Vietnam-based Vicostone JSC (VCS on HNX) recently released its consolidated financial report for Q1 2025, revealing a 5.2% year-on-year decline in revenue to over VND 1,018 billion.

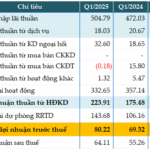

Gross profit for the quarter stood at nearly VND 245.9 billion, a 15.1% dip compared to the same period last year, after deducting cost of goods sold amounting to nearly VND 772.2 billion.

Financial income for the period rose by 26% year-on-year to over VND 23.4 billion, while financial expenses also increased by 19.2%, totaling more than VND 13.7 billion.

Selling and management expenses followed a similar upward trajectory, with selling expenses climbing 15.1% to nearly VND 43.6 billion, and management expenses inching up to over VND 14 billion.

Illustrative image

Vicostone’s pre-tax accounting profit for the quarter reached over VND 196.2 billion, a decrease of 19.5% compared to the previous year. After accounting for various taxes and fees, the company posted a net profit of nearly VND 164.6 billion, reflecting a 19.6% year-on-year drop.

For the full year 2025, Vicostone has set ambitious targets, aiming for a consolidated revenue of VND 4,719 billion and a pre-tax profit of VND 975 billion, which would represent increases of 9.2% and 2.3%, respectively, over the 2024 financial results.

With the conclusion of Q1 2025, Vicostone has accomplished 21.6% of its revenue target and 20.1% of its pre-tax profit goal.

As of March 31, 2025, Vicostone’s total assets showed a slight increase from the beginning of the year, reaching over VND 6,470.4 billion. Cash and cash equivalents stood at nearly VND 1,772.9 billion, a 12% rise, and accounted for 27.4% of total assets.

Additionally, the company held maturity-dated investments, including a 6-month term deposit in a commercial bank worth VND 768 billion, making up 11.9% of total assets. Inventory levels decreased by 11.5% to over VND 1,641.3 billion, constituting 25.4% of total assets.

On the liabilities side of the balance sheet, total liabilities decreased by 10.5% from the start of the year to nearly VND 1,214.8 billion. Borrowings and finance lease obligations accounted for the majority of this figure, totaling nearly VND 1,005.8 billion, or 82.8% of total liabilities.

“Consumer Credit: Investment Opportunities Arising from the Easing Trend”

In the context of expected consumer recovery, the regulatory adjustments for credit management offer a promising path for consumer finance companies, and by extension, a potential profit recovery for retail-focused banks. With bank stock valuations at a low point, this presents an opportune investment landscape for 2025.

The Power of Nuclear Energy: Unlocking the Essential Element.

“The development of nuclear power in Vietnam presents critical challenges, and according to Dr. Tran Chi Thanh, President of the Vietnam Atomic Energy Institute (VINATOM), one of the foremost concerns is the availability of skilled human resources. In an exclusive interview with Vietnam Economic Times/VnEconomy’s Phan Anh, Dr. Thanh underscored the importance of cultivating a talented workforce to support the country’s ambitious nuclear agenda.”