I. MARKET ANALYSIS OF STOCKS AS OF 04/24/2025

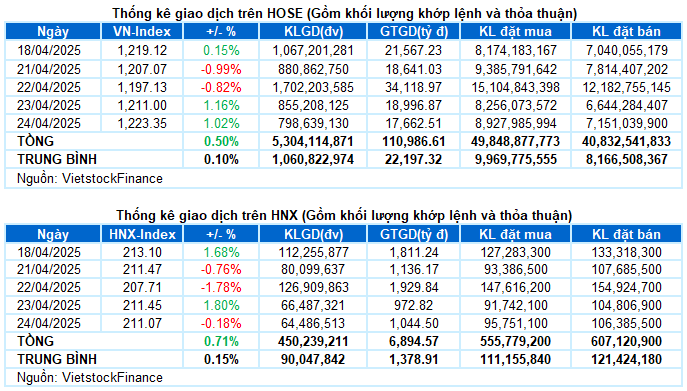

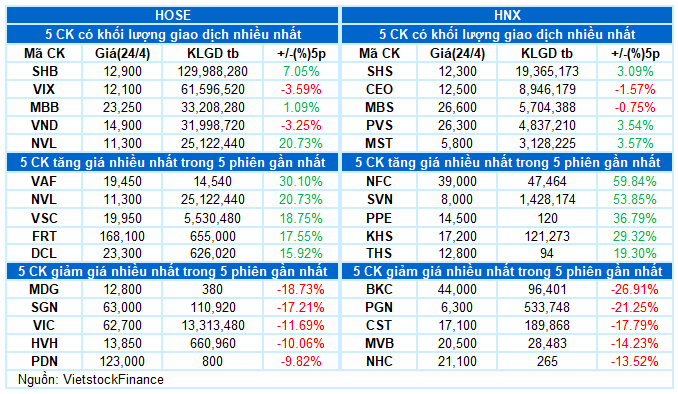

– The main indices traded mixed on April 24. While the VN-Index advanced 1.02% to 1,223.35, the HNX-Index edged down 0.18% to 211.07.

– Market liquidity remained low. Matching volume on the HOSE reached over 741 million shares, down 5.7% from the previous session. The HNX saw more than 60 million shares traded, up slightly by 1%.

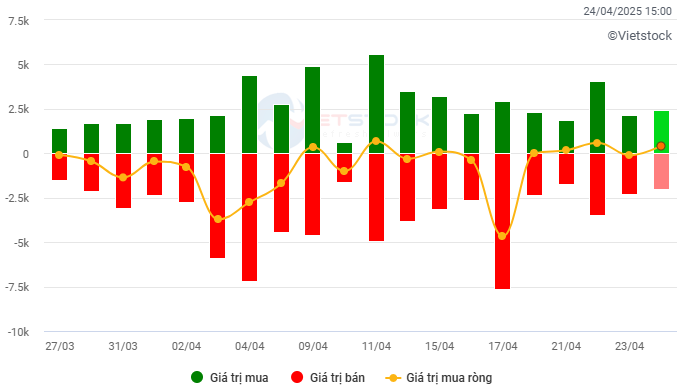

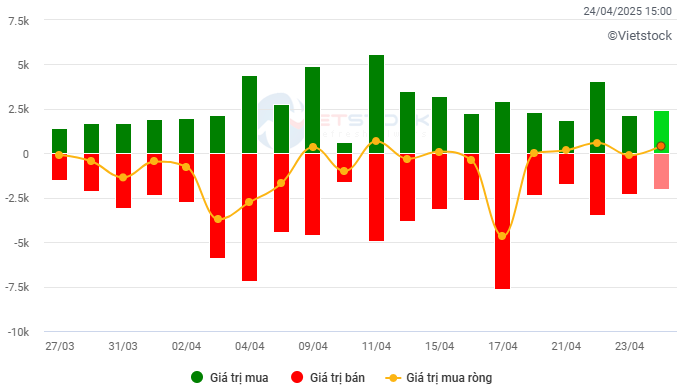

– Foreign investors net bought nearly VND 538 billion on the HOSE today, while they net sold about VND 10 billion on the HNX.

Trading value of foreign investors on the HOSE, HNX and UPCOM. Unit: VND billion

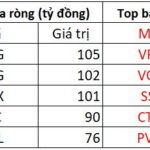

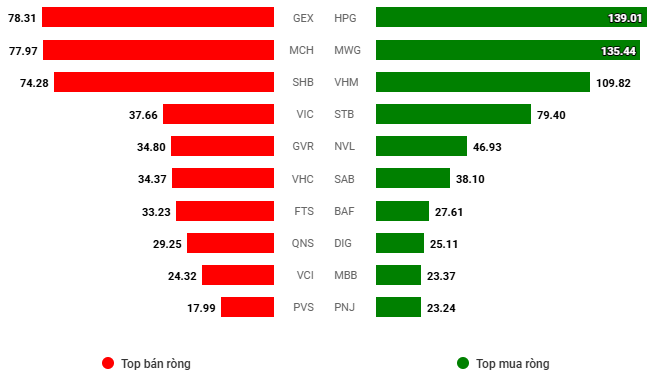

Net trading value by stock. Unit: VND billion

– The market fluctuated within a wide range as liquidity remained subdued. After surging over 11 points in the first hour of trading, profit-taking pressure caused the VN-Index to retreat and almost return to the starting point by the end of the morning session. However, a few large-cap stocks pulled the index higher in the afternoon session, which closed at 1,223.35, up 12.35 points from the previous session.

– In terms of contribution, the duo of Vingroup (VIC and VHM) lifted the market with a nearly 7-point gain. In contrast, TCB and ACB took away more than 1 point from the VN-Index, while the impact of other stocks was insignificant.

– The VN30-Index also stayed in positive territory, rising 0.66% to 1,311.66. Among the basket, 18 stocks climbed, 8 fell, and 4 stood at the reference price. Notably, VIC rebounded strongly after a previous losing streak. Moreover, BVH, VHM, and HDB also surged over 4%. On the other hand, ACB and TCB were the worst performers in the VN30 basket, falling 1.8% and 1.3%, respectively.

The green hue prevailed across all sectors, led by real estate and telecommunications, which gained over 3%. Numerous stocks in these two sectors witnessed strong breakouts, notably VIC and SIP hitting the ceiling price, VHM (+4.62%), VRE (+3.87%), KBC (+3.88%), NVL (+4.63%), DIG (+2.76%); VGI (+4.2%), CTR (+2.28%), FOX (+1.76%), and TTN (+7.19%).

The financial sector posted the most modest gain as stocks in the industry traded mixed. Red dominated the “king stocks” such as TCB, ACB, MBB, LPB, SHB, BAB, etc. Conversely, most insurance and securities stocks maintained their positive momentum, with prominent names including BVH (+5.57%), BMI (+2.42%), ABI (+2.66%), SSI (+1.1%), VCI (+1.24%), BSI (+2.05%), FTS (+1.94%), and SHS (+1.65%).

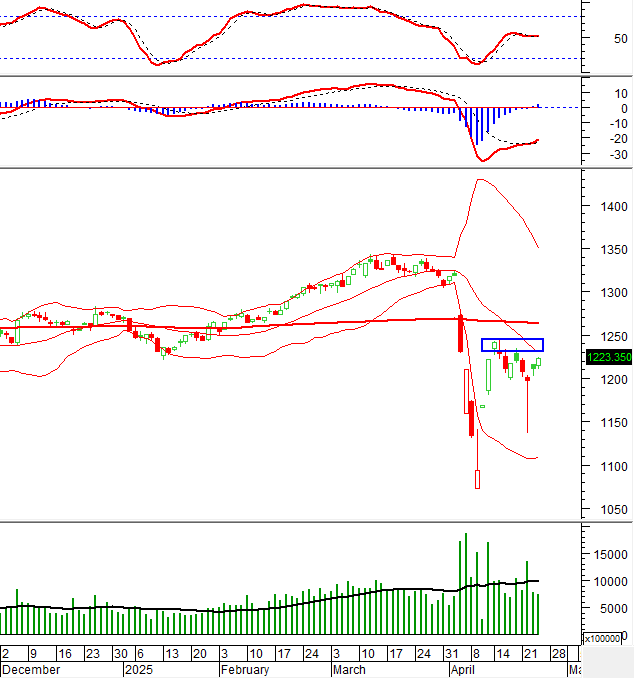

The VN-Index continued to rise strongly, while trading volume remained below the 20-day average. This indicates that buying demand is still limited as the index approaches the nearest resistance zone formed in mid-April 2025 (equivalent to 1,230-1,245 points). If the positive scenario is maintained along with a significant improvement in liquidity in the coming sessions, the VN-Index is likely to break out of this zone. Currently, the MACD indicator continues to give a buy signal after crossing above the Signal Line, suggesting an improving market trend.

II. TREND AND PRICE MOVEMENT ANALYSIS

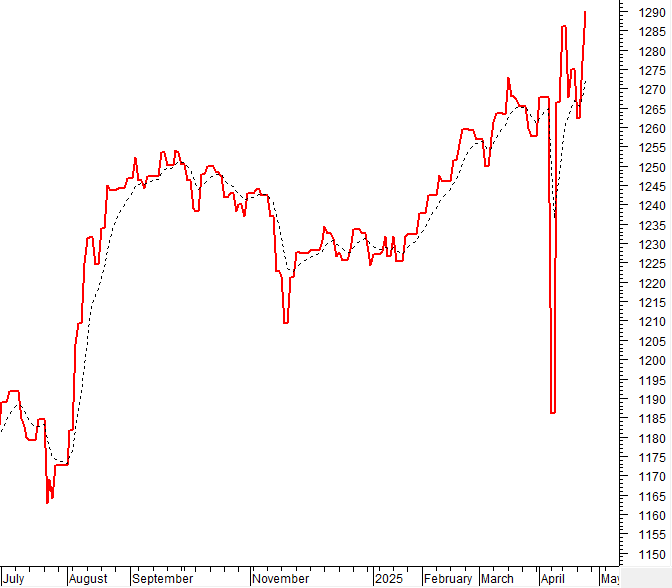

VN-Index – MACD indicator gives a buy signal again

The VN-Index continued to rise strongly, while trading volume remained below the 20-day average. This indicates that buying demand is still limited as the index approaches the nearest resistance zone formed in mid-April 2025 (equivalent to 1,230-1,245 points). If the positive scenario is maintained, accompanied by a significant improvement in liquidity in the coming sessions, the VN-Index is likely to break out of this zone.

Currently, the MACD indicator continues to give a buy signal, suggesting an improving market trend.

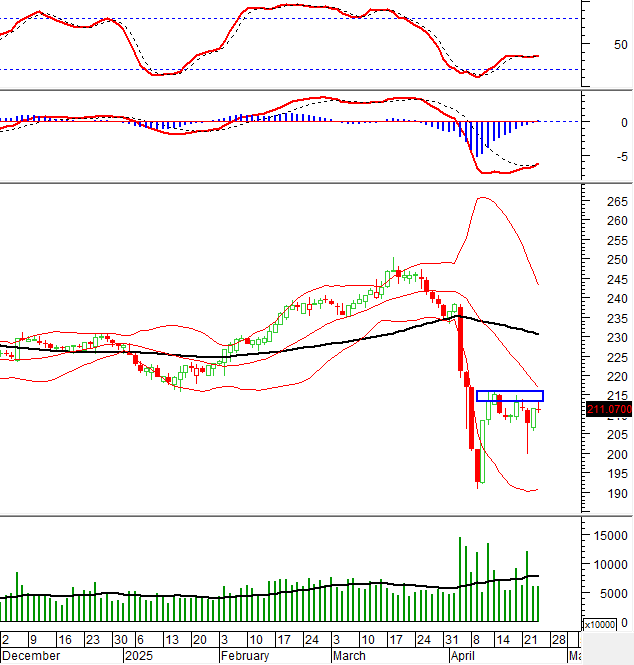

HNX-Index – Approaching the mid-April 2025 resistance zone

The HNX-Index edged down slightly, with trading volume below the 20-day average, reflecting investors’ cautious sentiment. Currently, the index has broken below the October 2023 low (equivalent to the 204-208 zone) and is heading towards the next resistance zone formed in mid-April 2025 (equivalent to the 213-216 zone).

On the other hand, the MACD indicator has just given a buy signal again after crossing above the Signal Line. If this status is maintained in the coming sessions, the short-term outlook may not be too pessimistic.

Analysis of Money Flow

Movement of smart money: The Negative Volume Index indicator of the VN-Index crossed above the EMA 20-day line. If this status continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign capital flow: Foreign investors net bought in the trading session of April 24, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more optimistic.

III. MARKET STATISTICS AS OF 04/24/2025

Economic and Market Strategy Division, Vietstock Consulting and Research

– 16:32 04/24/2025

No Problem with Margins: Q1 Results Support VN-Index’s Uptrend

“Vietnam is highly regarded as a nation with immense potential to forge an early tariff agreement with the United States, according to Mirae Asset. The country’s consistent political stance and diplomatic policy flexibility are key factors in this favorable outlook.”

“Foreign Investors Surprise with Net Buy of Nearly VND 1,000 Billion, Heavily Investing in Real Estate Stocks”

The real estate stocks DXG and NLG witnessed a strong net buying in the afternoon, with each stock attracting over a hundred billion VND in value.