the number of domestic investors opening securities accounts, marking the highest increase in an eight-month period. This surge comes amidst a volatile market, heavily influenced by external factors.”