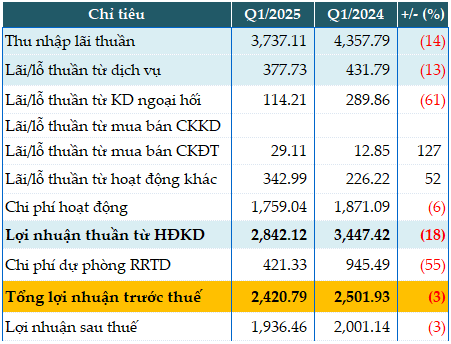

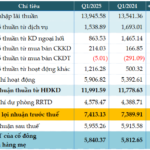

VIB’s net interest income for the first quarter reached over VND 3,737 billion, a 14% decrease year-on-year due to increased interest expense on deposits. The net interest margin (NIM) stood at 3.6%.

Service income amounted to nearly VND 378 billion, a 13% drop, as a result of higher expenses for payment services and agency commissions.

Foreign exchange trading income witnessed a 61% decline to VND 114 billion, attributable to reduced profits from currency-related financial instruments.

On the other hand, investment securities trading income surged to nearly VND 29 billion, more than doubling compared to the same period last year.

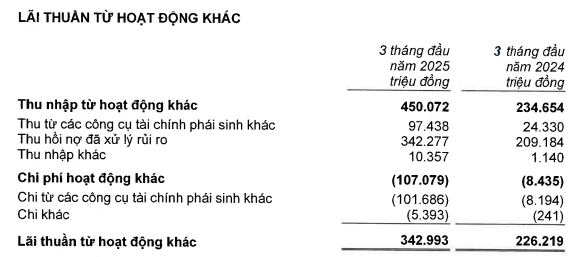

Other income also saw a significant 52% increase, reaching nearly VND 343 billion, mainly due to the recovery of previously written-off bad debts totaling VND 342 billion, a 64% jump.

Operating expenses were trimmed by 6% to over VND 1,759 billion. Consequently, profit from operations decreased by 18% to VND 2,842 billion.

During the quarter, the Bank reduced its credit loss allowance by 55%, allocating just over VND 421 billion thanks to prudent provisioning in the previous period. Thus, pre-tax profit neared VND 2,421 billion, a slight 3% dip year-on-year.

With a full-year pre-tax profit target of VND 11,020 billion, VIB has accomplished 22% of its plan in the first three months.

|

VIB’s Q1/2025 Financial Results in trillion VND

Source: VietstockFinance

|

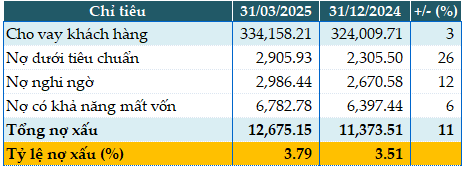

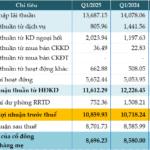

As of the end of the first quarter, the Bank’s total assets grew slightly by 1% from the beginning of the year to VND 495,727 billion. While deposits with the State Bank of Vietnam decreased by 42% (to VND 5,716 billion) and placements with other credit institutions fell by 14% (to VND 43,029 billion), loans to customers rose by 3% to VND 334,158 billion. This growth was evenly distributed across retail, SME, corporate, and financial institution segments, with the retail lending ratio maintained at nearly 80%.

Government and SBV deposits and borrowings also declined by 68% from the beginning of the year to VND 5,897 billion. Conversely, deposits from other credit institutions climbed by 8% to VND 101,767 billion, and securities increased by 11% to VND 25,800 billion. Customer deposits inched up by 2% to VND 282,298 billion, driven primarily by retail deposits, which accounted for over 70%. CASA experienced a notable 17% increase.

The Bank’s capital adequacy ratio (CAR) under Basel II stood at 11.8%, while the loan-to-deposit ratio (LDR) was 75%. The net stable funding ratio (NSFR) under Basel III was 115%, and the ratio of short-term funding for medium and long-term loans was 23%.

As of March 31, 2025, total non-performing loans (NPLs) increased by 11% from the beginning of the year to VND 12,675 billion, pushing the NPL ratio up slightly from 3.51% to 3.79%. VIB’s standalone NPL ratio was approximately 2.68%.

|

VIB’s Loan Quality as of March 31, 2025, in trillion VND

Source: VietstockFinance

|

– 3:28 PM, April 29, 2025

“Boosting Pre-Tax Profits: Bac A Bank’s Strategic Focus Yields 8% Growth in Q1”

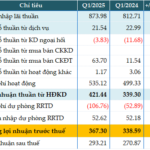

“Bac A Bank, a leading joint-stock commercial bank in Vietnam, has announced its consolidated profit for the first quarter of 2025. The bank reported a remarkable consolidated profit of over VND 367 billion, reflecting an impressive 8% increase compared to the same period last year. This significant growth showcases the bank’s strong performance and continued financial success.”

“VietinBank Reports Over VND 2,000 Billion in Other Operating Income, Boosting Q1 2025 Pre-Tax Profit by 10%”

In the recently released consolidated financial statements for the first quarter of 2025, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank, HOSE: CTG) reported a remarkable performance with a profit before tax of over VND 6,823 billion, reflecting a 10% increase compared to the same period last year.

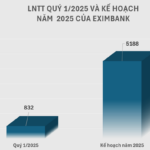

“A Profitable Quarter: Eximbank’s Pre-Tax Profits Soar by 26% in Q1 2025”

The first quarter of 2025 painted a diverse picture of profits in the banking industry, with a notable performance gap between private and large banks. While the big players maintained their steady growth trajectory, a few private banks, including Eximbank, stood out with impressive double-digit profit increases. This development underscores the evolving landscape of the banking sector, where smaller institutions are making their mark and challenging the traditional dominance of industry giants.

“Vietcombank Reports Flat Profit in Q1 2025 Despite Significant Cut in Provisions”

In the first quarter of 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, known as Vietcombank (HOSE: VCB), reported a slight increase in pre-tax profits, reaching nearly VND 10,860 billion, a 1% rise compared to the same period last year. This positive result is attributed to a significant reduction in provision for risks.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)