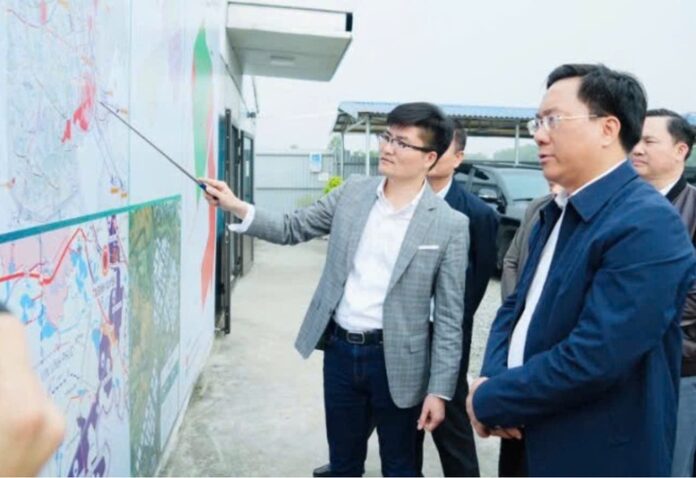

Chairman of the Provincial People’s Committee Tran Duy Dong inspects the site clearance work in Nam Binh Xuyen Industrial Park

Proactive Management Leads to Nearly Half of the Year’s Revenue Target Being Met

According to statistics from Vinh Phuc, in the first four months of 2025, the province’s total state budget revenue reached VND 11,645 billion, equivalent to 43.1% of the target assigned by the Central Government and the Provincial People’s Council, and a 4.8% increase compared to the same period in 2024. Notably, this figure also accounts for 36.3% of the province’s ambitious double-digit growth target set for this year.

Furthermore, including taxes that were extended under the Government’s decrees, the total estimated revenue reached VND 11,550 billion, equivalent to 52.4% of the annual plan and a 19.4% increase compared to the previous year. This is an encouraging result, given the challenges posed by the global and domestic economic situation and the impact of the US tax countermeasures on many businesses in the province.

Breaking down the revenue sources reveals a stable contribution from production and business activities, generating VND 8,441 billion, or 49.4% of the target, with a 12.5% increase compared to the same period last year. When taking into account the extended payments, this figure rises to VND 9,491 billion. The production and business sector now accounts for 82% of the province’s total domestic revenue.

The FDI sector continues to play a pivotal role, with an estimated revenue of VND 7,220 billion (47.2% of the target) in the past four months. When including the extended payments, this figure rises to VND 8,205 billion (53.6% of the target), contributing 86% of the revenue from production and business activities. This substantial contribution comes from the province’s two leading enterprises, Honda and Toyota, with a combined tax payment of VND 6,720 billion, an increase of over VND 1,600 billion compared to the previous year.

Additionally, the non-state enterprise sector has also witnessed positive changes. Corporate income tax increased by 22.4% (an increase of VND 261 billion), with notable performances from Asia-America Industrial Joint Stock Company (an increase of VND 128 billion) and Kehin Company (an increase of VND 19 billion).

These positive results reflect improved economic governance and enhanced production and business capacity of enterprises. The provincial government has been proactive in addressing difficulties and coordinating with ministries and sectors to promote a favorable and stable investment environment.

Synchronized Solutions to Promote Growth and Sustainable Revenue

Based on the positive budget revenue results, Vinh Phuc province has clearly defined its strategic orientation for 2025 and the following years.

Mr. Nguyen Khac Hieu, Vice Chairman of the Provincial People’s Committee, shared: “Following the Government’s guidance, Vinh Phuc continues to promote innovation, strengthen institutional reform, enhance decentralization, maintain financial and budgetary discipline, and ensure that the international situation does not affect our growth targets.”

The Provincial Party Committee and People’s Committee have assigned specific targets, requiring departments, sectors, and localities to develop plans to achieve a GRDP growth rate of 10-11%, higher than the 9% target assigned by the Government.

The province has set a revenue target of VND 32,100 billion for 2025, an additional VND 5,000 billion compared to the target assigned by the Provincial People’s Council. In addition, it aims to attract USD 800 million in FDI and VND 5,000 billion in DDI. Thus, increasing the scale of investment and credit becomes the key to maintaining growth momentum.

To accelerate growth, the province focuses on removing bottlenecks. Specifically, it reviews growth potentials, expedites the progress of 32 FDI/DDI projects, 30 public investment projects, 16 industrial infrastructure projects, along with 47 urban and social housing projects. In 2025 alone, Vinh Phuc plans to start the construction of more than 2,000 social housing units.

Administrative reform has been a particular area of emphasis. The province has promptly completed the reorganization of its apparatus, with clear delegation of powers, and coordinated with Phu Tho and Hoa Binh provinces to adjust its administrative model accordingly. This ensures not only efficient service for businesses and citizens but also maintains the overall growth target of the region.

Moreover, the provincial government has strengthened its dialogue with enterprises. The People’s Committee held four thematic meetings at the beginning of the year to promptly address any challenges faced by businesses. Simultaneously, guidelines for implementing new policies were promptly issued, with a particular focus on resolving bottlenecks related to land, site clearance, and digital transformation.

The province also considers public investment disbursement as a key task. Following the Prime Minister’s Directive No. 112/CD-TTg, Vinh Phuc has promoted investment in inter-regional transportation, electricity infrastructure, clean water supply, and waste treatment to attract high-tech projects.

At the same time, the province has reviewed its policies to prioritize projects in the semiconductor industry, a field with great potential for breakthrough development. Collaboration in training high-quality human resources has been strengthened, involving major corporations in specialized training in technical fields, logistics, electronics, and mechanics.

When the US issued a decree imposing the highest level of tax countermeasures on Vietnam, significantly impacting exporting enterprises, Vinh Phuc promptly established a rapid response team to review 73 directly affected enterprises (with a turnover of over USD 500 million) and many others indirectly impacted.

Subsequently, the province organized meetings, including a direct dialogue session, to address these challenges. Measures to promote trade, develop e-commerce, stimulate consumption, and support market diversification were swiftly implemented.

“Vinh Phuc has oriented itself towards expanding exports to potential markets such as the Middle East, Eastern Europe, South Asia, Egypt, and South America to reduce over-dependence on a single market,” said the Vice Chairman of the Provincial People’s Committee. “At the same time, the tourism sector is being promoted through international promotion and connection of attractive destinations.”

“Post-AGM and Q1 Results: Navigating Investment Strategies Amid Tariff Turbulence”

“As the AGM season and Q1 earnings reports draw to a close, investors have cause for optimism. Despite ongoing tariff tensions, Le Duc Tien, a Shinhan Vietnam Securities analyst, suggests that investors consider taking profits and monitoring policy developments on tariffs, rather than solely focusing on corporate news. This strategic shift is advised as expectations have been met and further policy moves may impact the market dynamic.”

The Greening of Vietnam: Unveiling the Secrets Behind 29 Tree-Planting Projects

The People’s Committee Chairman of Bac Lieu Province has requested that the relevant authorities provide a comprehensive compilation of documents pertaining to 29 tree-planting and urban embellishment projects from 2019 to 2023. This initiative aims to foster transparency and ensure the availability of vital information regarding these projects to the relevant stakeholders.

“The Mattress Giant Awakens: Vietnam’s Largest Bedding Retailer, Backed by Mekong Capital, Prepares for its Stock Market Debut with a 98% Profit Surge Plan”

With an anticipated timeline in place, the company aims to go public in July 2025, followed by securities registration in August 2025, and ultimately, trading on the Upcom Exchange by September.