At a recent seminar, Mr. Nguyen Quoc Hung, Vice Chairman and Secretary-General of the Banking Association, shared that as of December 31, 2024, the non-performing loan (NPL) ratio of the banking system, including potential bad debts, was estimated at approximately 5.46%, corresponding to a total bad debt amount of VND 1,030,000 billion – a significant figure. Of this, on-balance sheet bad debts amounted to VND 778,000 billion, VND 101,000 billion was sold to VAMC, and potential bad debts stood at VND 150,000 billion.

Notably, approximately VND 677,000 billion of bad debts have been handled using risk provisions and were written off the balance sheet, but the banks have not recovered this amount. According to Mr. Hung, many assets related to this debt cannot be processed due to legal disputes, and in some cases, even though the court’s decision has taken effect, it cannot be executed. Statistics from the Banking Association show that as of the end of 2024, there were about 446,000 related cases, with a debt recovery rate of only about 15%.

Mr. Hung also added that in the first two months of 2025, the total bad debt of the banking system increased by VND 34,000 billion, reaching VND 1,064,000 billion. On-balance sheet bad debts rose to VND 833,000 billion, VND 99,000 billion was sold to VAMC, and potential bad debts stood at VND 130,000 billion.

Additionally, there was about VND 63,000 billion of debt that was restructured under Circular 02, but as the circular has expired, this debt is still considered potential bad debt, bringing the total potential bad debt to about VND 193,000 billion.

According to Mr. Hung, a significant issue currently is that customers’ debt repayment awareness has not improved but has worsened, and they have become more sophisticated in evading their obligations. Over the past 5-6 years of handling bad debts under Resolution 42, many customers have tried to avoid handing over their assets, and if they do, they try to regain benefits, even creating more disputes to prolong the recovery process. For example, in Ho Chi Minh City, the number of related lawsuits has exceeded the court’s capacity, overburdening the judges.

Which bank has the highest NPL ratio?

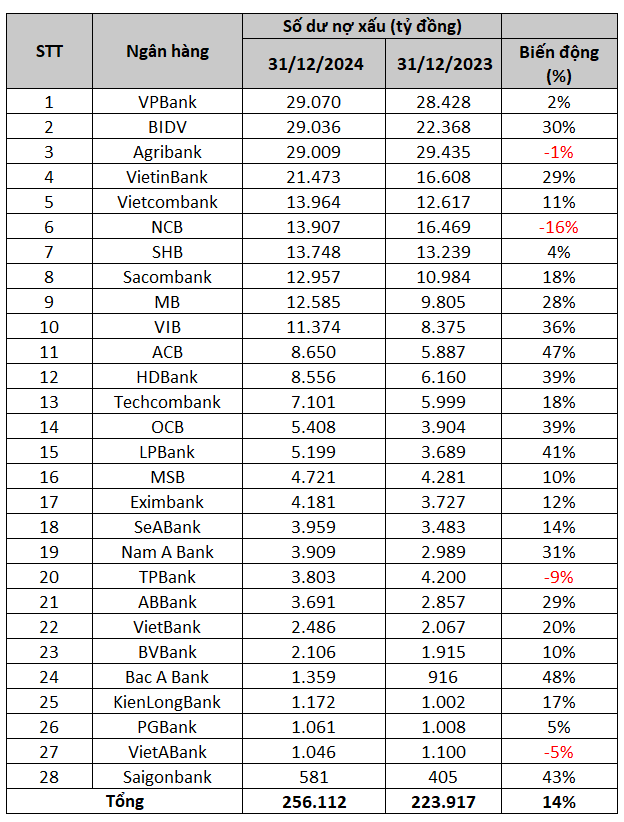

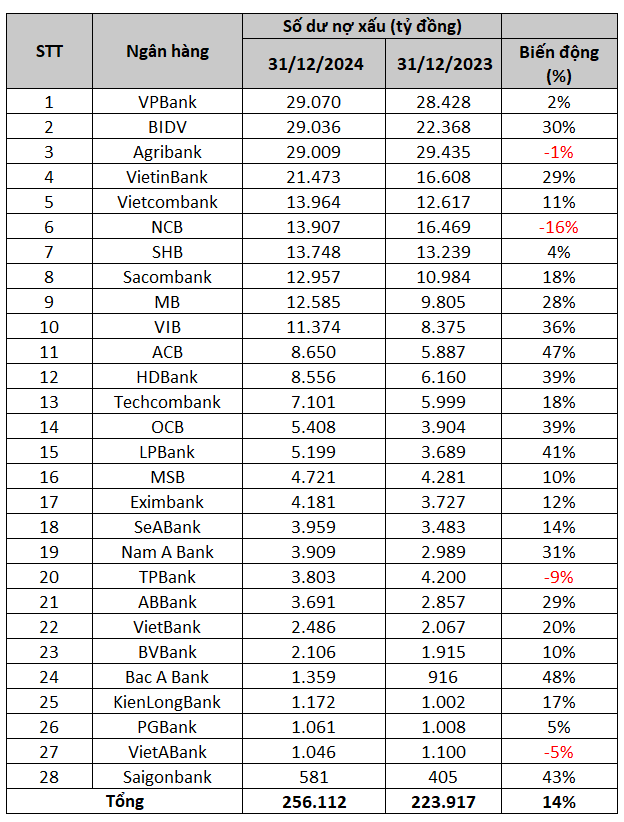

According to the financial statements of 27 banks listed on the stock exchange and Agribank as of the end of 2024, the NPL balance (from Group 3 to Group 5) was VND 256,112 billion, up 14% compared to the end of 2023.

Except for Agribank, NCB, VietABank, and TPBank, all other banks in the surveyed group experienced an increase in NPL balance compared to the end of 2023.

.

Although it increased compared to the end of 2023, the NPL balance of the banks tended to decrease compared to the end of Q3/2024. Accordingly, 21/27 banks on the stock exchange recorded a decrease in NPL balance compared to the end of September 2024, with NCB leading the reduction (down by VND 5,801 billion) followed by BIDV (down by VND 4,350 billion).

The big four banks and large joint-stock commercial banks (MB, ACB, Techcombank, and VPBank) all witnessed a decrease in NPL balance in Q4. As a result, compared to the beginning of the year, the NPL of some banks, such as VPBank and Vietcombank, increased by only 2% and 11%, respectively, much lower than the industry average.

The results of the business trend survey of credit institutions (CIs) in Q2/2025 recently published by the State Bank show that the overall risk level (MBRR) of all customer groups in Q1/2025 was assessed by CIs to have slightly increased compared to the previous quarter, higher than expected in the previous survey, and is forecast to continue to increase slightly in Q2/2025.

In particular, 26.3% of CIs assessed the overall risk of customers as “high” (24.5%) and “quite high” (1.8%). Contrary to the expectation of a decreasing MBRR in 2025 recorded in the previous survey, in this survey, CIs forecast that the MBRR of all customer groups would continue to “slightly increase” in 2025, but at a slower pace than in 2024. For 2026, CIs expect the MBRR to gradually decrease.

CIs assessed that the NPL ratio continued to decrease in Q1/2025 and was expected to decline further in Q2/2025, contrary to the “increase” assessment in the same period last year. In this survey, CIs adjusted downward the forecast for the bad debt ratio/credit balance as of the end of 2025 compared to the results recorded in the previous survey.

“Breaking News: Report on SCB Bank Submitted to Congress”

The State Bank of Vietnam has presented a report to the National Assembly, outlining a proposed restructuring plan for the Saigon Commercial Bank (SCB). In alignment with government resolutions, the State Bank is diligently refining the plan, which will be submitted to the appropriate authorities for approval.

Unlocking Profitability: MSB’s Strategic Cost-Cutting Measures Yield Fruitful Results, with Q1 Pre-Tax Profits Soaring to VND 1,631 Billion, a 7% Increase

In the recently released consolidated financial statements for the first quarter of 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) reported a remarkable performance with a pre-tax profit of nearly VND 1,631 billion, reflecting a 7% increase compared to the same period last year. This impressive growth can be attributed to the bank’s effective management of credit risk provisions.

“SCB Bank Restructuring Enters a Crucial Phase”

The State Bank is refining the restructuring plan for SCB and will submit it to the appropriate authorities for approval.