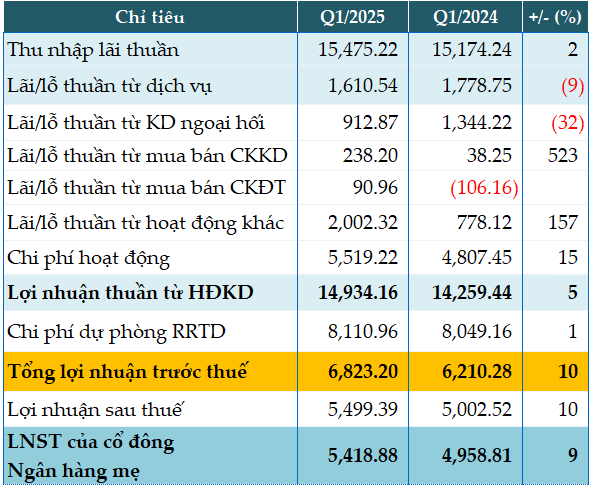

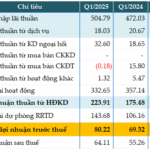

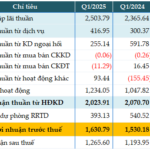

VietinBank’s net interest income for the first quarter reached over VND 15,475 billion, a modest 2% increase year-on-year.

Service income decreased by 9% to VND 1,611 billion, and foreign exchange trading income also fell by 32% to VND 913 billion.

On the other hand, proprietary trading activities yielded VND 238 billion in profits, a significant improvement from the VND 38 billion recorded in the same period last year. Additionally, investment securities trading turned profitable with VND 91 billion in gains.

Notably, other operating income surged to VND 2,002 billion, more than doubling the figure from the first quarter of 2024.

Operating expenses rose by 15% to VND 5,519 billion, mainly due to higher staff costs. Consequently, profit from operating activities climbed by 5% to VND 14,934 billion.

During the quarter, VietinBank set aside VND 8,111 billion in credit risk provisions, a slight 1% increase. This resulted in a 10% year-on-year growth in pre-tax profit to VND 6,823 billion.

|

CTG’s Q1 2025 Financial Results in trillion VND

Source: VietstockFinance

|

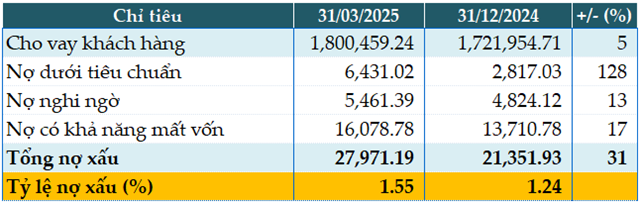

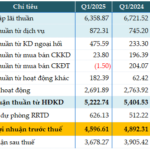

As of the end of the first quarter, VietinBank’s total assets stood at nearly VND 2.47 quadrillion, a 4% increase since the beginning of the year. Customer loans grew by 5% to VND 1.8 quadrillion, while customer deposits inched up by 1% to VND 1.62 quadrillion.

The Bank’s total non-performing loans as of March 31, 2025, amounted to VND 27,971 billion, representing a 31% rise since the start of the year. Consequently, the non-performing loan ratio increased from 1.24% to 1.55% during this period.

|

CTG’s Loan Quality as of March 31, 2025, in trillion VND

Source: VietstockFinance

|

Han Dong

– 8:09 PM, April 29, 2025

“Vietcombank Reports Flat Profit in Q1 2025 Despite Significant Cut in Provisions”

In the first quarter of 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam, known as Vietcombank (HOSE: VCB), reported a slight increase in pre-tax profits, reaching nearly VND 10,860 billion, a 1% rise compared to the same period last year. This positive result is attributed to a significant reduction in provision for risks.

Sacombank: The Power of Business Savvy

Despite facing significant challenges from the restructuring plan, including constraints on capital increases, Sacombank has achieved notable successes in financial indicators, credit ratings, and risk management. These accomplishments have significantly enhanced the appeal of Sacombank’s stock, attracting the attention of domestic and foreign investors alike.

Unlocking Profitability: MSB’s Strategic Cost-Cutting Measures Yield Fruitful Results, with Q1 Pre-Tax Profits Soaring to VND 1,631 Billion, a 7% Increase

In the recently released consolidated financial statements for the first quarter of 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) reported a remarkable performance with a pre-tax profit of nearly VND 1,631 billion, reflecting a 7% increase compared to the same period last year. This impressive growth can be attributed to the bank’s effective management of credit risk provisions.

“ACB’s Q1 2025 Profit Dip: Unraveling the Mystery Behind the 20% ROE Maintenance”

The consolidated financial statements for Q1 2025 revealed that Asia Commercial Joint Stock Bank (HOSE: ACB) posted a pre-tax profit of VND 4,597 billion, a 6% decline compared to the same period last year.