“VietinBank Steps Up Support for Agroforestry and Aquaculture with Preferential Credit Programs”

Since August 2023, VietinBank has been one of the first banks to initiate a preferential credit program for the agroforestry and aquaculture sectors, with an initial registered scale of VND 1,500 billion. The bank offered interest rates at a minimum of 1.0% – 2.0% per year lower than the average lending rates for the same term. Recognizing the significant capital demands from the market and the positive response to the program, VietinBank, in 2024, twice registered supplementary funds with the State Bank, increasing the program’s scale to VND 6,000 billion.

In 2025, in alignment with the directives of the Government, the Prime Minister, and the State Bank regarding the expansion and adjustment of the credit program for the agro-forestry-aquaculture sector, with a maximum limit of VND 100,000 billion, VietinBank registered to increase its participation in the program to VND 12,000 billion, providing investment capital for the development of the agroforestry and aquaculture sectors.

Concurrently, VietinBank is also implementing various preferential credit programs across diverse industries, sectors, and customer segments, including small and medium-sized enterprises, import and export businesses, and individual customers. Individual customers and businesses involved in aquaculture, processing, exporting, and operating in the agro-forestry-aquaculture sector are also eligible to participate in these preferential loan programs.

VietinBank not only expands the scale of preferential credit but also focuses on enhancing credit accessibility for individuals and businesses. VietinBank is committed to simplifying loan procedures through digitization and technology application in credit operations, enabling customers in the agroforestry and aquaculture sectors to access capital conveniently and swiftly.

The proactive deployment of preferential credit provision for the agro-forestry-aquaculture sector underscores VietinBank‘s concrete commitment to supporting individuals and businesses in overcoming challenges, promoting the development of the “Agriculture, Farmers, Rural Areas” sector, thereby reinforcing its role as a pivotal bank in the economy and contributing to the nation’s economic growth.

“VietinBank Reports Over VND 2,000 Billion in Other Operating Income, Boosting Q1 2025 Pre-Tax Profit by 10%”

In the recently released consolidated financial statements for the first quarter of 2025, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank, HOSE: CTG) reported a remarkable performance with a profit before tax of over VND 6,823 billion, reflecting a 10% increase compared to the same period last year.

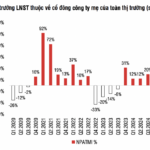

Listed Companies Aim for a 13.6% Revenue Increase in 2025

Based on the 2025 statistical plan of 104 large-cap listed companies, which account for approximately 70% of market capitalization, the total revenue plan for 2025 shows an increase of about 13.6% compared to the revenue realized in 2024.

The Capital Injection Conundrum: Why Are Businesses Still Struggling to Secure Loans Despite Banks’ Efforts?

The banking sector injected nearly VND 200,000 billion into the economy in the first few months of the year, yet businesses still cry out for easier access to this capital. Experts assert that directing this bank funding towards businesses requires a harmonious interplay between governing policies, strategic banking initiatives, and proactive enterprise from businesses themselves.