Domestic and global gold prices are surging.

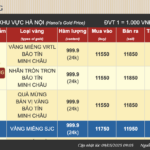

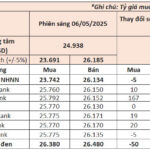

As of 1 pm (6/5), Saigon Jewelry Company listed SJC gold bar prices at 120.8 – 122.8 million VND per tael, a 3 million VND increase compared to the morning. Other gold businesses also adjusted the SJC gold bar price to 122.8 million VND per tael.

Domestic gold rings also saw a significant increase. Accordingly, Bao Tin Minh Chau Jewelry Company listed gold ring prices at 117.5 – 120.5 million VND per tael, a 2 million VND increase from the morning. Phu Quy Jewelry Group listed gold ring prices at 115 – 118 million VND per tael, a 1.5 million VND increase.

Gold prices in Vietnam surge for both gold bars and rings. Illustrative image.

Global gold prices also surged, reaching 3,383 USD per ounce, a 50 USD increase from the morning. From last night until now, global gold prices have increased by more than 130 USD per ounce. According to experts, the surge in global gold prices is mainly due to safe-haven demand and the weakening of the US dollar. The weaker dollar makes gold less expensive for buyers using other currencies.

Moreover, gold prices are also influenced by recent statements made by US President Donald Trump. Specifically, on May 4, President Trump announced a 100% import tax on all films produced abroad. This has raised concerns about the impact of the global trade war, as the US economy faces recessionary pressures.

What’s the gold price forecast for the coming days?

Jim Wyckoff, senior analyst at Kitco Metals, said: “We see safe-haven demand continuing to fuel gold’s rally. Gold prices will remain above the 3,000 USD mark, at least in the short term.”

Additionally, the market is awaiting the outcome of this week’s policy meeting of the US Federal Reserve (Fed). Jim Wyckoff predicts that the Fed will not adjust interest rates this time but wants to monitor whether the Fed’s outlook leans in any particular direction.

In reality, the Fed has kept interest rates at 4.25 – 4.5% since December 2024. Currently, the agency wants to wait for more data to assess the impact of President Trump’s unprecedented economic policies.

According to experts, safe-haven demand amid global instability has pushed gold prices up by 26% since the beginning of 2025. Gold prices have also repeatedly hit record highs, even reaching 3,500 USD at some points.

Goldman Sachs Bank (US) predicts that the surge in gold demand will also pull silver prices higher. However, gold’s increase will still outperform silver.

What does the World Gold Council forecast for gold prices?

According to WGC expert, gold prices could continue to rise in the coming months. Illustrative image.

According to the World Gold Council’s (WGC) report on gold demand trends for Q1/2025, total gold demand (including over-the-counter markets) was 1,206 tons, a 1% increase compared to the same period in 2024, amid record-high gold prices surpassing 3,000 USD per ounce.

Mr. Shaokai Fan, WGC’s Director for Central Banks and Public Policy, Asia-Pacific (excluding China), said that in the context of rising economic and geopolitical risks, investment demand for gold is expected to increase in investment channels such as exchange-traded funds (ETFs) and over-the-counter markets. Gold bars and coins may remain attractive, while demand for gold jewelry could remain weak due to high gold prices.

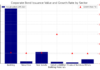

Overall, according to the WGC report, investment demand for gold bars and coins in the first three months of 2025 increased significantly compared to the same period last year in ASEAN markets. However, Vietnam was an exception, with gold investment demand falling by 15% year-on-year. According to the expert, this trend was influenced by limited supply of gold products, which pushed gold price spreads to high levels. Moreover, Q1/2024 saw the highest gold investment in a decade. In addition, the weak local currency further increased the USD-denominated gold price, affecting buyers’ affordability.

Ms. Louise Street, Senior Market Analyst at WGC, said that the global market had a volatile start to the year due to trade uncertainties and unpredictable policy announcements from the US.

The expert predicts that the overall economic picture will remain unpredictable, and this uncertainty could drive gold prices higher. As the volatile period continues, demand for gold as a safe-haven asset from institutions, individuals, and official sectors may increase in the coming months.

Reference sources: Reuters, Kitco, WGC

The Golden Rush: When Gold Prices Tumble

The gold market witnessed a dramatic turnaround on May 6th, with bullion prices plummeting by a staggering 1.1 million VND per tael during the afternoon session, following a sharp surge in the morning. This sudden reversal caught investors off guard, as the buy-sell spread widened significantly. However, gold jewelry prices remained resilient, showing no signs of fluctuation and maintaining their stability throughout the day’s volatile trading session.

The Golden Gamble: Speculation, Price Manipulation, and Profiteering in Vietnam’s Gold Market

The domestic and global gold price discrepancy can be attributed to speculation and price manipulation by certain individuals and businesses aiming to profit from the volatility.

The Golden Crash: When World Gold Prices Plummet and Bitcoin, Stocks Soar.

The gold price took a significant dip following US President Donald Trump’s announcement of a trade deal with the UK, sparking hopes of similar breakthroughs with other nations. Global stock markets, cryptocurrencies, and oil prices rebounded, indicating a shift towards a more positive investor sentiment.