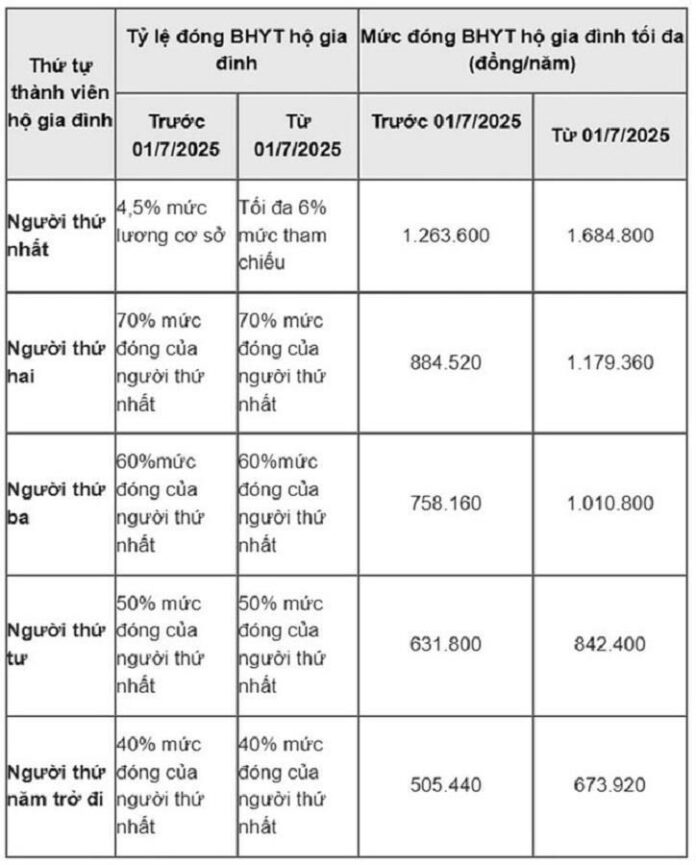

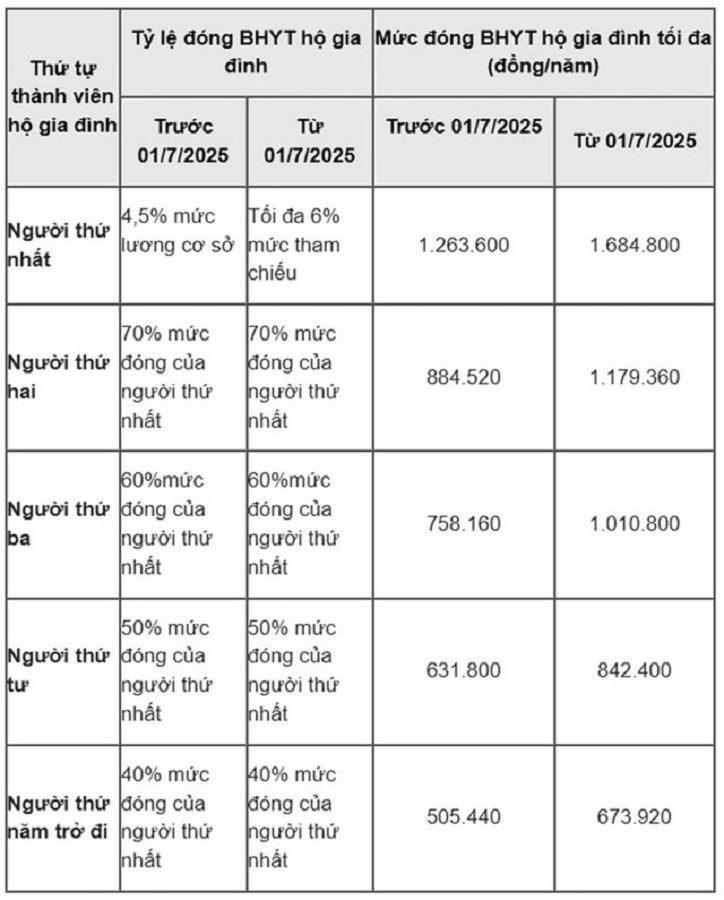

Article 1, Section 11 of the 2024 Health Insurance Law stipulates the contribution rate for the self-paying health insurance group, including family members, with a maximum of 6% of the reference rate.

Specifically, for family members participating in health insurance as a household in a fiscal year, the contribution rate shall be reduced as follows:

– The first person contributes a maximum of 6% of the reference rate;

– The second, third, and fourth persons contribute 70%, 60%, and 50%, respectively, of the first person’s contribution rate;

– From the fifth person onwards, the contribution rate is 40% of the first person’s rate.

The reference rate for health insurance is the amount of money used to calculate the contribution rate and benefits for certain participants and is decided by the government.

Starting July 1, 2025, the government will base its calculations on the reference rate instead of the current base salary.

Regarding the applicable reference rate when the Law takes effect, the 2024 Law on Amending and Supplementing the Health Insurance Law stipulates in Article 3, Section 5 on transition:

“The reference rate stipulated in the 2024 Health Insurance Law shall be applied according to the base salary rate. In case of changes in the salary policy, the Government shall decide on the specific reference rate.”

According to Resolution 159/2024/QH15 on the state budget estimate for 2025, the base salary remains at VND 2.34 million/month. Therefore, the reference rate applied from the effective date of the 2024 Health Insurance Law on July 1, 2025, is also VND 2.34 million.

According to current regulations in point e, clause 1, Article 7 of Decree No. 146/2018/ND-CP, the monthly health insurance contribution rate for a family is based on the base salary (VND 2.34 million/month). Accordingly:

– The first person contributes 4.5% of the base salary.

– The second, third, and fourth persons contribute 70%, 60%, and 50%, respectively, of the first person’s contribution rate.

– From the fifth person onwards, the contribution rate is 40% of the first person’s rate.

Thus, from July 1, 2025, there will be a change in the basis for household health insurance contributions (reference rate instead of base salary) and an increase in the maximum contribution rate for each family member.

Proposed Addition of Mandatory Health Insurance Coverage for Specific Individuals

As per the proposal from the Ministry of Health, individuals with employment contracts lasting for at least 1 month will be required to contribute to the health insurance scheme, instead of the current requirement of “3 months”.