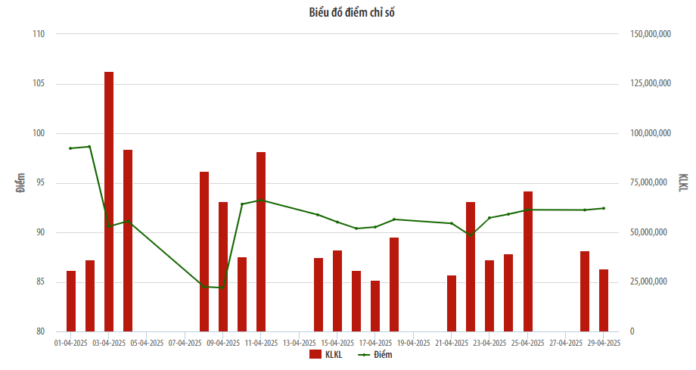

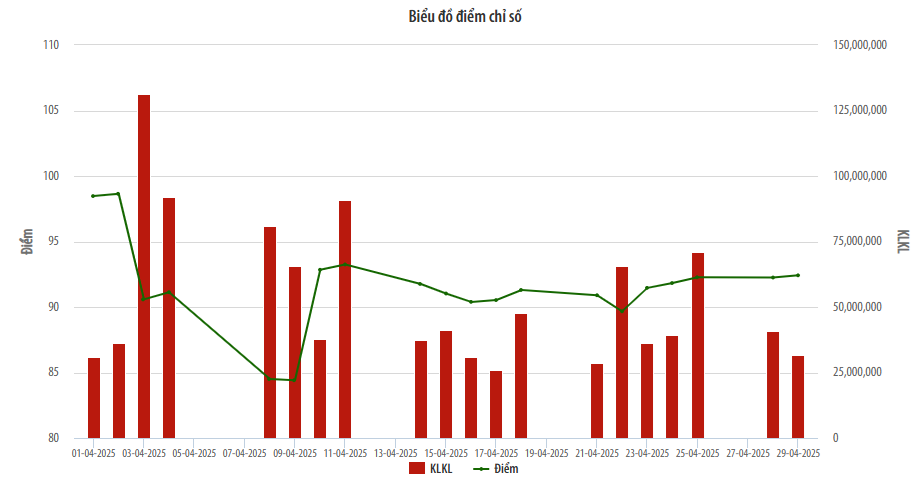

The UPCoM-Index closed the last trading session of the month at 92.42 points, a 6% decrease from the end of March. Average trading volume increased by 13%, reaching nearly 61.4 million shares per session, while the average trading value rose by 11%, surpassing VND 803 billion per session. The trading session on April 3rd witnessed the highest trading volume and value of the month, with 135.4 million shares and VND 1,775 billion, respectively.

Source: HNX

|

In terms of liquidity, HNG shares maintained their position as the most traded, with nearly 119 million shares, accounting for 9.7% of the total market. HNG shares have consistently demonstrated high liquidity in the UPCoM market over the past six months.

BVB shares climbed to the second position, accounting for nearly 6% of the market, with a trading volume of over 72.4 million shares. This was followed by SBS shares, which recorded a trading volume of more than 56.7 million shares, making up 4.6% of the market.

Regarding share prices, FRM witnessed the strongest increase, closing the month at VND 12,400 per share, reflecting a remarkable 202% surge compared to the previous month. TIN shares also displayed a significant upward trend, ending the month at VND 18,200 per share, marking a 105% increase. Additionally, CTX, CMM, and DCG were among the top gainers during the month.

Foreign investors’ trading value on UPCoM witnessed a substantial increase compared to the previous month, continuing the net selling trend with a value of over VND 657 billion. Their net selling position was evident, with sales of VND 1,299 billion and purchases of over VND 642 billion. ACV shares attracted the most foreign investment, with a trading volume of nearly 3.9 million shares (accounting for 23.3% of foreign investment), followed by HNG shares, with a volume of approximately 3.1 million shares (18.4%).

On the selling side, QNS remained the top choice for foreign investors’ divestment, with more than 8.7 million shares sold, accounting for 25.9% of the total market. OIL shares followed closely, with nearly 6.9 million shares sold, representing 20.4% of the market.

Self-trading by securities companies recorded a total trading value of nearly VND 428.2 billion, a 4% decrease from the previous month, with a net selling position of over VND 217 billion on UPCoM.

The UPCoM market witnessed the addition of three new registered businesses and the departure of one enterprise that delisted to move to the Ho Chi Minh Stock Exchange (HOSE). As of the end of April 2025, the UPCoM market hosted 888 enterprises, with a total registered trading value of over VND 534 trillion. The market capitalization stood at over VND 1.36 quadrillion at the end of the month, reflecting a 4% decrease compared to the previous month.

Huy Khai

– 15:32 09/05/2025

The Big Money Rush: Stocks Soar as VN-Index Recovers from Tariff Trauma

The lethargic morning trading pace took an unexpected turn within the first 15 minutes of the afternoon session. Leading stocks, notably FPT, witnessed a dramatic surge in volume, swiftly triggering a frenzied buying spree. HoSE’s afternoon matching volume skyrocketed by 66% compared to the morning session, with the VN-Index closing at its strongest gain in 16 sessions.

Stock Market Insights: Chasing the ‘Odd-Lot’ Money Trail

Today’s trading session witnessed a slowdown with declining liquidity and a preponderance of stocks in the red. The exuberant upward momentum observed yesterday was confined to a select few stocks, notably FPT and LPB. However, their capacity to spearhead a broader market rally is questionable, particularly as other leading stocks also exhibit signs of weakness.