Market remains buoyant as money flow targets real estate, tourism, and oil & gas sectors.

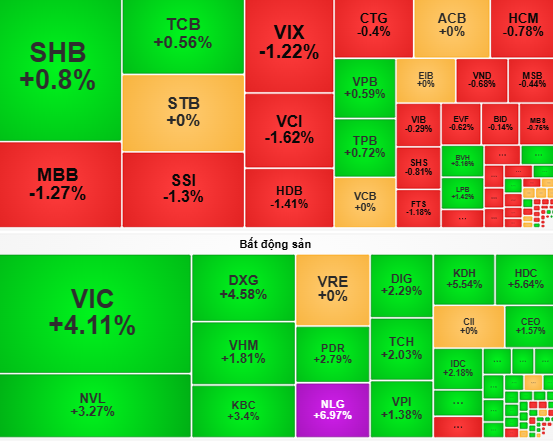

VN-Index witnessed a robust start to the morning session, surging by 5 points within the first 30 minutes. This upward momentum was driven by large-cap stocks such as VIC, HVN, and GAS. The tourism, oil & gas, and real estate sectors emerged as key attractions, drawing significant money flow.

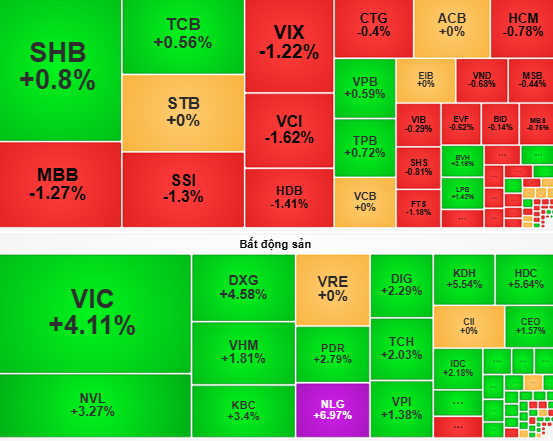

As the afternoon session progressed, VN-Index continued its ascent towards the 1,250-point resistance level. Real estate stocks, including NLG, HDC, and KDH, shone brightly, alongside energy and utilities stocks like BSR, POW, and PC1, which witnessed robust buying interest. However, the market’s gains were partially offset by a pullback in the banking sector.

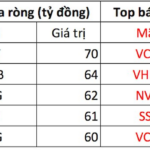

A notable highlight of the session was the strong foreign buying, amounting to VND 905 billion, primarily focused on real estate stocks such as DXG and NLG.

According to VCBS, while the VN-Index has a chance to consolidate its upward trend, investors are advised to remain cautious amidst potential fluctuations stemming from the international market. Nonetheless, buying momentum showed signs of slowing down as investors adopted a wait-and-see approach ahead of significant macro events expected later on May 7th.

“Investors should maintain a reasonable stock proportion, closely monitor market movements and macro news in the coming sessions. This is also an appropriate time to restructure their portfolios, eliminating stocks with weak money flow while taking advantage of the uptrend to realize profits or restructure their portfolios,” VCBS recommended.

Meanwhile, Rồng Việt Securities (VDSC) attributed the slight decline in trading volume on May 7 compared to the previous session to easing selling pressure. The money flow continues to underpin the market, laying the foundation for further gains.

“Although the uptrend is not yet well-defined, money flow remains supportive, positioning the VN-Index to target the 1,262-1,273 range in the near future,” VDSC anticipated.

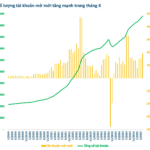

The Stock Market Shakes Things Up: Domestic Investors Rush to Open Accounts

“There has been a significant surge in the number of domestic investors opening securities accounts, marking the highest increase in an eight-month period. This surge comes amidst a volatile market, heavily influenced by external factors.”