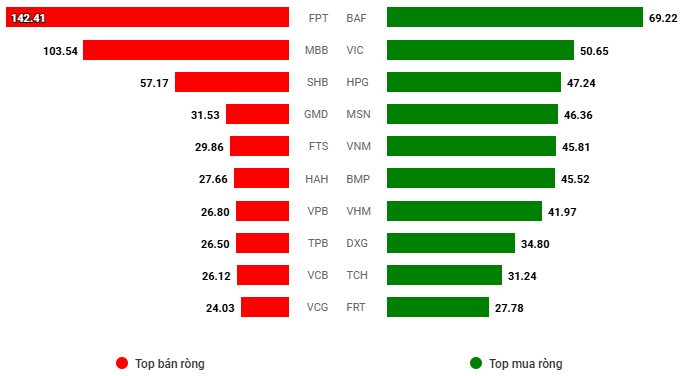

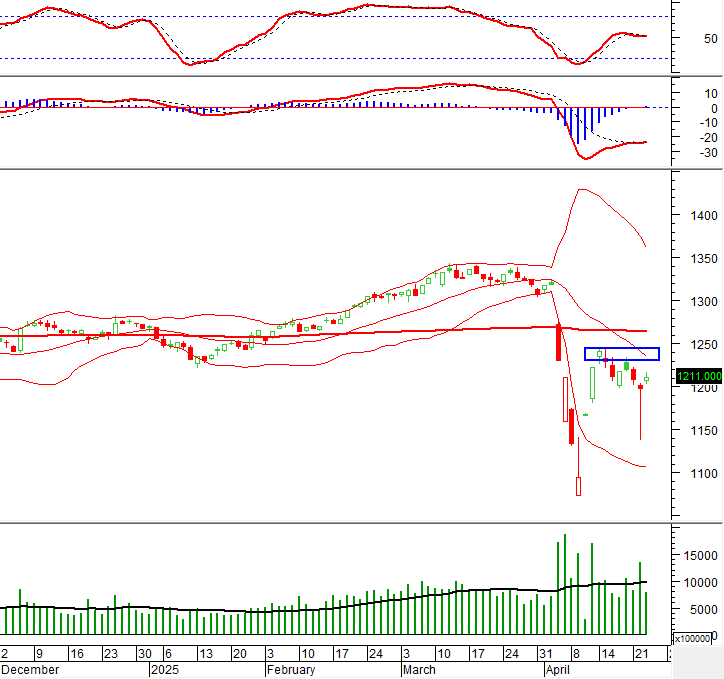

In the coming sessions, if the indices continue to remain positive, there is a possibility of extending the upward momentum towards the nearest resistance level formed in mid-April 2025 (equivalent to 1,230-1,245 points). This is an important resistance level, and for the VN-Index to maintain its upward trajectory, it needs to surpass this hurdle. Currently, the MACD indicator has just given a buy signal after crossing above the Signal Line, indicating that the situation is gradually improving.

I. MARKET ANALYSIS OF STOCK EXCHANGE ON APRIL 23rd, 2025

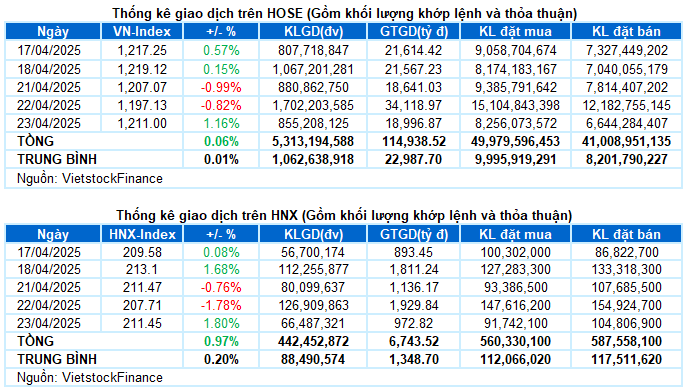

– The main indices regained their positive momentum during the trading session on April 23rd. The VN-Index rose by 1.16%, reaching 1,211 points, while the HNX-Index also witnessed a strong recovery of 1.8%, ending the day at 211.45 points.

– The matched order volume on HOSE reached over 786 million units, a decrease of 41.3% compared to the previous session. Meanwhile, the matched order volume on the HNX also decreased by 50%, reaching nearly 60 million units.

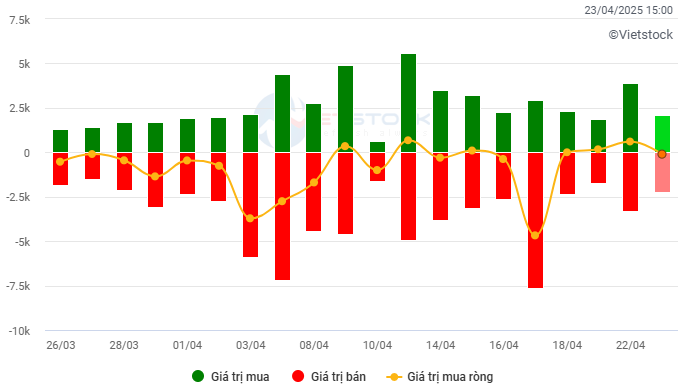

– Foreign investors turned to net sellers, with a net sell value of over VND 81 billion on the HOSE and VND 15 billion on the HNX.

Trading value of foreign investors on HOSE, HNX, and UPCOM. Unit: VND billion

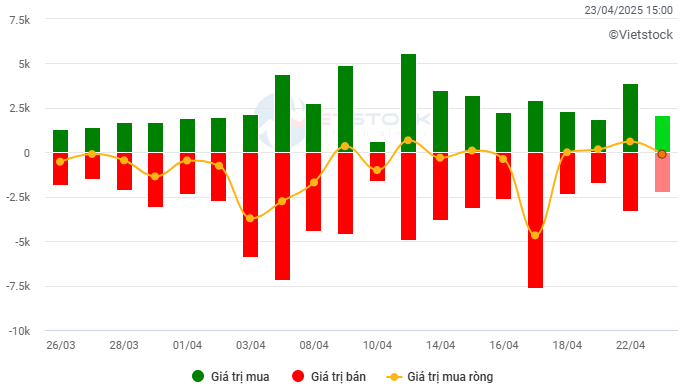

Net trading value by stock code. Unit: VND billion

– The Vietnamese stock market witnessed a strong recovery amid positive global market sentiments, with hopes of easing trade tensions between the US and China. Buying interest propelled the VN-Index to surge by nearly 19 points right after the market opened. Despite maintaining the positive territory throughout the session, market liquidity indicated that investor sentiment remained cautious following the previous volatile session. The upward momentum slightly weakened, and the VN-Index fluctuated around the 1,210-point level for most of the remaining trading time. At the close of April 23rd, the VN-Index settled at the 1,211-point mark, an increase of 13.87 points compared to the previous session.

– In terms of impact, TCB, VHM, and GVR were the most positive contributors, helping the VN-Index gain more than 3.5 points. On the other hand, VCB was the only stock that exerted significant downward pressure, taking away 1 point from the index.

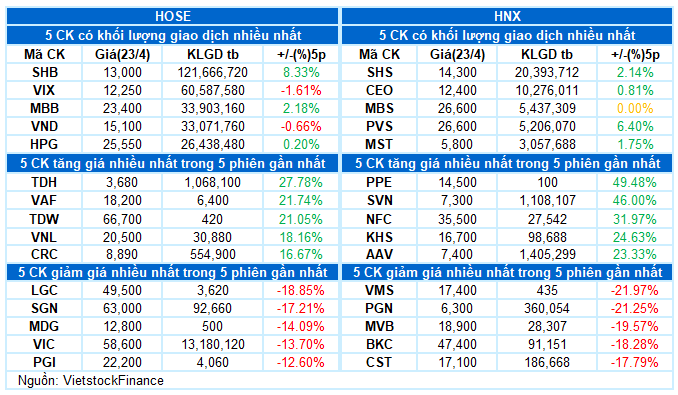

– Buying interest was mainly focused on small and mid-cap stocks, while large-cap stocks witnessed a more modest increase. The VN30-Index climbed by 0.98%, closing at the 1,303.04-point level. The bullish side dominated with 23 rising stocks, 5 falling stocks, and 2 stagnant stocks. Notably, VRE shone brightly, surging almost to its daily limit, alongside strong breakthroughs from BCM, SAB, GVR, and TCB, which all rose by around 3-6%. Conversely, SSB, SHB, STB, VCB, and VIC went against the general upward trend, ending the day in negative territory.

Green dominated across all industry groups. The telecommunications group impressed the most with an outstanding increase of 7.83%, thanks to a strong rally in stocks such as VGI (+9.93%), CTR (+6.91%), VNZ (+3.26%), YEG (+6.46%), FOX (+1.78%), VNB (+6.11%), and TTN (+6.16%), among others.

The materials, industrials, energy, and real estate sectors also witnessed a strong recovery of over 2%, with stocks like HSG, BMP, VTP, CTI, ITS, DXS, BCR, and SGR shining in purple. Meanwhile, information technology was the weakest performer, inching up by merely 0.11%, mainly due to the stagnation of the large-cap stock FPT, which faced significant foreign selling pressure.

The VN-Index rebounded strongly and retested the old peak from November 2024 (equivalent to the 1,195-1,215 range). However, trading volume has been erratic, fluctuating around the 20-day average, reflecting unstable investor sentiment. In the coming sessions, if the indices maintain their positive trend, there is a chance to extend the upward momentum towards the nearest resistance level formed in mid-April 2025 (equivalent to 1,230-1,245 points). This is a crucial resistance level, and for the VN-Index to sustain its upward trajectory, it needs to surpass this hurdle. Currently, the MACD indicator has just given a buy signal, suggesting that the situation is gradually improving.

II. TREND AND PRICE MOVEMENT ANALYSIS

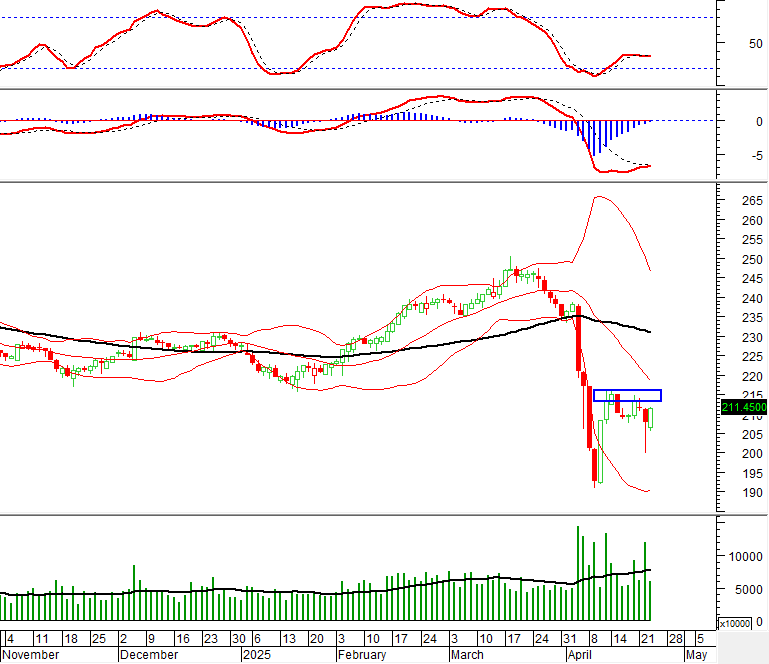

VN-Index – MACD indicator gives a buy signal

The VN-Index rebounded strongly and retested the old peak from November 2024 (equivalent to the 1,195-1,215 range). However, trading volume has been erratic, fluctuating around the 20-day average, indicating unstable investor sentiment. If the indices maintain their positive trend in the upcoming sessions, there is a possibility of extending the upward momentum towards the nearest resistance level formed in mid-April 2025 (1,230-1,245 points). This resistance level is significant, and for the VN-Index to continue its upward trend, it needs to break through this barrier.

Currently, the MACD indicator has just given a buy signal by crossing above the Signal Line, suggesting that the situation is gradually improving.

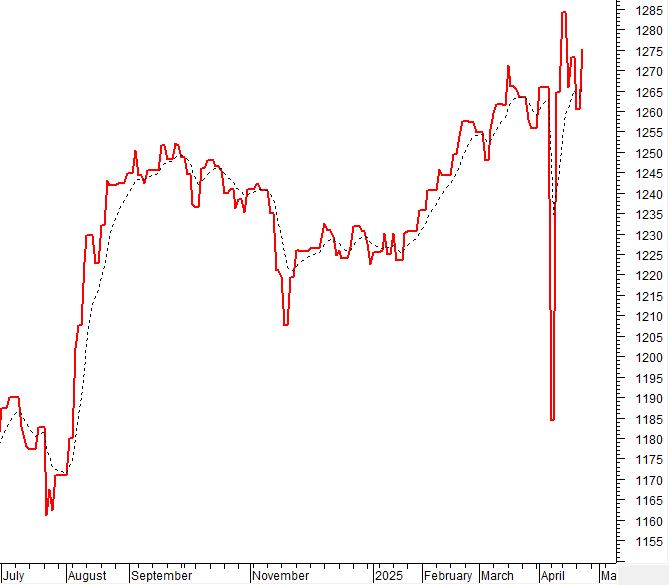

HNX-Index – Approaching resistance level from mid-April 2025

The HNX-Index returned to positive territory, but trading volume declined below the 20-day average, indicating that investors remain cautious. Currently, the index has broken through the old bottom from October 2023 (equivalent to the 204-208 range) and is heading towards the next resistance level formed in mid-April 2025 (equivalent to the 213-216 range).

At present, the MACD indicator is likely to give a buy signal as it narrows the gap with the Signal Line. If this status quo persists in the upcoming sessions, the short-term outlook will remain optimistic.

Analysis of Capital Flows

Changes in Smart Money Flows: The Negative Volume Index of the VN-Index has crossed above the 20-day EMA. If this status quo continues into the next session, the risk of an unexpected downturn (thrust down) will be limited.

Changes in Foreign Capital Flows: Foreign investors turned to net sellers during the trading session on April 23, 2025. If foreign investors maintain this stance in the upcoming sessions, the situation may become less optimistic.

III. MARKET STATISTICS FOR APRIL 23rd, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting and Research

– 17:05 23/04/2025

Deep Discounts, Stock Market Surges: 194,000 New Accounts Join the Fray.

As of April 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to Vietnam Securities Depository (VSDC). The country’s stock market boasted over 9.88 million accounts, reflecting an increase of 194,023 accounts since March. This remarkable growth marks the highest increase in the past eight months.

The Optimistic Outlook Persists

The VN-Index showed a positive upward trend, surpassing the previous peak formed in mid-April 2025 (1,230-1,245 points). However, for the upward momentum to be reinforced, the trading volume needs to rise above the 20-day average.

SSI Research: Positive Trade Negotiation Developments to Spur Market Recovery

The SSI Securities Analysis Department’s strategic report highlights the need for positive developments in trade negotiations to sustain the market’s recovery momentum. The current blended P/E ratio remains low, and the estimated one-year market yield is attractive compared to deposit interest rates.

Market Beat: VN-Index Sees Extended Tug-of-War as Caution Prevails

The market closed with the VN-Index down 2.5 points (-0.2%), settling at 1,267.3. The HNX-Index followed suit, dropping 1.08 points (-0.5%) to 214.13. The day’s trading saw a slight tilt towards decliners, with 396 stocks falling against 353 advancing. The VN30 basket mirrored this trend, showing a sea of red with 15 decliners, 8 gainers, and 7 stocks holding steady.