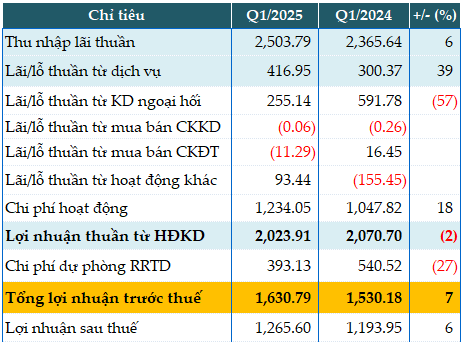

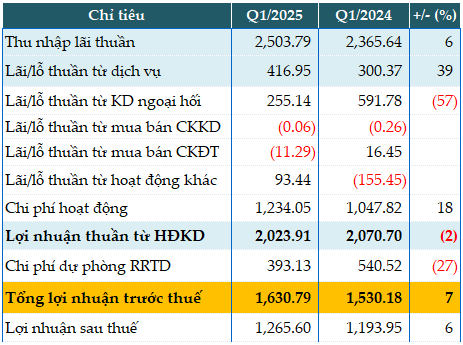

In Q1, MSB’s net interest income increased by 6% year-on-year to nearly VND 2,504 billion.

Notably, service income increased by 39% to nearly VND 417 billion, thanks to higher other income from services. Other operations also turned from loss to profit of over VND 93 billion.

In the quarter, the bank increased operating expenses by 18% to over VND 1,234 billion. As a result, profit from business activities decreased by 2% year-on-year to VND 2,024 billion.

The bank also reduced credit risk provisions by 27%, only allocating over VND 393 billion. Therefore, pre-tax profit reached nearly VND 1,631 billion, up 7%.

Compared to the pre-tax profit target of VND 8,000 billion for the whole year just approved by the AGM, MSB achieved 20% after the first quarter.

|

MSB’s Q1/2025 business results. Unit: Billion VND

Source: VietstockFinance

|

As of the end of Q1, the bank’s total assets decreased slightly by 2% to VND 314,727 billion. Specifically, deposits at the SBV decreased by 30% (to VND 3,869 billion), and deposits at other credit institutions decreased by 20% (to VND 43,229 billion).

Lending to customers increased by 9% to VND 192,345 billion. In particular, individual customer loans increased by 3%, corporate credit increased by 11%, mainly allocated to industries with low volatility such as transportation business, light industry and consumer goods trade, electronics production – telecommunications equipment… Corporate bond debt continued to decrease to over VND 700 billion from over VND 900 billion at the beginning of the year.

On the capital side, deposits and loans from the Government and SBV decreased by 45% (to VND 5,081 billion), deposits from other credit institutions decreased by 15% (to VND 51,003 billion), and customer deposits increased by 5% (VND 160,035 billion). The ratio of non-term deposits (CASA) accounted for 24.35% of total deposits.

The loan-to-deposit ratio (LDR) as of March 31 was 79.09%, the ratio of short-term capital for medium and long-term loans was 27.05%. MSB’s capital adequacy ratio (CAR) according to Basel II reached 12.25%.

|

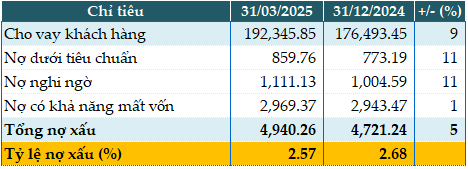

MSB’s loan quality as of 31/03/2025. Unit: Billion VND

Source: ViestockFinance

|

MSB’s total bad debt as of March 31, 2025 increased by only 5% compared to the beginning of the year, to VND 4,940 billion. Accordingly, the bad debt ratio/loan balance decreased from 2.68% at the beginning of the year to 2.57%. The individual bad debt ratio was at 1.88%.

Han Dong

– 15:58 28/04/2025

The Ultimate Guide to Captivating Copy: “Unleashing the Power of Words: Digiworld’s Generous Dividend Payout for 2024”

Digiworld plans to spend nearly VND 110 billion on dividends for the fiscal year 2024, offering a 5% payout ratio. The record date for shareholders to be eligible for this dividend is May 26, 2025.

“D2D Announces 2024 Cash Dividend Payout: A Whopping 84% Yield”

Industrial Urban Development Joint Stock Company (HOSE: D2D) is pleased to announce its latest cash dividend offering to shareholders. On May 22nd, the company declared an 84% dividend yield, equivalent to VND 8,400 per share, with the payment expected to be made on June 10th. This announcement marks an exciting opportunity for investors, showcasing the company’s commitment to returning value to its shareholders.