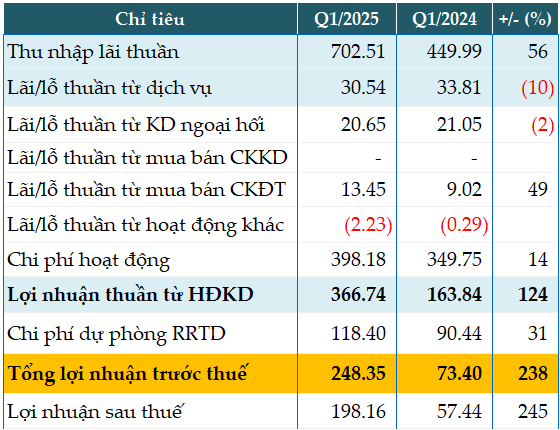

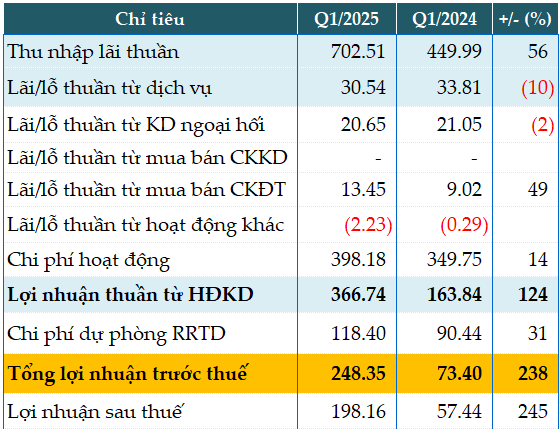

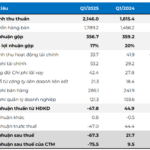

Vietbank’s core revenue in the first quarter grew by up to 56% year-on-year, with net interest income reaching nearly VND 703 billion.

Non-interest income accounts for a small proportion of the Bank’s income structure: service income decreased by 10% (to VND 31 billion), income from foreign exchange trading decreased by 2% (to VND 21 billion), and income from securities trading increased by 49% (VND 13 billion).

Operating expenses in the quarter increased by 14% to VND 398 billion, resulting in a net profit from business activities of nearly VND 367 billion, twice as much as the same period last year.

The bank set aside more than VND 118 billion for credit risk provisions, an increase of 31%, resulting in a pre-tax profit of over VND 248 billion, 3.4 times higher than the previous year.

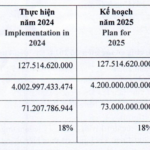

However, compared to the target of VND 1,750 billion in pre-tax profit for the full year 2025, Vietbank has only achieved 14% of its plan after the first quarter.

|

VBB’s Q1/2025 business results. Unit: VND billion

Source: VietstockFinance

|

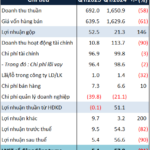

As of the end of the first quarter, the Bank’s total assets increased by 7% from the beginning of the year to VND 174,377 billion. Specifically, deposits at the SBV decreased by 60% (to VND 2,841 billion), deposits at other credit institutions increased by 29% (VND 43,917 billion), and loans to customers increased by 4% (VND 97,298 billion).

On the capital side, deposits and loans from the Government and the SBV stood at over VND 6 billion, while they were nearly VND 223 billion at the beginning of the year. Customer deposits increased by 9% (VND 103,017 billion), and the issuance of valuable papers increased by 14% (VND 20,118 billion).

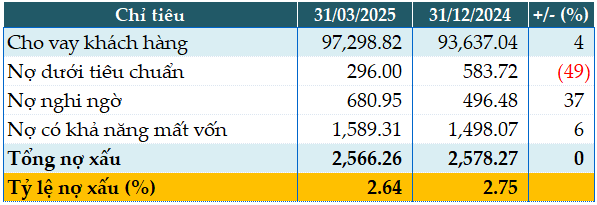

As of March 31, 2025, Vietbank’s total bad debt remained almost unchanged from the beginning of the year at VND 2,567 billion. The bad debt ratio decreased from 2.75% at the beginning of the year to 2.64%.

|

VBB’s loan quality as of 31/03/2025. Unit: VND billion

Source: VietstockFinance

|

Han Dong

– 09:19 30/04/2025

The Soaring Price of Coconuts: A ‘Coconut Tycoon’ Reports a Revenue of Nearly $40 Million but a 23% Drop in Profits

The profit margin of ACP has significantly decreased to 7.5%, a notable drop from the 12.63% enjoyed in 2023.

“HBC’s Q1 Net Profit Down Despite Reversal of VND 104 Billion Allowance for Doubtful Accounts”

Despite a reinstatement of nearly VND 40 billion in management expenses, the Q1 2025 net profit of Hoa Binh Construction Group Joint Stock Company (UPCoM: HBC) witnessed a staggering 91% decline year-over-year.