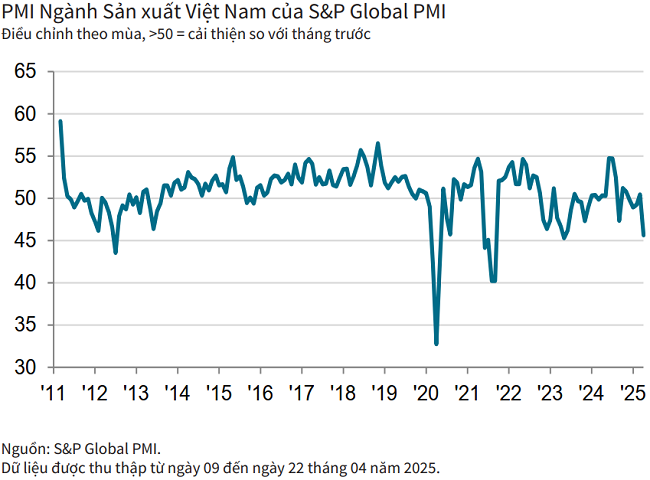

On May 5, 2025, S&P Global released the Vietnam Manufacturing Purchasing Managers’ Index (PMI) report for April 2025, highlighting three key points: a significant decline in output, new orders, and employment; business sentiment hitting a 44-month low; and a slowdown in input cost growth coupled with lower output charges.

FALL IN NEW ORDERS, BUSINESS SENTIMENT DIPS

According to S&P Global’s report, announcements of US tariffs caused a setback for Vietnam’s manufacturing sector in April. Output, new orders, employment, and purchasing activity all contracted sharply, while business sentiment fell to a 44-month low amid concerns about the future impact of tariffs on production. Faced with weak demand, companies continued to lower their selling prices, even as input costs rose marginally.

The Vietnam Manufacturing PMI fell below the 50.0 no-change mark in April, reversing the growth signaled in March, the first in four months. The latest reading of 45.6, down from 50.5 in March, indicated a marked deterioration in the health of the sector. In fact, business conditions worsened to the greatest extent since May 2023.

New orders received by Vietnamese manufacturers fell substantially in April, reversing the previous survey period’s expansion. Moreover, the rate of decline was sharp and the fastest in nearly two years. According to survey respondents, the decrease in new orders reflected the impact of the US tariff implementation and volatile international market conditions.

New export orders fell even faster than total new orders amid tariff announcements. The sixth consecutive monthly fall in new business from abroad was the steepest since June 2023.

The fall in new orders, coupled with tariff concerns, caused output to contract in April, reversing the previous month’s growth. The decline in production was substantial and the fastest since January 2023. Manufacturers also expressed worries about the impact of tariffs on future production. Business sentiment weakened considerably and was at its lowest since August 2021. In fact, the level of optimism was among the weakest recorded over the survey history.

WEAK DEMAND, INPUT COSTS CONTINUE TO RISE

The report from S&P Global also noted that backlogs of work decreased sharply as new orders fell, with the rate of reduction almost matching that of the previous month. Lower workloads led manufacturers to cut staff numbers, marking the seventh consecutive monthly reduction in employment. Furthermore, the rate of job shedding was the most pronounced in three and a half years.

Companies also significantly reduced their purchasing activity as new orders and output demands fell. Input buying decreased for the second month in a row, posting the steepest drop since May 2023. As a result, pre-production inventories also declined, with the rate of depletion being the most marked since last September.

According to the report, the decrease in input demand led to only a slight lengthening of suppliers’ delivery times during April, which was the least pronounced in eight months. However, there were some reports of delivery delays due to issues with the speed and availability of transportation.

Weak demand also affected prices in April. While input costs continued to rise amid higher prices for some raw materials, the rate of inflation was only marginal and the weakest since the current sequence of cost increases began in August 2023.

Some companies mentioned lower oil prices and transportation costs. Output charges declined for the fourth month in a row, and while only modest, the rate of reduction was the sharpest in 21 months.

Commenting on the survey results, Andrew Harker, Economics Director at S&P Global Market Intelligence, said: “The imposition of US tariffs pushed Vietnam’s manufacturing sector back into decline during April, with companies seeing sharp falls in new orders, exports, and output. Moreover, the potential for further disruption to the sector from additional tariffs caused business sentiment to drop to one of the lowest levels ever recorded.”

“Given this uncertain situation, it will be important to monitor the Vietnam Manufacturing PMI data over the coming months to see how business conditions evolve,” advised Mr. Harker.

“No Headaches Over US Tariffs: Optimism Abounds as Real Estate Rebounds”

With unwavering confidence, Mr. Le Duc Nghia, at the annual meeting held on May 8th, asserted that An Cuong Wood (HOSE: ACG) possesses the prowess to offset revenue losses from the American market. The wood company is expediting production to fulfill orders during the retaliatory tariff hiatus, with no intention of altering its business strategy.

Unlocking the Potential: Strategies for Vietnamese Textile Industry to Navigate Tariff Barriers and Seize Opportunities in the US Market

Amid the US-China trade war, Tran Nhu Tung, Chairman of the Board of Directors of Thanh Cong Textile Garment Investment Trading Joint Stock Company (HOSE: TCM), asserts that solving the traceability puzzle is key to Vietnam’s textile industry overcoming American tariff barriers. If successfully executed, Vietnam has a real opportunity to capture market share previously held by China in the US market.

The Billionaire’s Daughter: A $41 Million Rescue Mission for Her Father’s Struggling Empire

“With an astute eye for investment, Ms. Hoang Anh has just made a significant move in the stock market. She has purchased an impressive 4 million HAG shares, a bold decision that has caught the attention of the financial world.”

“Vietnam’s Manufacturing Sector Loses Momentum in Late 2024”

The Vietnamese manufacturing sector faced headwinds in the final month of 2024, as the Purchasing Managers’ Index (PMI) dipped from 50.8 in November to 49.8 in December, slipping below the 50-point threshold for the first time in three months. This indicates a mild deterioration in business conditions, presenting a challenging landscape for the industry as the year drew to a close.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)