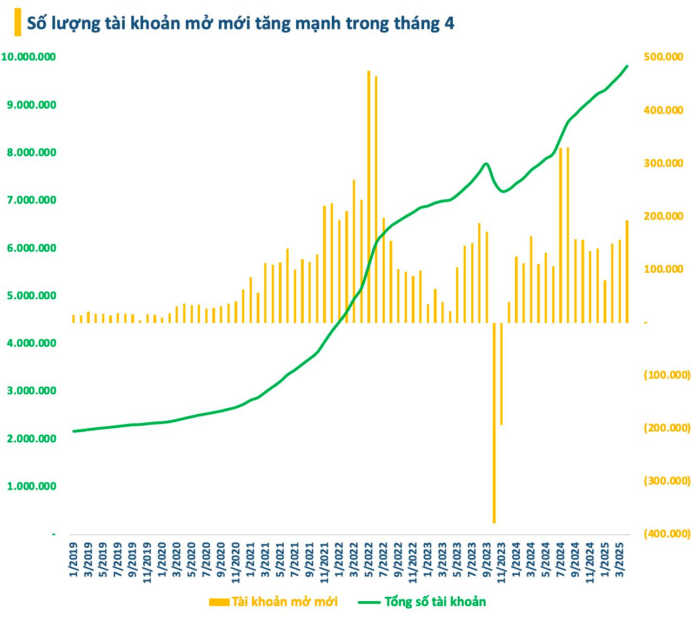

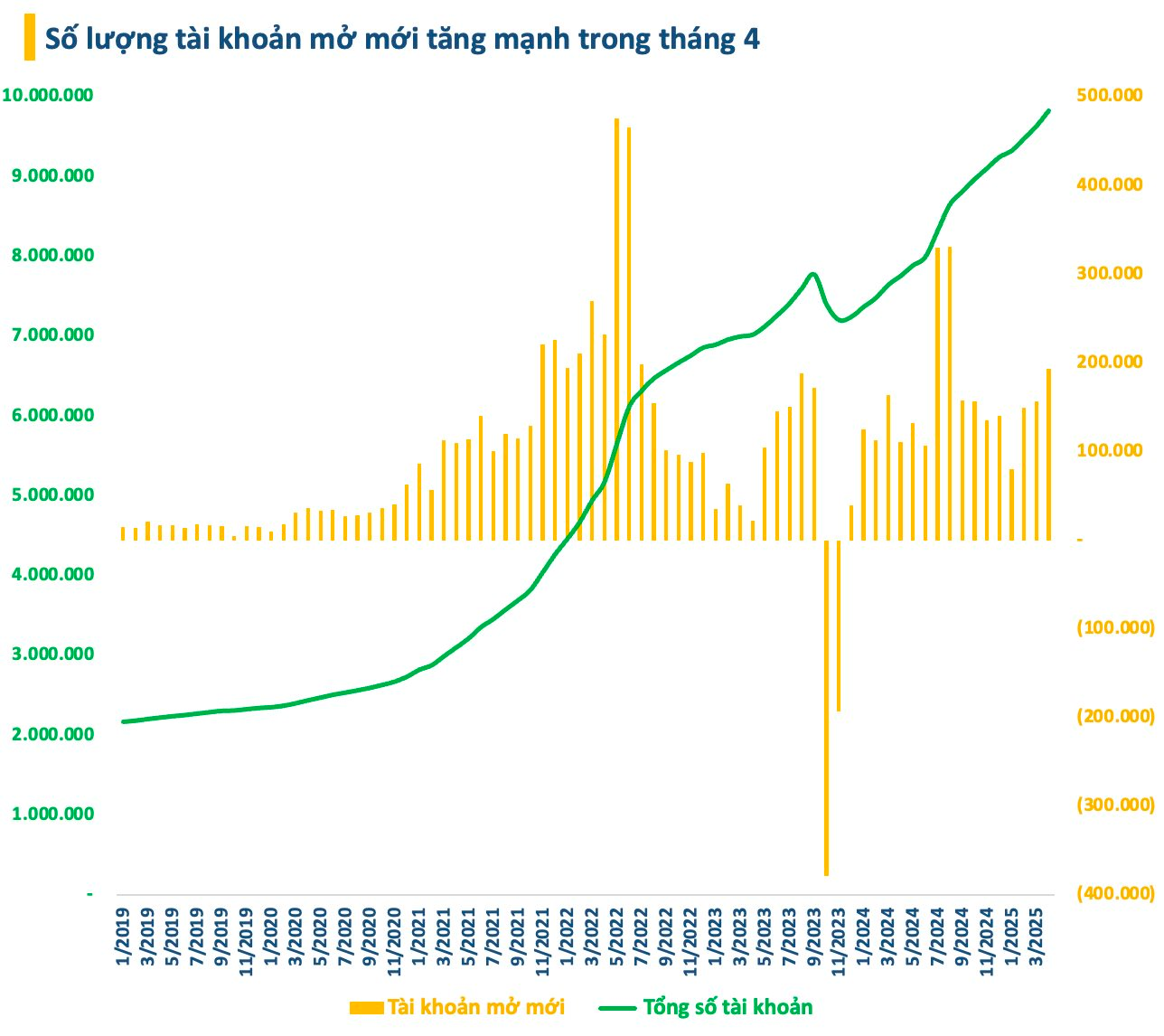

According to data from the Vietnam Securities Depository Center (VSD), the number of domestic investor accounts surged by over 194,000 in April 2025, a significant increase compared to the previous month and the highest in eight months. The newly opened accounts in April mainly belonged to individual investors, while there was also a notable rise in the number of institutional investors.

As of the end of April, the total number of domestic individual investor accounts stood at over 9.8 million, equivalent to nearly 10% of the country’s population, surpassing the target set for 2025 ahead of schedule and now aiming for 11 million accounts by 2030.

This surge in account openings occurred against a backdrop of volatile market conditions in April, influenced by external information flows. The VN-Index plummeted after the US first announced countervailing duties earlier in the month, even dipping below the 1,100-point mark. However, the market witnessed a swift recovery thanks to strong bottom-fishing demand and more positive news on the tariff front. Nonetheless, the VN-Index still closed April with a loss of over 6%.

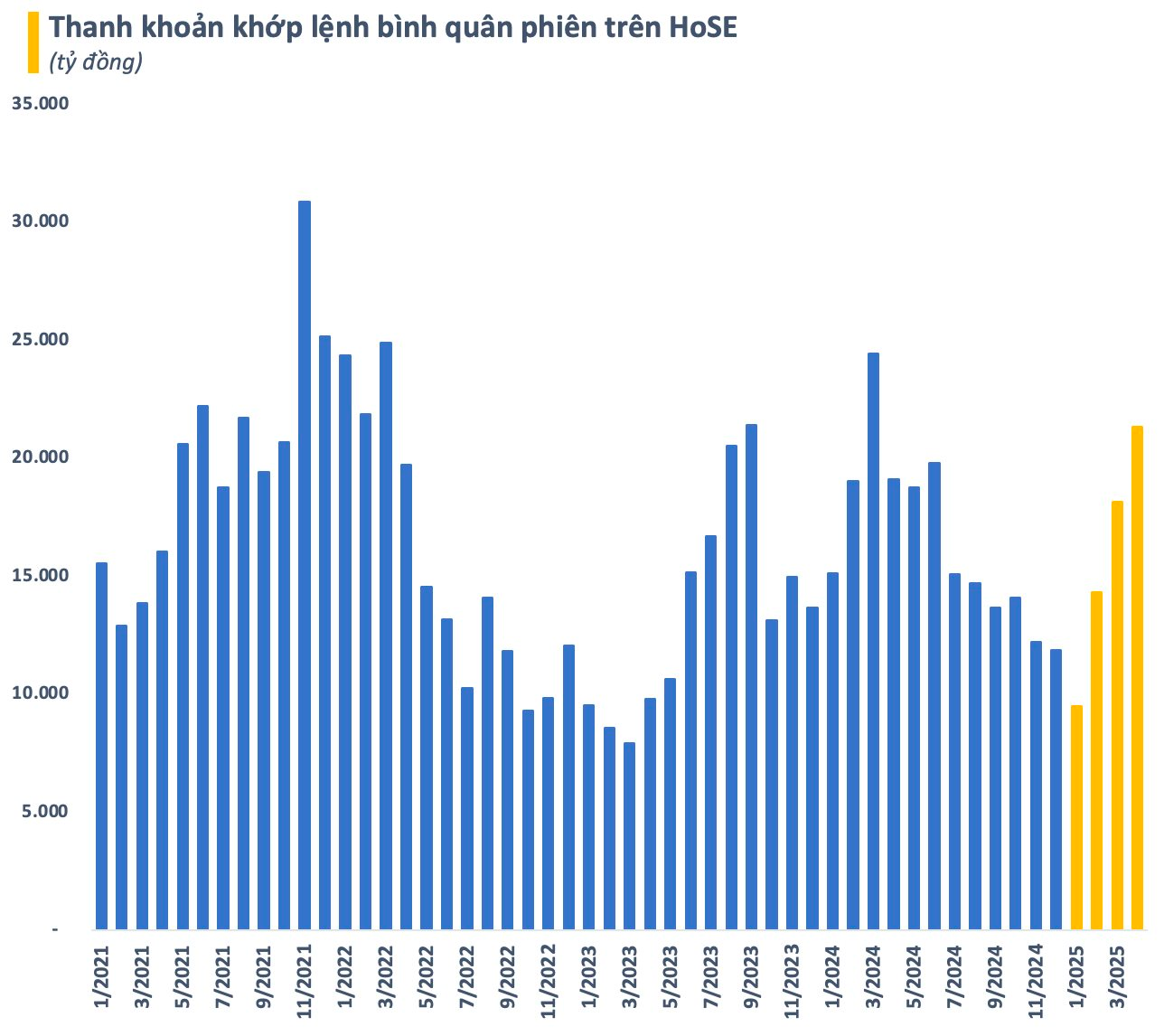

The market’s turbulence also led to a spike in liquidity. The average matching value on the HoSE in April exceeded VND 21,000 billion, up nearly 18% from the previous month and the highest in a year. “Force sell” activities and bottom-fishing money were the primary drivers of this surge in market liquidity.

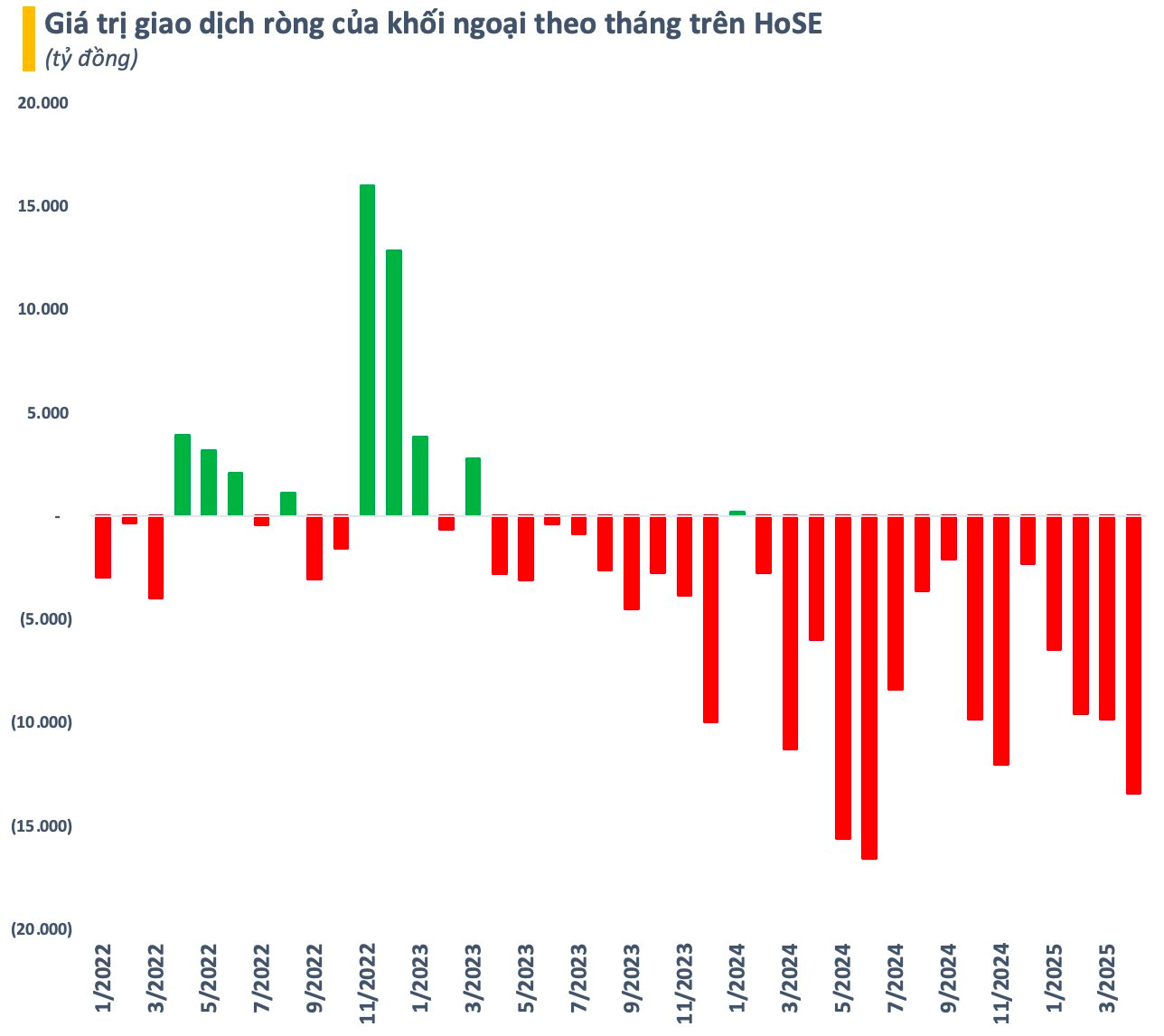

Vietnam’s stock market experienced intense selling pressure from foreign investors in April due to unfavorable external news. The net selling value on the HoSE exceeded VND 13,400 billion, bringing the total net selling value since the beginning of the year to over VND 39,000 billion (approximately USD 1.5 billion). This was the month with the strongest foreign net selling since mid-2024.

Notably, the number of foreign investor accounts in Vietnam unexpectedly decreased by 28, mainly attributed to individual investors. While individual investor accounts declined by 52, organizational investor accounts increased by only 26. As of the end of April, the total number of foreign investor accounts stood at 48,233.

The Pearl of Vietnam’s Stock Market: Vinpearl’s HoSE Listing Leaves Rivals in the Dust

With a valuation of approximately 128 trillion VND, Vinpearl has surpassed veteran brands such as Vinamilk, ACB Bank, and the Masan Group to become one of the top-capitalized companies on the Vietnamese stock exchange.

The Cash Flows In, Stock Markets Flourish

A surge of capital inflow, coupled with net foreign buying for the fourth consecutive session, has breathed new life into the stock market, painting a rosy picture for investors.