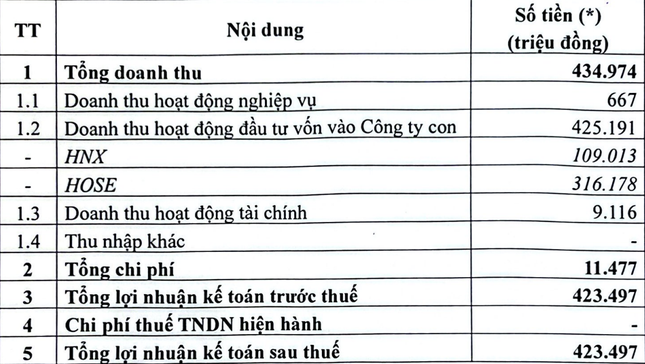

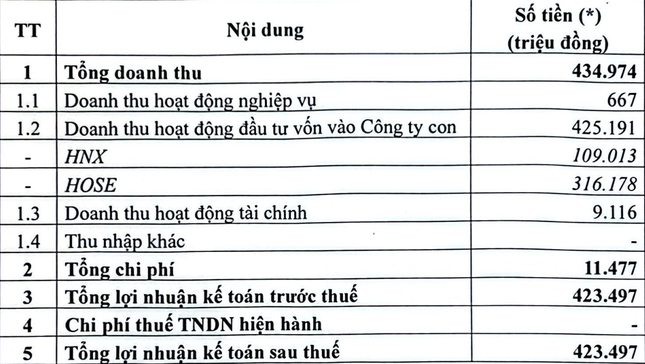

VNX announced its financial results for the first quarter, reporting a total revenue of nearly VND 435 billion and a net profit of VND 423 billion, both down 26% from the previous year. On average, VNX earned approximately VND 4.7 billion per day in the first quarter.

The majority of VNX’s revenue comes from its investments in subsidiary companies, with the Ho Chi Minh City Stock Exchange (HoSE) contributing VND 316 billion and the Hanoi Stock Exchange (HNX) contributing nearly VND 109 billion, down 30% and 12% respectively from the previous year. Financial revenue exceeded VND 9 billion, while business operations brought in VND 676 million.

VNX’s revenue primarily comes from investments in subsidiary companies.

VNX’s revenue sources are mainly from investments in stock exchanges, directly reflecting market performance.

The VN-Index ended the first quarter at 1,306 points, up 3.16% from the end of 2024. This is the lowest compared to the same period in the last three years. In the first quarter of last year, the VN-Index rose by an impressive 13.6%. Market liquidity in the first months of this year was also less vibrant compared to the previous year.

Previously, VNX had a profitable 2024, achieving a record high since the merger of HoSE and HNX. Despite a 33% decrease in revenue to VND 2,198 billion, VNX’s net profit still increased by 11% to VND 2,203 billion due to lower total expenses.

Established in late 2020 and officially operating from mid-2021, VNX is a limited liability company wholly owned by the State with a charter capital of VND 3,000 billion. It operates under a parent-subsidiary model, resulting from the restructuring of HoSE and HNX.

According to the roadmap for restructuring the stock market, after July 1st, HNX will no longer accept new listing applications, and all listing activities will be transferred to HoSE. By the end of 2026, the transfer of all stocks from HNX to HoSE will be completed.

Nearly 10% of the Population Have Securities Accounts

According to the Vietnam Securities Depository (VSDC), in April, domestic investors opened nearly 194,000 new securities accounts. As of April 30, more than 9.88 million accounts have been opened, equivalent to 9.8% of the population.

The number of new accounts surged amid strong fluctuations in the stock market. The VN-Index fell 6.16% from the previous month to 1,226 points, while liquidity surged nearly 20% from the previous month’s average. On average, more than VND 27,100 billion changed hands in each trading session, indicating active trading.