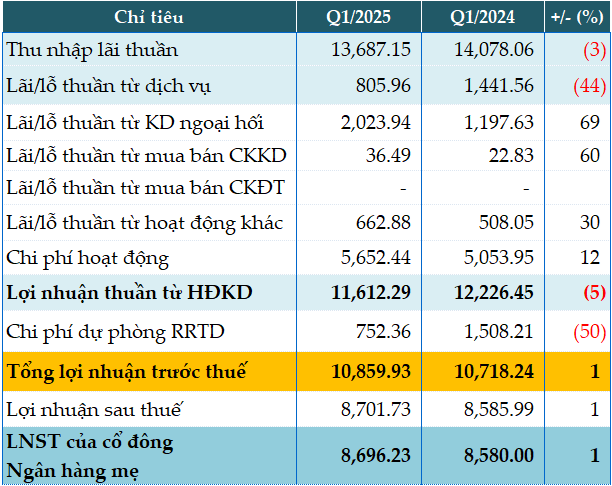

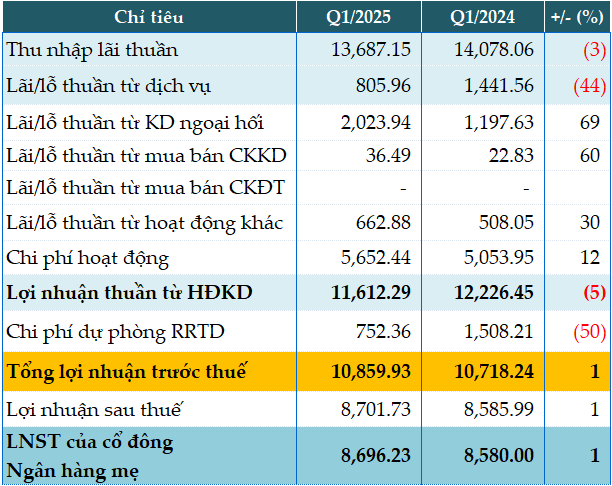

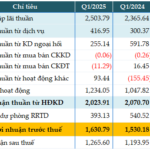

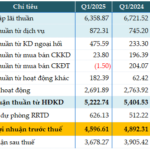

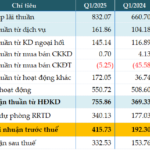

Vietcombank’s net interest income for Q1 decreased by 3% year-on-year to over VND 13,687 billion. Service income also declined by 44%, amounting to nearly VND 806 billion.

On the other hand, some non-interest income sources showed growth, including forex trading profits, which increased by 69% (VND 2,024 billion), profits from securities trading activities, which rose by 60% (VND 37 billion), and other business activities, which grew by 30% (VND 623 billion).

Operating expenses increased by 12% to VND 5,652 billion. Consequently, the bank’s profit from business operations decreased by 5%, amounting to VND 11,612 billion.

During the quarter, Vietcombank set aside more than VND 752 billion in credit risk provisions, a 50% decrease compared to the previous year. As a result, the bank reported a slight increase of 1% in pre-tax profit, reaching nearly VND 10,860 billion.

|

VCB’s Q1/2025 Financial Results. Unit: Billion VND

Source: VietstockFinance

|

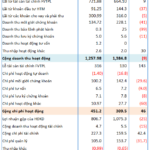

As of the end of Q1, Vietcombank’s total assets exceeded VND 2.1 quadrillion, a 1% increase from the beginning of the year. Customer loans and deposits remained stable at nearly VND 1.47 quadrillion and over VND 1.5 quadrillion, respectively.

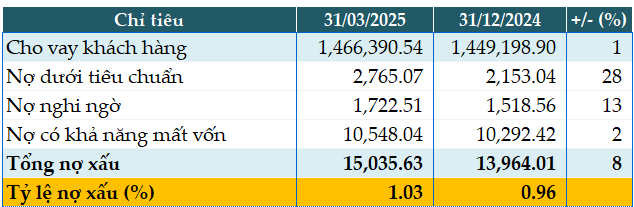

As of March 31, 2025, the bank’s total non-performing loans amounted to VND 15,036 billion, an increase of 8% from the beginning of the year. The non-performing loan ratio also rose slightly from 0.96% to 1.03% during this period.

|

VCB’s Loan Quality as of March 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

Han Dong

– 08:46 30/04/2025

“Boosting Risk Reserves, BVBank Posts 16% Rise in Q1 Pre-Tax Profit”

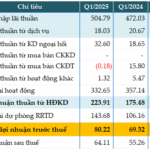

The consolidated financial statements for the first quarter of 2025 show that BVBank (UPCoM: BVB) recorded a pre-tax profit of over VND 80 billion, a 16% increase compared to the same period last year, despite a 35% rise in risk provisions by the Bank.

Unlocking Profitability: MSB’s Strategic Cost-Cutting Measures Yield Fruitful Results, with Q1 Pre-Tax Profits Soaring to VND 1,631 Billion, a 7% Increase

In the recently released consolidated financial statements for the first quarter of 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) reported a remarkable performance with a pre-tax profit of nearly VND 1,631 billion, reflecting a 7% increase compared to the same period last year. This impressive growth can be attributed to the bank’s effective management of credit risk provisions.

Profitable ABBank’s Q1 2025: Pre-tax profit soars to 2.2 times the same period last year

The recently released consolidated financial statements for the first quarter of 2025 reveal that An Binh Joint Stock Commercial Bank (ABBank, UPCoM: ABB) reported a remarkable pre-tax profit of VND 416 billion, reflecting a significant 2.2-fold increase compared to the same period last year.