Illustration photo (Vietnam+)

|

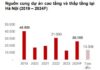

Experts predict that the real estate market in Q2 and throughout 2025 will be challenging to forecast, with both opportunities and challenges ahead. The real estate market is expected to undergo significant changes and be influenced by factors such as plans to reorganize and merge provinces and cities, streamline government management, and expedite public investment disbursements and the completion of key transport projects. However, the market’s recovery momentum continues, with residential real estate, particularly apartments that meet actual housing needs in large cities with convenient transportation, leading the way.

Mr. Luu Quang Tien, Deputy Director of the Institute for Economic-Financial-Real Estate Research of Dat Xanh (Dat Xanh Services – FERI), observes that instead of being “excited” about a new cycle, the real estate market is now in a calm state of observation and anticipation. However, as the real estate market has been “compressed” for a long time, there is a genuine impetus for “decompression,” and we can expect to see a continuous and increasingly positive improvement in the Vietnamese real estate market during this period and in the future.

Dat Xanh Services – FERI forecasts three growth scenarios for the real estate market in Q2 2025. The first and most optimistic scenario is an early market recovery. If new supply increases by 25-30%, floating interest rates remain at 8-10%, selling prices increase by 5-7%, and absorption rates reach 30-40%, this will be the most favorable outcome.

The second scenario expects new supply to increase by 20-25% with floating interest rates of 9-11%, selling prices to increase by 3-5%, and absorption rates to reach 25-30%. Dat Xanh Services – FERI experts consider this to be the most feasible scenario, reflecting the market’s improved and positive growth.

Additionally, the market is predicted to face challenges if new supply only increases by 15-20%, floating interest rates reach 10-12%, selling prices remain unchanged, and absorption rates reach 20-25%. While this scenario calls for caution, the experts at Dat Xanh Services – FERI find it reasonable given the market’s current “variables.”

Moreover, global economic factors are also expected to influence the real estate market. Specifically, in the macroeconomic context, the US tax policy is predicted to have far-reaching consequences for many economies, impacting domestic and foreign investment decisions. This will not only affect the overall economic growth rate but also the recovery of the real estate industry. Institutional changes will also impact the dynamics of the real estate market.

The market has witnessed active cooperation, M&A activities since the beginning of the year. Continuous portfolio restructuring has opened up more collaboration opportunities. However, FDI may face short-term interruptions due to US policies.

Among the various segments, industrial real estate is expected to be impacted by US President Donald Trump’s tax policy. This policy will significantly affect the global supply chain, with Vietnam being an ideal destination for capital flow, especially in manufacturing industries. Consequently, it will influence the demand for production floor space and the logistics industry. As a result, the plans of new industrial park projects by investors will be affected to some extent.

Given this context, the commercial real estate segment is anticipated to be less affected. Still, the potential reduction in business operations or market exit by some enterprises may lead to a short-term decrease in demand. Currently, only the retail sector is expected to remain relatively unaffected in the short term, as domestic consumption continues to grow positively.

Residential real estate is expected to continue its positive trajectory in Q2 2025. The residential real estate market is predicted to witness intense competition among major players across various markets and segments. However, challenges stemming from macroeconomic factors may impact investment flows and rental demands in the short and medium term…

Assessing the market dynamics, Ms. Trinh Thi Kim Lien, Director of Business at Dat Xanh Services, notes that after a “hot” period in Hanoi and some northern provinces and cities, investment capital is gradually shifting from the North to the South. However, real estate investment capital is becoming polarized. Customers with actual housing needs mainly focus on affordable housing with proper legal documentation.

“Caution still prevails in the market. It is hoped that the “compressed” state in Q1/2025 will be “released” in Q2/2025 as supply increases significantly, leading to improved consumption levels. Projects from reputable developers are expected to lead the demand,” shared Ms. Lien.

From a different perspective, Ms. Pham Thi Mien, Deputy Director of the Institute for Vietnam Real Estate Market Evaluation, suggests that the State Bank’s signal of “monetary loosening” and the government’s directive to maintain low-interest rates stimulate real estate demand not only from buyers but also from individual investors. This is because real estate remains an attractive investment channel with good profit potential and is a favored long-term asset storage option.

However, Ms. Mien also recommends caution, as the market’s vibrant recovery, thanks to legal policy solutions, is based on economic growth, robust infrastructure development, and stable low-interest rates. Still, there are risks related to the financial health of developers. Moreover, the supply-demand imbalance persists, posing challenges to people’s housing affordability, even with improved supply from numerous social housing projects. The real estate market continues its upward trajectory, with prices remaining high and unlikely to drop significantly, especially in central areas of major cities.

Nevertheless, the market’s price increase will slow down as more products meet actual housing needs and align with people’s purchasing power. Investment capital tends to flow to districts and rural areas, as city prices have already soared, leaving little room for further growth./.

– 09:20 05/05/2025

HQC Shareholder Meeting: Halt 198-hectare Project with Hai Phat in Binh Thuan, Continue Seeking Land Opportunities for Social Housing with NVL.

HQC Chairman Truong Anh Tuan continued his “refrain” about the challenges that have prevented the company from achieving its goals for over a decade. The annual general meeting, held on the morning of May 10, 2025, saw lively discussions on addressing debts, implementing social housing projects, succession planning, and tackling ESG initiatives.

“Patience is Key: ADTD Shareholders Refrain from Dividends, Awaiting Project Permits”

The sluggish market conditions in the real estate sector prompted HAR to focus on financial cost-cutting measures and refrain from paying dividends. While a significant portion of the company’s capital is tied up in uninitiated projects, the leadership assures that the permitting process is currently delayed and advises shareholders to “exercise patience.”

The Power of Perseverance: Shark Le Hung Anh’s Story of Overcoming Judgment and Achieving Success

“Two years ago, Shark Le Hung Anh’s statement about being a ‘lesser grey broker’ stirred up a frenzy in brokerage forums. Now, a story he shared about wearing broken sandals to buy a house and being ignored by brokers who assumed he couldn’t afford it has resurfaced and captured attention once again.”